Deferred Tax Reconciliation

This is where the deferred tax calculation arising on the Fixed assets is calculated. The entries made in the window are a mixture of manual and auto calculated entries based on the entries made elsewhere in the Tax Account Summary. The window is made up of two separate data entry areas.

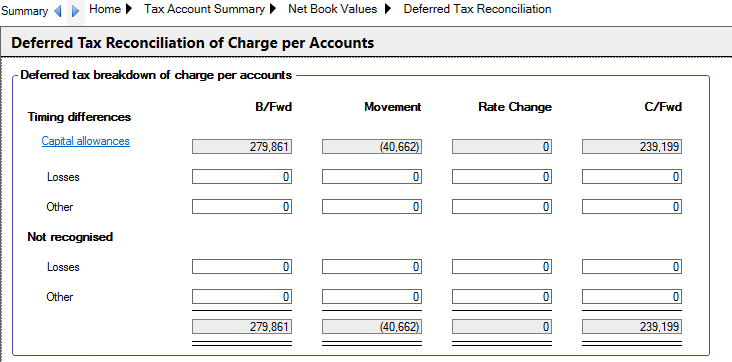

Deferred Tax Breakdown of charge per accounts

The breakdown shows the movements of capital allowances within Timing Differences with inputs for losses and amounts not recognised.

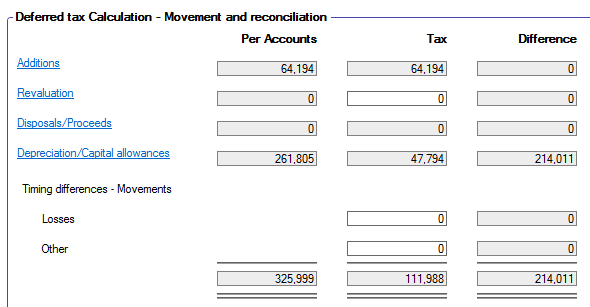

Deferred Tax Calculation - Movement and reconciliation

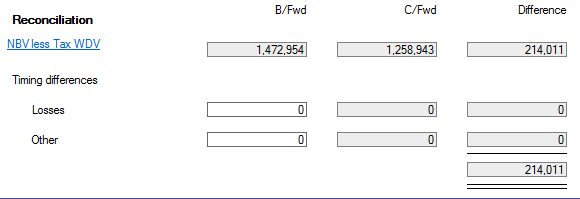

The Deferred Tax calculation shows the difference in movement values per the accounts and Tax and displays the difference followed by a reconciliation of the net book value less tax written down value.