Net Book Values

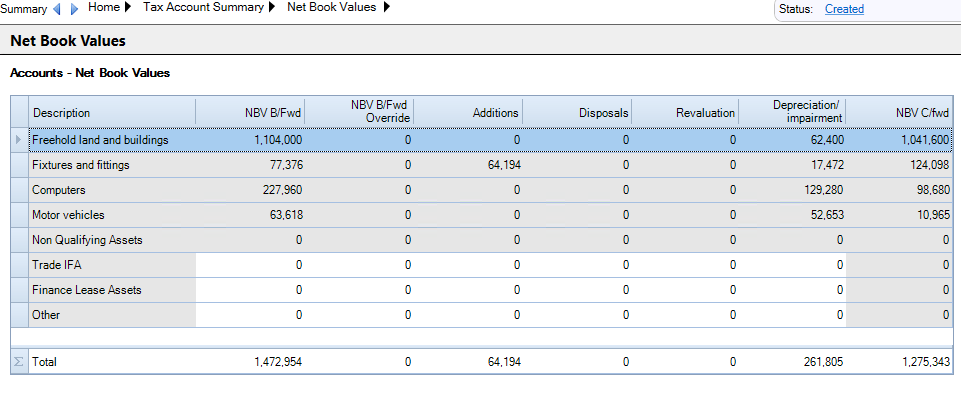

Accounts Net Book Value (NBV)

The Net Book Value data entry window will be automatically completed with the information from the Tangible Fixed Asset Summary window. It is a representation of the net book values and movements as seen in the company's Financial statements for the period of account.

Non-qualifying assets are also displayed here and deducted to arrive at the total movements relating to qualifying assets necessary for the calculation of deferred tax on fixed asset differences. The information displayed is derived from the entries made in the Non-qualifying assets data entry window.

Details of relevant qualifying assets relating to Trade Intangible Fixed Assets and any Other qualifying assets will need to be entered manually into the associated rows indicated in the data entry window.

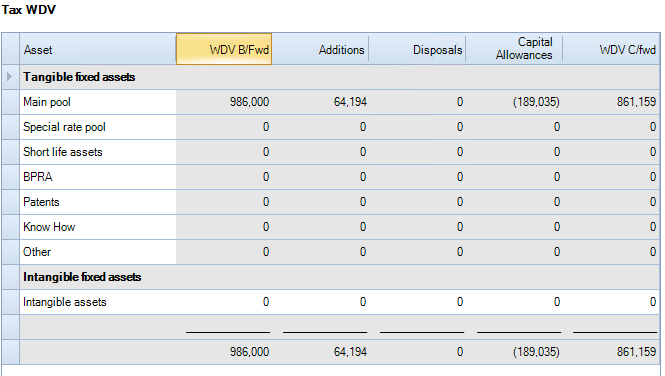

Tax WDV

This is automatically populated from the data entries made in the capital allowance areas within corporation tax. Manual entries are required to be made for any Intangible Fixed Assets.

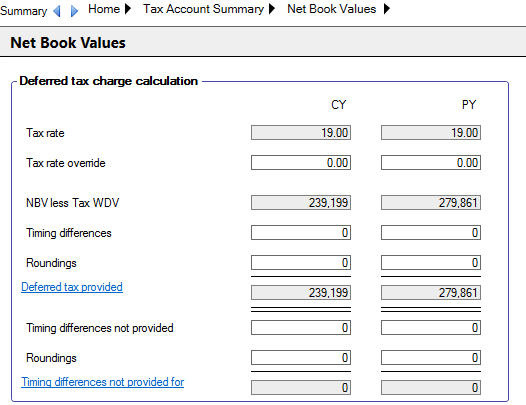

Deferred tax charge calculation

The Deferred Tax charge calculation shows the deferred tax provided for the current and prior years and allows the tax rate to be entered together with any provisions required for timing differences and any roundings.