CCH Personal Tax 2024.1: Release Notes

Release Highlights

This release of Personal Tax includes the following items:

- SA100 & supplementary forms

- SA800 & supplementary forms

- SA900 & supplementary forms

- R40

- R185

- Help sheets HS290, HS295, HS302 and HS304

Details of these and other changes are included in these release notes.

Prerequisites

Installing CCH Personal Tax 2024.1

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licenced are installed in the correct sequence. Click here to learn about the Central Suite Installer.

Items to be included in the next release

As in previous years, information provided by third parties is not made available until after April 5th; it is not possible to include these items as part of the main 2024.1 release. Subject to their timely provision, the following items are planned to be included as part of the next release:

- FTSE350 file

- Exchange Rates

- Double Tax Treaty rates

- Updated Specials & Exclusions for 2023/24

In addition to these items, we will be making changes in the 2024.1 Service Pack for the changes required by HMRC for Silent Login. At this time HMRC does have any plans to make Silent Login to other users; only users currently white listed by HMRC are able to use the Silent Login functionality.

Legislative and Compliance Updates

2024 Tax Forms

We have added the updated forms for the year ended 5 April 2024 for the following:

- SA100

- SA800

- SA900

- Foreign Tax Credit Relief Working Sheet and Expat version

- R40

- Forms R185

- Updated Help Sheets HS295, HS302, HS304 and AAG4.

Note! Any references to Coronavirus Support Payments have been removed inline with the updated tax returns.

Update Rates and Allowances

The rates and allowances for both Individuals and Trusts have been updated for 2023/24 and 2024/25. Details of the updated rates and allowances can be viewed from Maintenance > Tax settings > Personal Tax > Rate and Allowances:

The updated rates and allowances are automatically applied to the computations for Individuals and Trust and Estate cases.

Scottish Rates of Tax for 2024/25

The new Scottish rates of tax have been updated but are not yet available as part of the 2024/25 computation.

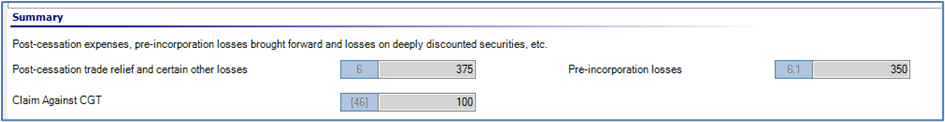

SA101 - New box for Pre-Incorporation Losses

HMRC have added a new box 6.1 to page Ai 2 the Tax Return Additional Information (SA101) pages to separately capture entries for Pre-Incorporation losses.

There are no changes to the grid in the data entry window for Post cessation expenses. The relevant claim type (Pre-incorporation losses) is still selected from the dropdown, but there is now a new field included in the Summary section to reflect entries posted to box 6.1.

Entries in the grid with Claim type equals Post cessation expenses and Deeply discounted security losses are summed to Box 6, entries with Claim type equal to Pre-incorporation losses are summed to the new Box 6.1. We have also updated the number for the field Claim against CGT to reflect the correct Box on the Capital Gains Tax summary (SA108) supplementary page.

SA102 - Changes to the Car Benefits Table

CO2 emissions and car fuel benefit multiplier

The Employment car fuel benefit multiplier has been updated as follows:

- 2024 to £27,800

- For 2025 the multiplier is frozen at £27,800

The latest car fuel emissions data to September 2023 is included with this release.

Note: The Car Benefit worksheet utilises the old style help sheet which was retired by HMRC in 2019. The values populated are correct.

Capital Allowances

Capital Allowances for Freeport Structures and Buildings and Zero-emission cars have been updated, and now include Investment Zones. All references to Freeport Structures and Buildings Allowance now read Freeport SBA or Investment Zone. The in addition the rate of Annual Investment Allowance remains £1 million after 31 March 2023.

SA105 - AIA claims

HMRC has updated the RIM artefacts for the SA105 for AIA claims for 2023/24. As a result of this, the data entry screen has been updated to show only a single box (Box 32) for AIA claims:

SA106 - Foreign Dividends

The 2024 Tax Returns have reduced the limit for the Foreign Dividends that may be reported on the SA100 (as opposed to the SA106) to £1,000. The level for Interest received remains unchanged at £2,000.

Expat

We have updated the Expat module within Personal Tax for the 2023/24 compliance changes. The user interface, computation and backing schedules have all been updated.

