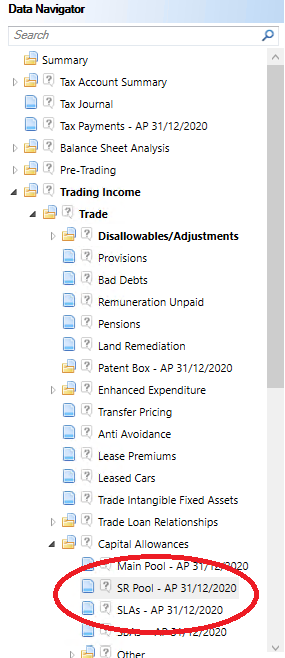

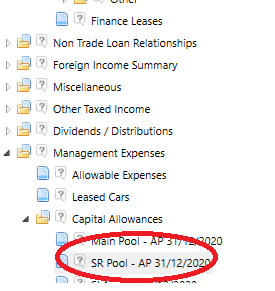

Special Rate Pool (SR Pool)

The Special Rate Pool is located under Capital Allowances in the Trading Income and Management Expenses sections of the Data Navigator.

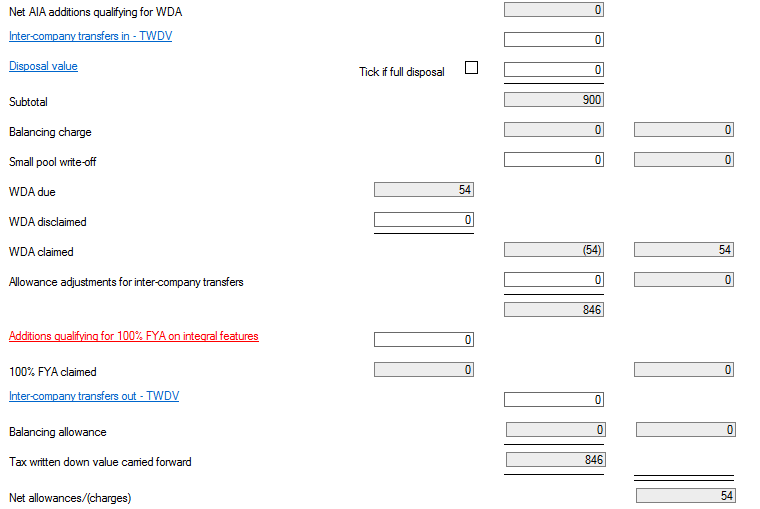

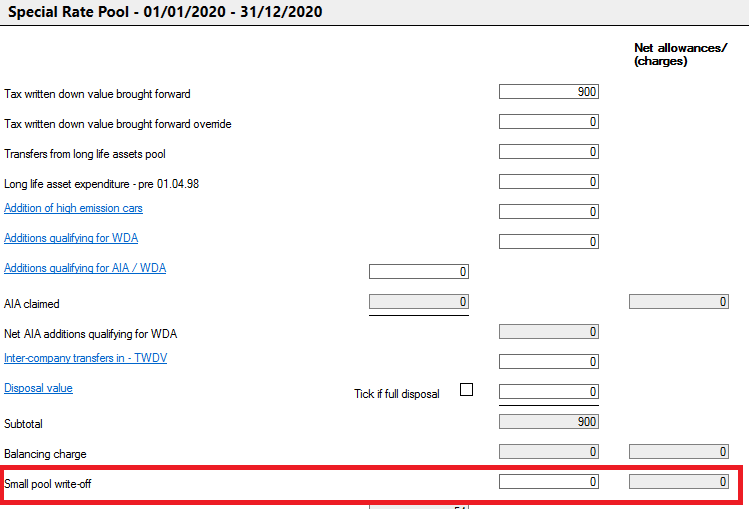

Tax written down value brought forward is a manual entry in the first accounting period. For subsequent accounting periods it is calculated from the preceding period's carry forward. If this value requires amendment then use the Tax written down value brought forward override.

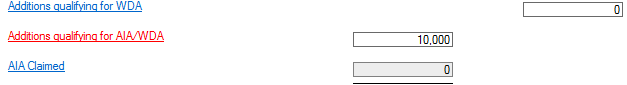

Additions qualifying for AIA/WDA can be either manual entry or linked from the the Tangible Fixed Assets Additions Analysis input screen.

To claim the annual investment allowance click on the AIA Claimed hyperlink and complete the AIA Claim input screen located in the Data Navigator under Tax Planning > AIA Claim.

A Small pool write off appears when the written down value is £1,000 or less.

To disclaim Written down allowance, enter the value to disclaim in the WDA disclaimed field.

First Year Allowances can be entered or linked from the Tangible Fixed Assets Additions Analysis input screen.