Non Resident Landlords

Finance Act 2019 enacted rules under which from 6 April 2020, non-UK resident company landlords that carry on a UK property business, or have other UK property income, are charged to Corporation Tax on their property income ,

The non-UK resident company landlord remains subject to the normal Corporation Tax rules.

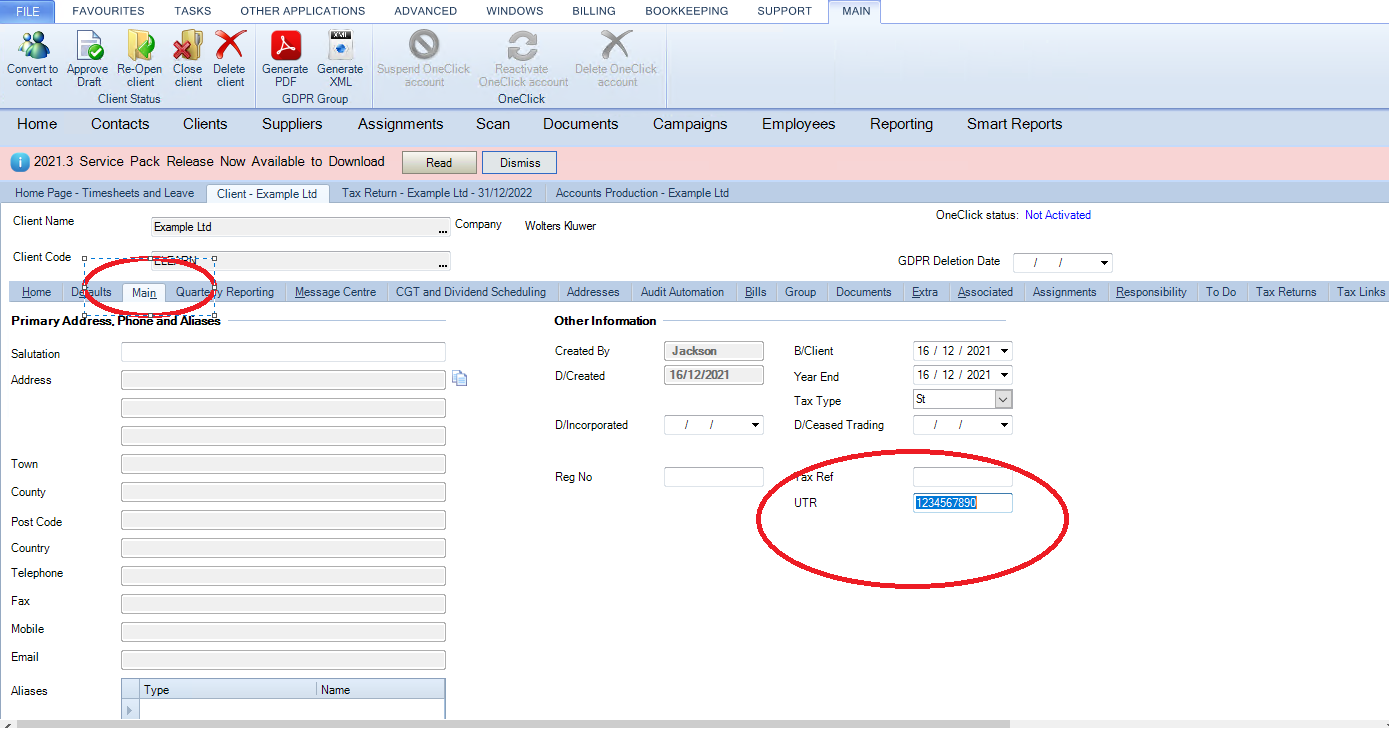

Once a company record has been created and the UTR entered with the Company's Main Tab,

S

S

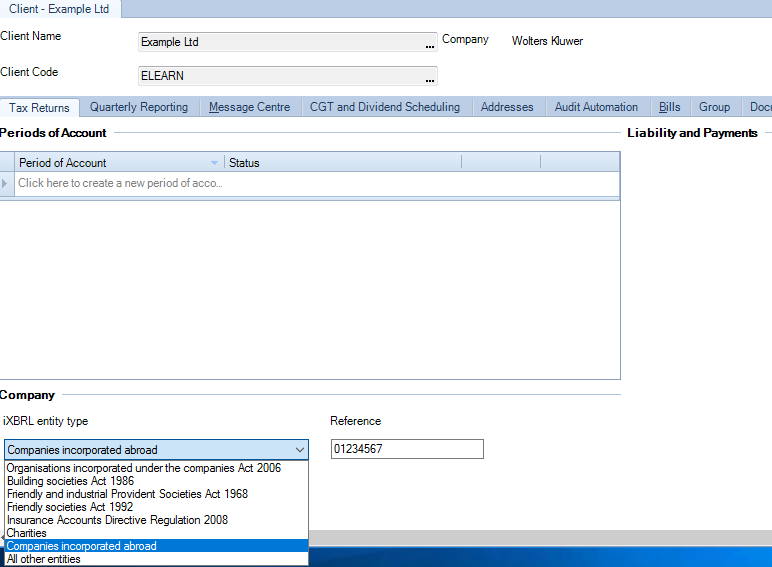

In the Tax Returns tab, select the appropriate iXBRL entity type from the dropdown before creating the Tax return period,

Within the Tax return period, enter the property business in the Trading Income section of the Data Navigator and make necessary adjustments and claim Capital allowances / Annual Investment allowance as appropriate.

Enter any relevant Non trade loan relationships.

Enter any relevant Capital Disposals.

Utilise any losses brought forward in the Loss Utilisation input statements of the Tax Planning area of the Data Navigator.

Complete the Main Return Data section and clear any errors in the Errors an exceptions for the period panel.

View the Computation or View the Return and its guide from the View menu in the top ribbon,

Notes can be added to the computation that will appear in the computation submitted to HMRC.

Tagged Accounts should be added when online filing.

If the accounts are tagged the country of incorporation should be tagged within the accounts along with the company registration number for the country of incorporation. This must match the Company Registration number in Main Return Data.