Main Return Data

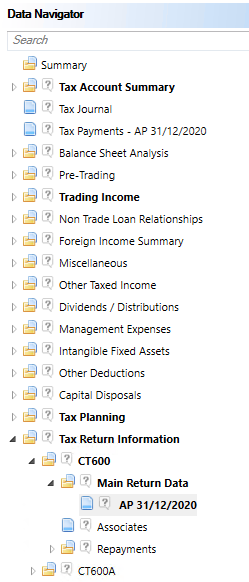

Main Return Data is where the standing data is input for the CT600.

It is located under Tax return information>CT600>Main return data within the Data Navigator.

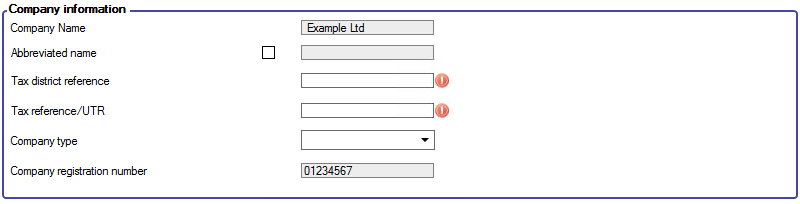

Company Information

This section relates to company information that would appear on page 1 of the return form.

In the Company information section the Company name is populated from CCH Central.

The Tax district reference code as this is mandatory for online filing.

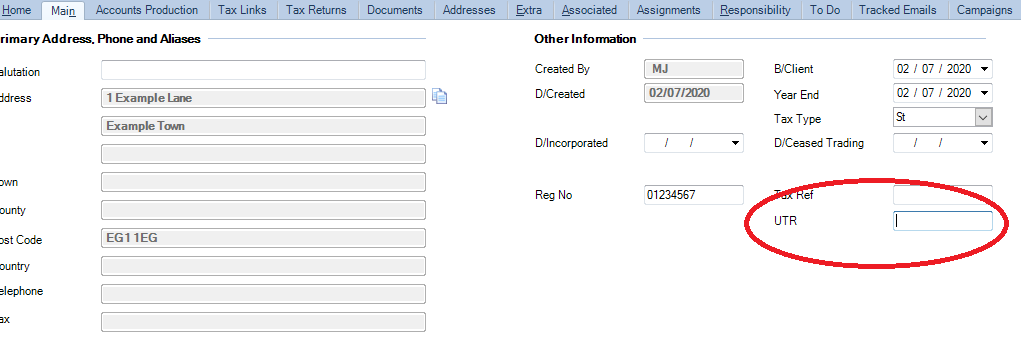

The Tax reference/UTR is populated from the UTR field in the Main tab in CCH Central or can be entered manually.

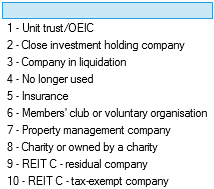

The Company type allows selection of company types from the dropdown menu.

The Company registration number is automatically populated from the Reg No field within the client record's Main tab within CCH Central.

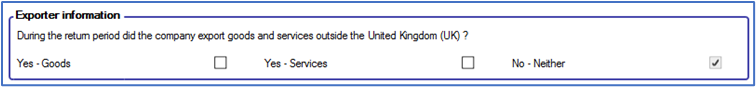

Exporter Information

For Accounting Periods ended after 31 March 2022, disclosure must be made if the company made exports of Goods and Services outside the United Kingdom.

The default entry will be No exports of Goods and Services have been made.

Signatory information

The signatory Name is mandatory for online filing.

The signatory Status is mandatory for online filing.

The signatory details will be populated read only fields in the next period.

To update the Signatory Name and Status check the box for Change signatory details.

If you want the same name and status to appear on relevant supplementary return pages, select the Use this information on all supplementary pages? check box.

If there are multiple Accounting Periods within the Period of Account, then the name and status should be entered in the first Accounting Period. The name and status will then be shown in the second and subsequent Accounting Periods.

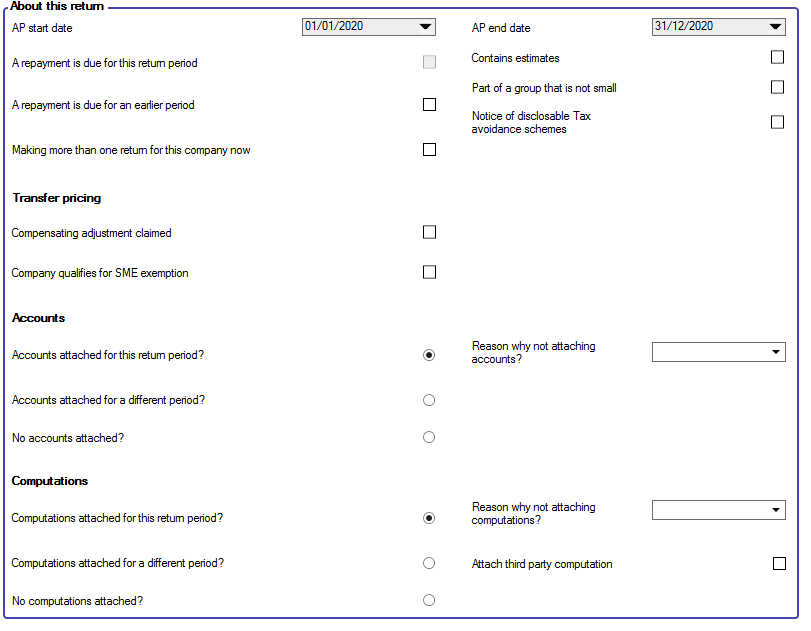

About this Return

This section allows you to complete many of the check boxes on page 1 of the return including the necessary information concerning the attaching of accounts and computations to the online submission documents.

A repayment is due for this return period is automatically checked when a repayment calculated for the period.

There are checkboxes for;

- A repayment is due for an earlier period. (This is not automatically calculated.)

- Making more than one return for this company now

- Contains Estimates

- Part of a group that is not small

- Notice of disclosable Tax avoidance schemes

Transfer Pricing

There are checkboxes for;

- Compensating adjustment claimed

- Company qualifies for SME Exemption

Accounts

If No accounts attached is selected then select a Reason why not attaching accounts? must be selected from the drop down list. This is mandatory for online filing.

Computations

If No computations attached is selected then select a Reason why not attaching accounts? must be selected from the drop down list. This is mandatory for online filing.

To attach a third party computation tick the box Attach third party computation. you will be able to attach the computation during the creation of the Online submission.

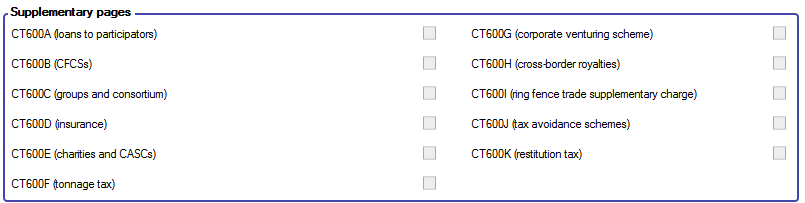

Supplementary pages

This section will automatically select the check boxes when the associated supplementary pages have been completed within the Tax Return Information area of the Data Navigator.