Additions Analysis

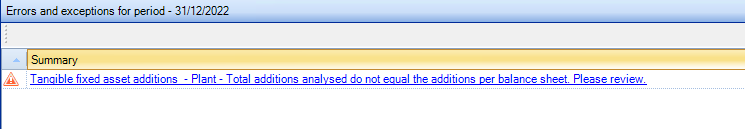

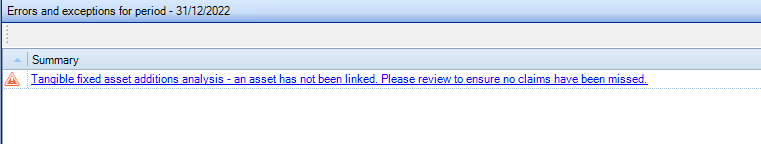

If there are any additions in the Tangible Fixed Asset statement, a warning will appear in the Errors and exceptions for the period panel;

Total additions do not equal the additions per balance sheet

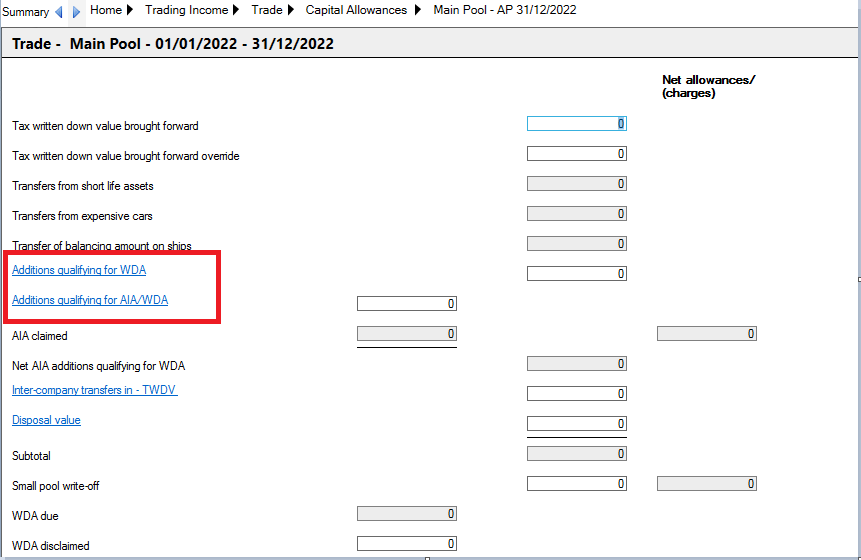

The Additions Analysis statement can be accessed directly from the Pools by clicking the additions hyperlinks;

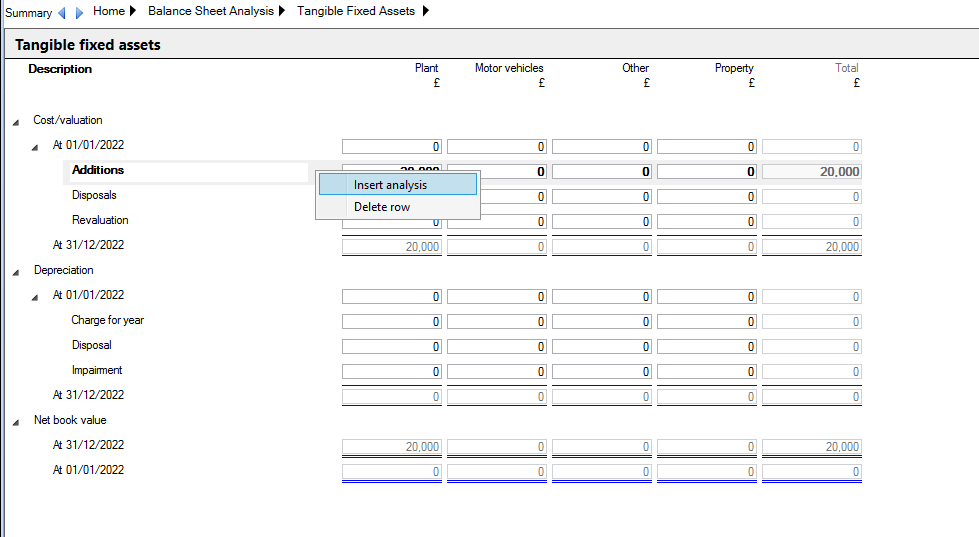

or by right clicking on the Additions row in the Tangible Fixed Asset statement imbetween the description column and the first value column and selecting Insert Analysis.

