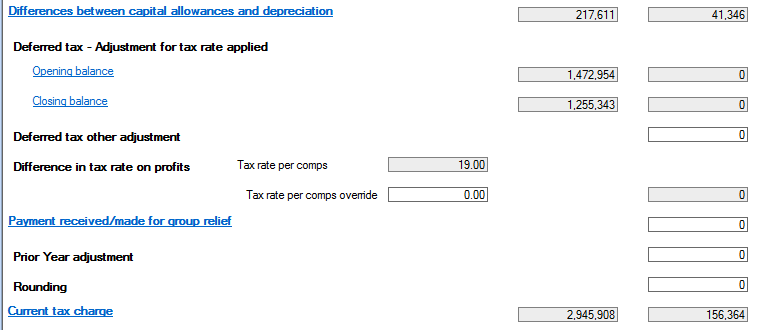

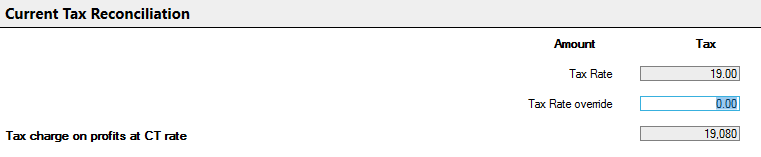

Current Tax Reconciliation

Tax on charge on Profits at CT Rate

The tax rate can be overidden in the Tax Rate override.

The Amount column displays amounts and the Tax column displays the tax calculated on those amounts.

The differences are then broken down by category.

Fixed asset differences

The amount of depreciation and profit/(loss) on disposal of fixed assets arising on assets not qualifying for capital allowances will be completed based upon the entries made in the non-qualifying assets data entry area.

Enter amounts of depreciation arising on other assets that do not qualify for capital allowances not already included in above.

Permanent differences

The entries for the permanent differences are taken from the corporation tax computation. It is not possible to identify all entries that are permanent or timing differences so manual entries may be required to be made.

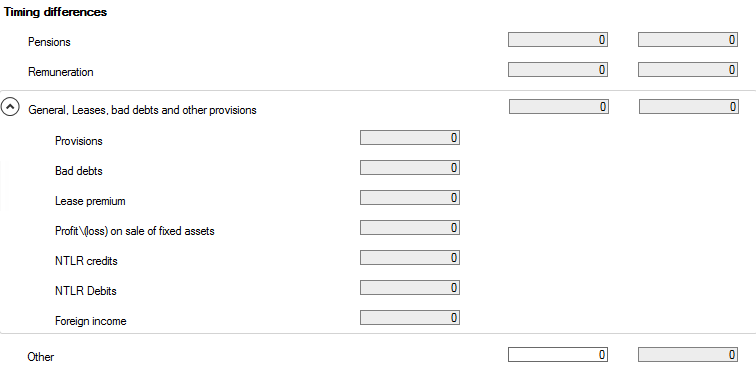

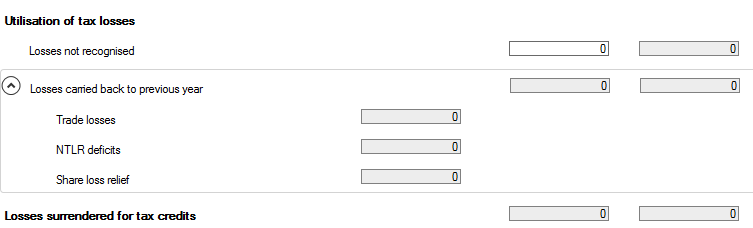

Section can be expanded by clicking on the  icon.

icon.

Capital Gains are not populated from the computation and so should be entered manually

Timing Differences

Timing differences are calculated and displayed

Group Relief is calculated from the computation.

Utilisation of tax losses and other entries

An entry can be made in the Difference in tax rates on profits and in Losses not recognised.

The differences between capital allowances and depreciation are shown, followed by the opening and closing deferred tax balances and any other reconciling items to the current tax charge displayed at the base of the input screen.