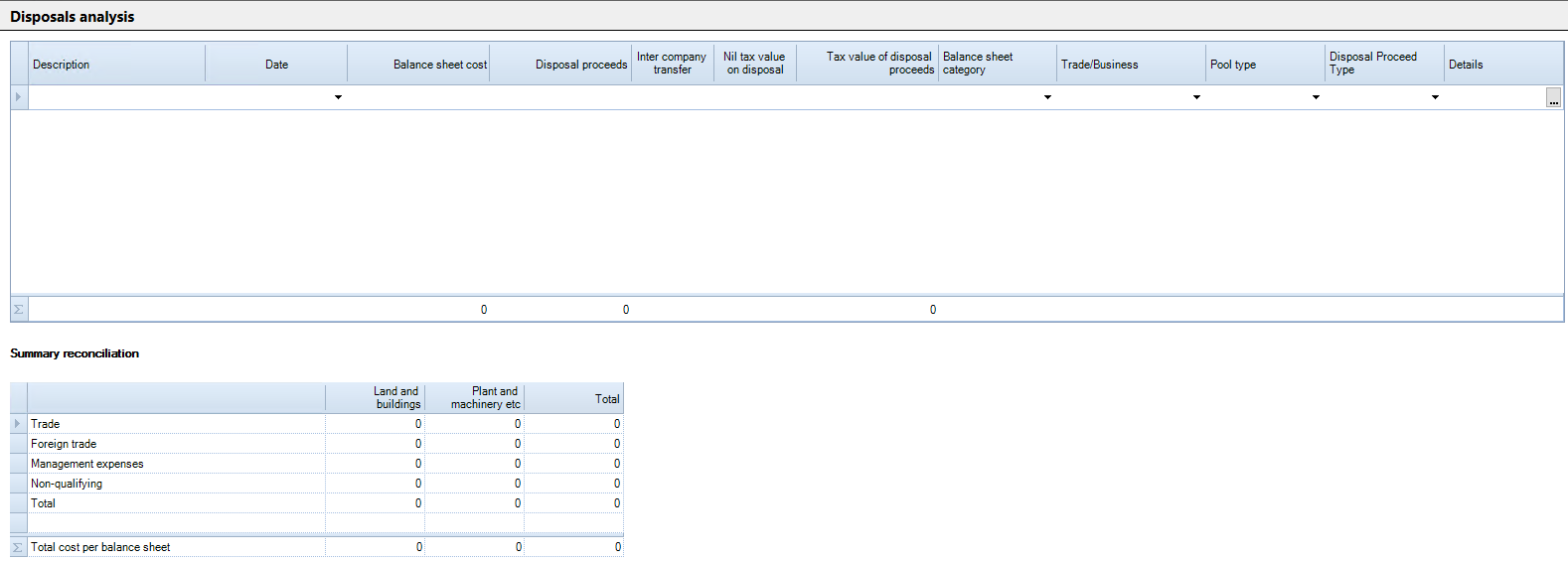

Disposals Analysis

Disposals can be entered manually or imported from a CSV file.

Import from CSV file

The data which is imported from a CSV is limited to the Description, Date, Balance sheet cost and Disposal proceeds columns only.

A specific format is required to import data from a CSV file. The column headings must be named

- Description

- Date

- Cost

- Disposal Proceeds

The CSV file can include other columns, but they will be ignored.

The first row in the CSV file must be the column headers with the specified names for the import to be successful.

To import asset disposals data from a CSV file

Click Import/Export in the Balance Sheet area of the ribbon.

Select "Import Fixed Asset Disposals" from the dropdown list in the Import/Export pop-up window and click 'OK'.

Locate the CSV file to import and click 'Open'.

A message should appear to say assets were successfully imported.

The assets should now show in the Disposals analysis window.

Disposals Analysis

The entries that should be made in the analysis are:

Description

Enter a description of the fixed asset disposal.

Date

Enter the date of disposal of the asset. A default date of the final day in the Period of Account will be shown after you enter the description and then use the tab function to navigate to the date field.

Balance sheet cost

The value entered here should be the cost of the asset as shown in the balance sheet. This value is used in the Summary reconciliation table to reconcile against the total cost per balance sheet.

Disposal proceeds

The value entered here should be the disposal proceeds of the asset.

Inter company transfer

If the asset has been disposed of by way of an inter-company transfer, this box should be selected.

Nil tax value on disposal

If the tax value of the disposal is nil, this box must be selected.

Tax value of disposal proceeds

If the tax value of the disposal for Capital Allowances is different to the Disposal proceeds value, the amount should be entered here.

If the tax value is nil, then a tick in the Nil tax value on disposal box should be made.

Balance sheet category

This is a dropdown menu based on the column descriptions shown in the Tangible Fixed Asset summary.

Trade/Business

This is a dropdown menu based on the entries shown in the Trading Income window. It allows the asset to be categorised against the trade, Management expenses or Non-qualifying, to identify where capital allowances were claimed.

Pool type

Choose the pool from which the asset is disposed of for capital allowance purposes.

Details

This is a hyperlink which is automatically created, except where the Pool type is a single asset pool or Trade/Business is Non-qualifying.

Where the asset is held in a single asset pool or is non-qualifying, the link must be manually made.

Click the ellipsis at the end of the box.

A Link selection pop-up window will appear showing all the assets held within the relevant single asset pool or the list of non-qualifying assets. Select the asset which has been disposed of.

Click 'Link'.

This will then create the hyperlink.

Clicking on the hyperlink will navigate directly to the area where the data is being used.