Tax Return Bundle, Disclosure Notes and Letter Paragraphs

We have updated the Tax Return Disclosure Notes, Tax Return Bundle and Letter Paragraphs to show the 2023/24 start and end dates. We have also updated the Data Dictionary supporting the Tax Return Disclosure Notes and Letter Paragraphs for the changes to the SA100 Tax Return and supplementary pages.

Information Request

We have included updated Information Request Templates for the 2024 tax return season; the amendments relate solely to the removal of Coronavirus payments. The templates are:

- 2024 – CCH Information Request New Client

- 2024 – CCH Information Request No PY Details

- 2024 – CCH Information Request PY Details

- 2024 – CCH Trust - Information Request No PY Details

- 2024 – CCH Trust - Information Request PY Details

Specials and Exclusions

HMRC has only recently made available their updated exclusions document for 2023/24, accordingly we have not added any new exclusions in this release.

2024/25 Tax Year

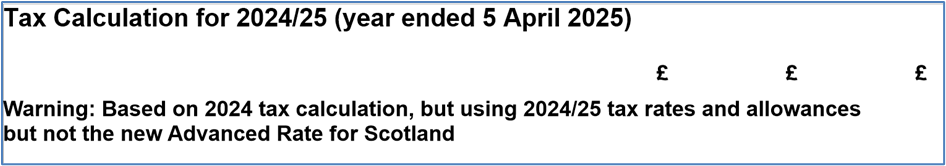

We have enabled the 2024/25 Tax year within Personal Tax. The computations for Individuals and Trust are based on the 2023/24 tax calculation but using the 2024/25 rates and allowances where appropriate. A warning message appears on the SA302 and the Trust Computation:

Treaty Rates

The Treaty Rates have been enabled for 2024.

Return review

The 2025 year has been created within Return Review and the variances for 2024 will be automatically applied to 2025. These can be changed within the maintenance data entry window.

Foreign Land and Property - Capital Allowances

For the SA100 and SA900, Zero Emission goods vehicles with Private Use, and Zero Emissions goods vehicles are now reported separately as 100% Zero Emissions goods vehicle allowances on the backing schedules.

R40 Changes

HMRC has made a number of changes to the R40 mainly renumbering of boxes and these have been updated as part of this release; there is however a major change relating to repayments. When a repayment is required to be made to an agent, HMRC now requires an Agent reference number (ARN). The repayment screen has been updated as follows:

The ARN uses the format XARNNNNNNNN where X is any alpha character and N is any numeric character. To enter details simply enter the details as a string of 8 characters, CCH Personal Tax automatically formats this into the correct layout.

It is planned to add an R40 option to Default Repayment Claims in a future release.

Software Enhancements

Basis Period Reform

CCH Personal Tax has been updated for the requirements of Basis Period Reform.

Background

For further information regarding the legislative changes and requirements the following links may be helpful:

Get Help with basis period reform - GOV.UK (www.gov.uk)

Assessable Period

2023/24 is the transition year, the assessable period is made up as follows:

- Standard Part – The 12 months starting from the date immediately after the prior basis period's end date. (If you have a short or long accounting period, an adjustment is required to included in the adjustment box so that only 12 months of profits are assessed as the standard part)

- Transition Part – The remainder over the 12 months up to 5 April 2024.

Note: Businesses commencing during 2023/24 only have a standard part from the commencement date to 5 April (or late accounting date).

If a prior basis period has not been entered and there is no commencement date, please check the start date being used; it should not overlap any prior period that has previously been assessed.

The transition boxes match HMRC's notes and include the step references for ease of comparison. CCH Personal Tax applies HMRC’s guidance to calculate the assessable amount. We have added a new section to the business tax backing schedule called Transition Part, which shows the calculations for steps 1 – 5, as applicable.

A new tick box Apply late accounting date rules for periods ending 31 March to 5 April has been included:

This prevents any apportionment when using an accounting period end date between those dates.

To disapply the election and assess to the 5 April untick the box. A disclosure note automatically appears on the return. Once made, this election is irrevocable and the box is disabled for the following 4 years.

