Claiming AIA

How do I claim Annual Investment Allowance (AIA)?

The software has a dedicated screen to enable you to claim AIA up to the maximum amount of AIA allowable for the period in question.

Once you have entered or linked additions qualifying for AIA into the relevant pools as per Adding assets for Capital allowances.

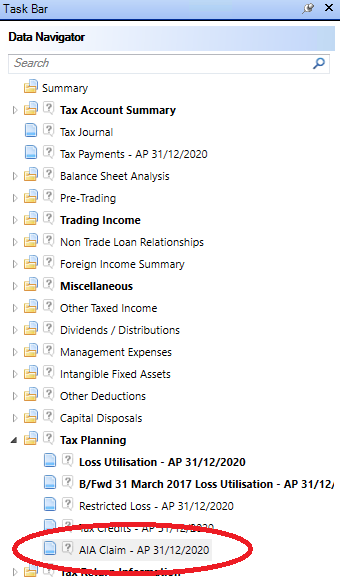

The AIA Claim input is located under the Tax Planning area of the Data Navigator.

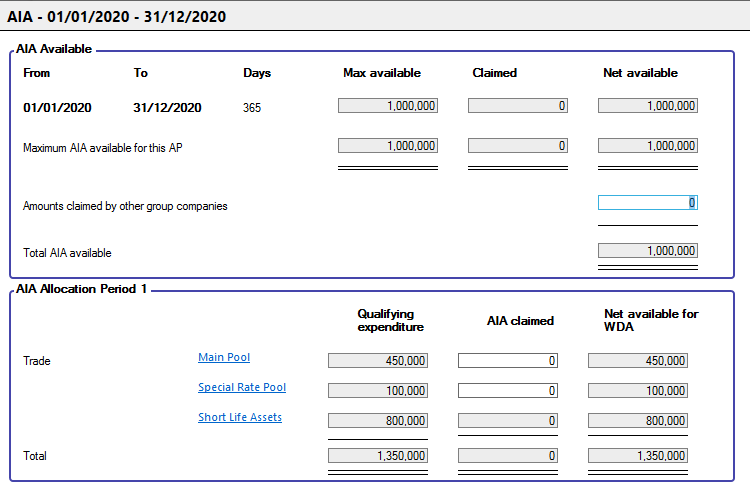

AIA Available displays the maximum amount of AIA available for the Accounting Period.

An entry in Amounts claimed by other group companies which will reduce the maximum available.

The 'Maximum AIA available for this AP' does not represent the grand total of the 'Max available' column.

The rules for calculating the 'Max available' for each period are based on apportioning the relevant maximum available amounts pre and post the straddling dates and the formulae for these periods are not the same.

The calculation of the maximum available can be by reference to the number of days or months in the Accounting Period. The calculation that produces the most beneficial result is the one applied.

However, the monthly basis cannot be used if the Accounting Period does not start on either the first day of the month or if the Accounting Period does not end on the last day of a month.

AIA Allocation allow you to specify the amount of AIA you wish to claim against qualifying expenditure.

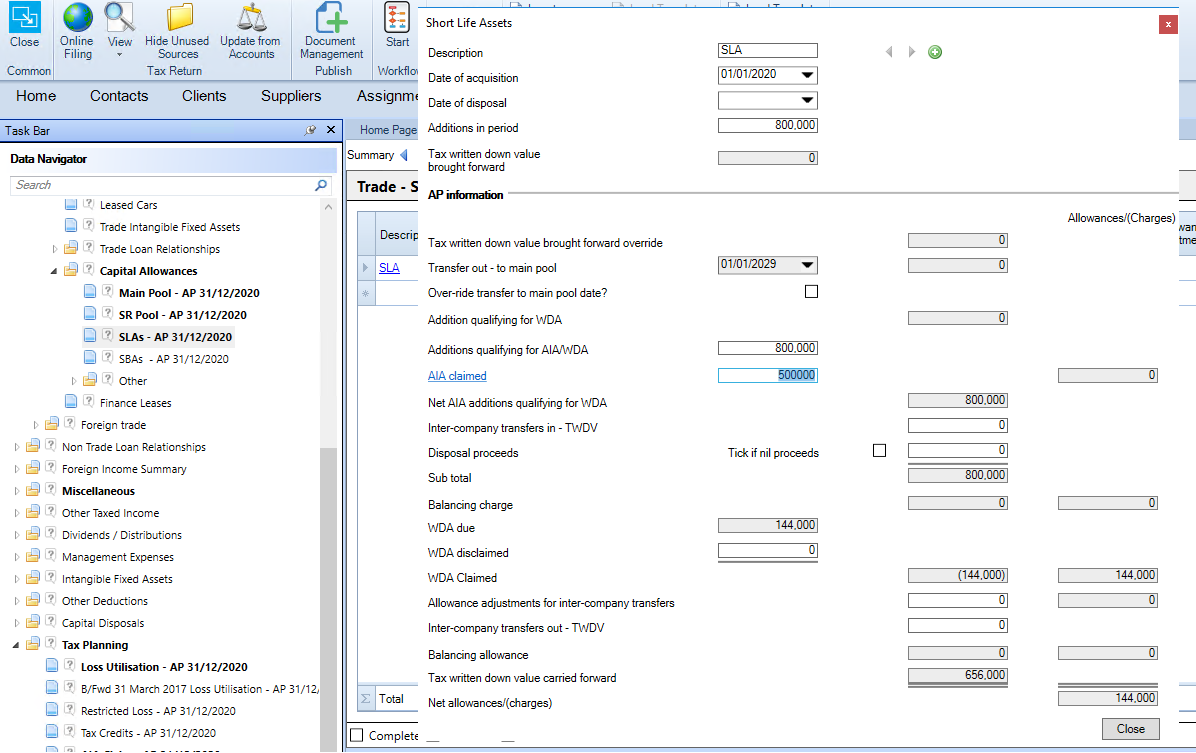

For Short life assets the AIA is claimed in the AIA Claimed cell within the individual short life asset's dialogue box.

A Warning will appear if the maximum amounts available is exceeded .