Enhanced Capital Allowances - Super Deductions

How to apply 'super deductions' for Enhanced Capital Allowances.

Enhanced Capital Allowances - Super Deductions

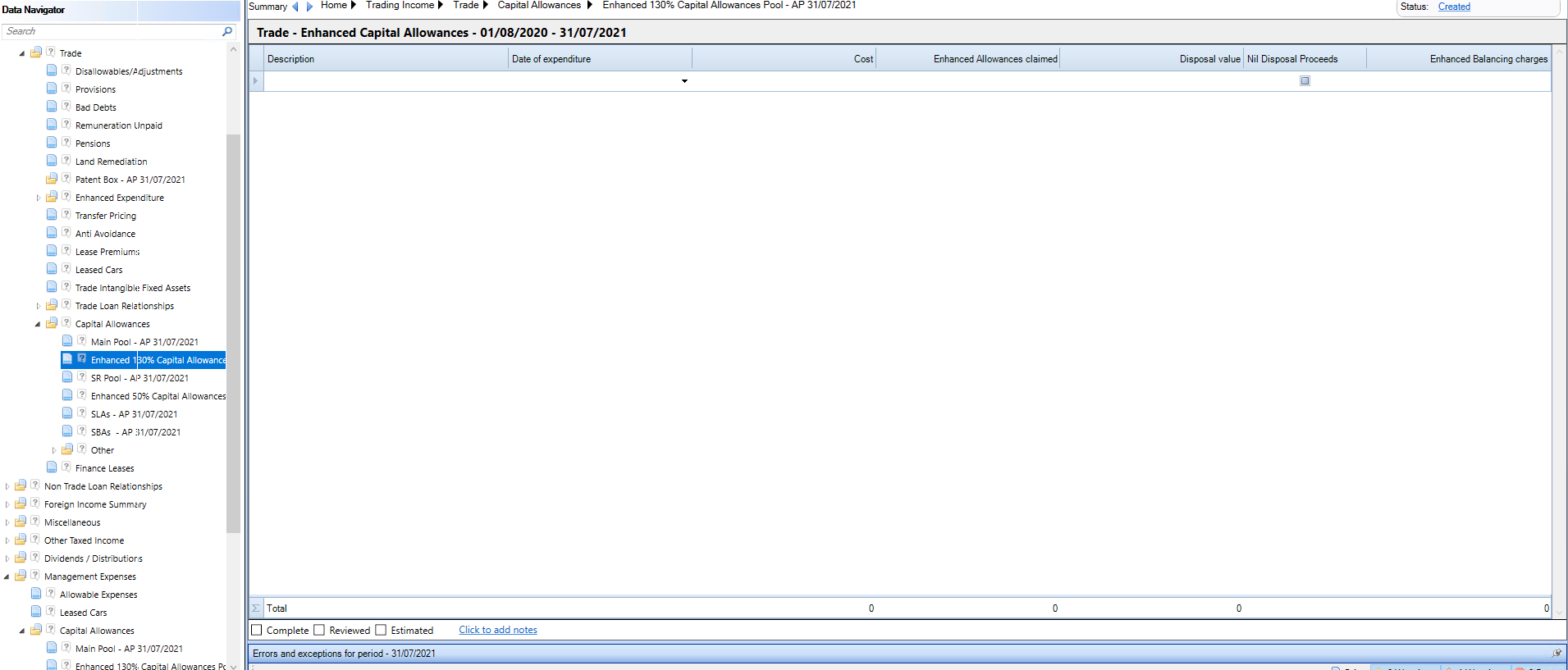

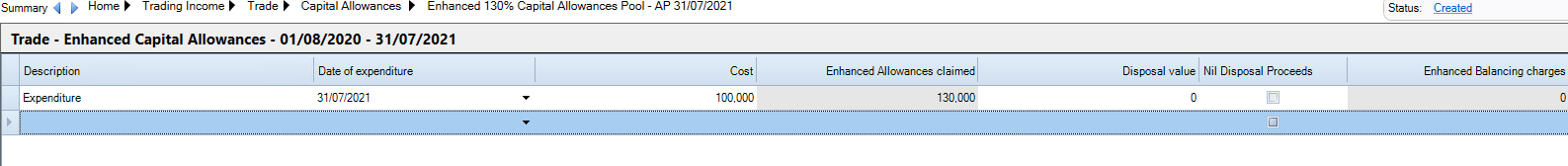

Allowances that attract an enhanced capital allowance of 130% and 50% enhanced allowances should be linked from the Additons Analysis or Disposals Analysis input screens from the Tangible Fixed Assets input screen in the Balance Sheet Analysis area of the Data Navigator or entered in either the Enhanced 130% Capital Allowances or Enhanced 50% Capital Allowances input screens located in the Capital Allowances areas of the Data Navigator.

Enter a Description and enter a Date of Expenditure or select it drop the date picker and enter the Cost to calculate the Enhanced capital allowance claimed.

Enter a Disposal Value to calculate any Enhanced Balancing charges.