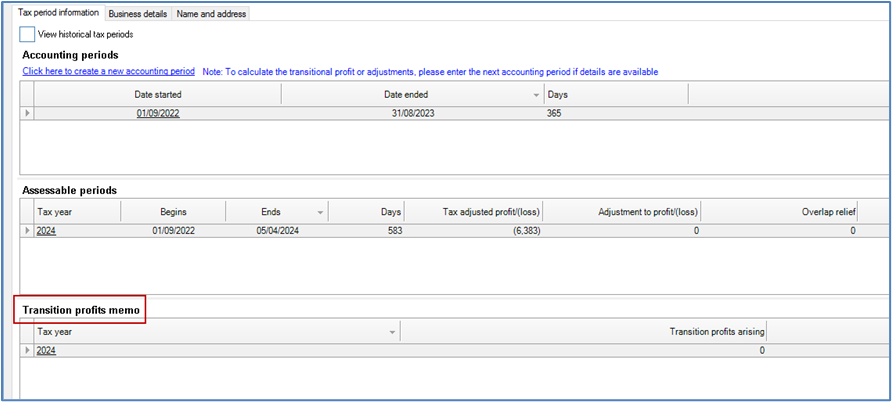

Business Tax

If the accounting period and tax year are not coterminous, please enter details of the subsequent accounting period to enable calculation of the transitional element. Add the new accounting period in the usual way:

Basis periods has been renamed Assessable periods. For 2023/24, it automatically populates the start date, the options are:

- The day immediately following the end date of the prior year’s period,

- The commencement date if the business started within 2023/24, or

- The start date of the accounting period entered, if there is no prior period.

In all instances the end date is automatically populated as 5 April 2024, unless you have a late accounting date (31 March to 4 April) or a cessation date has been entered.

The Overlap relief available section has been replaced by Transition profits memo. This lists each year and the rolling amount of transition profits until 2027/28, enabling you to see the amount of transition profits assessed in each year and how much remains, if any.

Note: To check the overlap history, open the prior year’s return. If the Overlap profit brought forward field within the Adjustments tab shows an incorrect amount, it can be edited after ticking the Lock Accounts box.

Business Tax, Assessable Period, Adjustments Tab

Where a transition part exists, only the FULL pages (SA103F) are produced. Tick to use SA103S short form is disabled.

Any adjustment required is automatically calculated, based on whether there is a commencement date or the accounting period dates. This is calculated on a daily basis (please remember that 2024 is a leap year).

To override any automatically apportioned fields , tick Lock Accounts this permits manual overrides, the following fields are now editable:

- Adjustment to arrive at profit or loss for this period

- Overlap profit brought forward

- Profit or loss of the transition part of the basis period

Where overlap profit brought forward exists, this is used in the following order:

1. Against the transition part.

2. If there is no transition part, but there is still an amount of overlap profit brought forward, it is offset against the standard part instead.

Spreading

Where there are transition profits and an overall profit position, the spread amount to be assessed in the year is calculated. It is possible to enter any additional transition profits to be accelerated accelerate and assessed within the tax year. This reduces the amount of transition profit to carry forward.

If the overall position is a loss,CCH Personal Tax calculates how much of those losses can be used using terminal loss relief rules.

This field is a memo only for the purpose of the transition part. If a cessation date has been entered it may not show the full loss allowable under terminal loss relief rules it is still populated with the lower of the overlap relief amount or the overall loss, but the losses schedule is not restricted.

Partnerships

Partnerships do not have the same level of autonomy as business tax due to the complexity of referencing back to the accounting period. There are no changes to the SA800. The changes are reflected in the SA104 forms. Like sole traders, only the full pages (SA104F) are produced where there is a transition element.

Note! IWhere the partnership is set up as a client, the end date that appears in box FPS7 defaults to 05/04/2024, even when a late accounting date is used. Where applicable this date can be amended.

When entering details of with the partnership income on the individual partners' returns, it is necessary to manually apportion:

- The standard part to assess 12 months from the start of the basis period

- The transition part to assess the amount after the 12 month standard part and up to 5 April 2024.

Once the manually apportioned figures are entered, CCH Personal Tax calculates the assessable amounts following HMRC’s guidance.

Profit

Loss

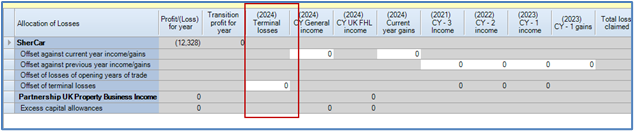

Losses

The Losses Allocation grid has been updated to include two new columns:

- Transition profit for year – Displays the amount of transition profits available against which b/fwd losses may be to offset

- B/fwd used against transition part – Displays the amount of brought forward losses set against transition profits.

There is also enhanced functionality for terminal loss relief. Where the use of overlap creates or increases a loss, this can be offset under terminal loss relief rules. The offset box is available to edit provided the data entry box loss allowable for offset under terminal relief rules within Business Tax or Partnership Income has been populated and validations are included.