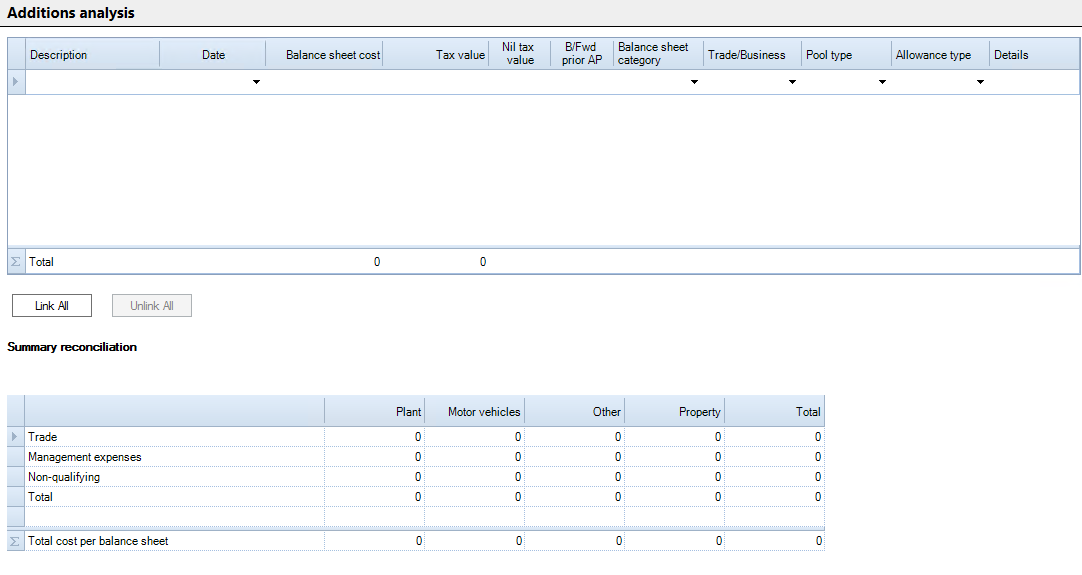

Once competed and linked (by selecting the Link All button), the additons analysis can be accessed under the Tangible Fixed Assets statement within the Balance Sheet Analysis area of the Data Navigator.

The Summary reconciliation table reconciles the fixed asset additions analysis entries, split into relevant trade/business types, to the figures entered in the Tangible Fixed Asset summary. Any differences in the totals will be flagged. Once all the columns have been completed, the assets can be linked so that the capital allowances are automatically populated in the relevant window

Additions can be entered manually, populated from the Fixed Asset Register or imported from a CSV file.

Import from CSV file

The data which is imported from a CSV is limited to the Description, Date and Balance sheet cost columns only.

A specific format is required to import data from a CSV file.

The first row in the CSV file must be the column headers with the specified names for the import to be successful.

The column headings must be named:

- Description

- Date

- Cost

The CSV file can include other columns, but they will be ignored.

To import asset additions data from a CSV file

Click Import/Export in the Balance Sheet area of the ribbon.

Select "Import Fixed Asset Additions" from the dropdown list in the Import/Export pop-up window and click 'OK'.

Locate the CSV file to import and click 'Open'.

A message should appear to say assets were successfully imported.

The assets should now show in the Additions analysis window.

Additions Analysis

The entries that should be made in the analysis are:

Description

Enter a description of the fixed asset addition.

Where the asset is to be included in a single pool, such as for Short Life Assets, then a unique description for the asset should be shown. The description should not match any asset description already existing in the single asset pool.

Date

Enter the date of acquisition of the asset. A default date of the final day in the Period of Account will be shown after you enter the description and then use the tab function to navigate to the date field.

Balance sheet cost

The value entered here should be the cost of the asset as shown in the balance sheet. This value is used in the Summary reconciliation table to reconcile against the total cost per balance sheet.

Tax value

If the tax value of the asset qualifying for capital allowances is different to the value shown in the balance sheet, the amount should be entered here.

Nil tax value

If the tax value is nil, then a tick in the Nil tax value box should be made.

B/fwd prior AP

If the asset was acquired in an earlier Period of Account and capital allowances are being claimed on the asset in the current Period of Account, this box should be selected.

To ensure this does not affect the reconciliation against the Tangible Fixed Asset summary, the Balance sheet cost of the addition should be zero.

Balance sheet category

This is a dropdown menu based on the column descriptions shown in the Tangible Fixed Asset summary.

Trade/Business

This is a dropdown menu based on the entries shown in the Trading Income window. It allows the asset to be categorised against the trade, Management expenses or Non-qualifying, to identify where capital allowances will be claimed.

Pool type

Choose the pool in which the capital allowance on the asset is to be claimed.

Allowance type

The options available in the drop down menu for the allowance type are based on the entry made in the previous field for Pool type.

Where the allowance type selected is Annual Investment Allowance, then the claim for Annual Investment Allowance should be made in the normal manner via the Tax Planning > AIA Claim window for pooled items, and via the individual asset where the asset is a Short Life Asset.

Details

This is a hyperlink which is automatically created when the asset has been linked and data is used elsewhere in the software.

Clicking on the hyperlink will navigate directly to the area where the data is being used.

Linking Assets

To allow the data entered in the Additions analysis window to be automatically used elsewhere in the software, click the Link All button below the data entry grid.

When an asset has been linked to another area, a hyperlink will appear in the Details column. The values will automatically populate the capital allowance pools, based on the entries made in the columns, and any single asset capital allowance pools will be created as appropriate.

Assets that have not been linked will show a red warning triangle in the Balance sheet cost field.

A warning will appeaer in the Errors and exceptions for the period panel

An asset has not been linked. Please review to ensure no claims have been missed.

If the value is changed after it has been linked, then the data will be automatically updated in the linked area.

If there is a Pool type is changed after it has been linked, the link will be removed. The asset will then need to be linked again.

Unlink All

There is an Unlink All function within the Tangible Fixed Asset Additions screen. When this is selected it removes all associated capital allowance data from the detailed capital allowance screens and the additions can then be relinked at a later time.