These boxes will remain in place until 2027/28.

Quality Improvements

The following items have been updated in this release.

Online Filing Validations - Time limit to submit a return online

The time limit for filing an earlier year's tax return online is 4 years from the end of the year to which it relates e.g. 05/04/2024 is the last date for which a return for 2019-20 can be filed. A validation to online filing has been added to prevent the online fling of the return more than after the deadline.

Notable Issues:

We have identified the following items as part of this release:

ITS 67929 - Central Workflow does not identify it is too late to file an amended return.

As mentioned above we introduced functionality to trap that it is past the deadline for submitting an Amended Tax Return (i.e. today's date is later than 4 years after the end of the tax year to which the Tax Return relates). This functionality works when the 'Online Filing' window is accessed through the UI. However, if the user attaches a Central Workflow containing the 'Pre-validate IR mark' Advanced workflow activity this error is not trapped.

SA101 - Lifetime Allowance Charge

We currently have an open query with HMRC regarding the lifetime allowance charge, according to Working Sheet 345 this is abolished for 2024 and subsequent years. Upon reviewing of the SA101 the relevant boxes AIL7 to AIL9 are still present. As the boxes are still available, we have not removed them for 2024; this remains under enquiry with HMRC.

Basis Period Reform

Changing accounting period to align with tax year

Where a taxpayer changes their accounting period to align with the tax year, we recommend extending the accounting period to 5 April (or a late accounting date), rather than creating a short accounting period ending in the same tax year.

For partnerships, this is an existing limitation.

For Business Tax, short accounting periods are not currently triggering multiple instances of page SA103F.

Changing basis period start date within Business Tax

When setting up a new client and the sole trade basis period start date is not the same as the accounting period start date, enter the commencement date if you are dealing with early years.

The only way to manually change this within the software is to change the accounting period start date. This changes the basis period start date if there is no prior tax year record. It affects the population of box FSE8 on the return; we suggest that if you use this approach, a white space note is added to provide the correct accounting period start date that should be in box FSE8. It is also necessary to manually apportion any adjustment needed for the standard part (and possibly the transition part) by ticking Lock Accounts.

Alternatively, enter the previous year's return details, before creating 2023/24 to replicate what was assessed in the prior year, so that the software can correctly calculate the period to use for 2023/24.

Partnerships

When ticking either of the Non active or limited partner or Active member of an LLP tick boxes, the page automatically scrolls up to the top. As this does not prevent the ticking of said boxes, we will look to address this low priority issue in a future release.

Computation

Where transition profits exist, a minimum of 20% of these are assessed in the tax year, with the remainder being spread over the following four tax years. The assessable transition profits do not form part of the main computation; instead an additional row plus Tax due on transition profit of £x,xxx appears after Income Tax charged after allowances and reliefs. The figure is the amount of transition profit before any brought forward losses have been offset, the tax amount is calculated on the lower amount after loss offset. This follows HMRC's computation.

HMRC Workaround relating to basis period reform (Specials and Exclusions)

As previously advised, we are introducing the updated specials and exclusions in a future release.

HMRC have introduced 5 Specials relating to basis period reform. These require workarounds due to their current validations and are noted below:

- Special 53 - Affects taxpayers claiming the trading allowance, where the standard profit is less than the trading allowance and the remainder is set against the transition profit. Validation rules will only allow an entry of up to the standard profit in box FSE16.1.

- Enter the maximum possible trading allowance against the standard profit as usual.

- Reduce the amount of transition profits in box FSE73.1 by any remaining trading allowance.

- Provide details of the claim to trading allowance in a white space note and advise that the workaround has been used.

- Special 54 – Affects taxpayers with a positive adjustment in boxes FSE71/FSE72 and a transition loss that creates or increases an overall loss. Validation rules will result in the transition loss being used to incorrectly reduce the positive adjustments in FSE76.

- Remove the adjustments from boxes FSE71/FSE72 and instead, enter them in box FSE75 within the Total taxable profits tab.

- Add a white space note to advise that the workaround has been used.

- Special 55 - Affects taxpayers with a positive adjustment in boxes FSE71/FSE72 and a transition loss that creates or increases an overall loss, who want to use brought forward losses against the positive adjustments. Validation rules will result in an inaccurate maximum restriction of brought forward losses that can be claimed in box FSE74.

- Remove the adjustments from boxes FSE71/FSE72 and instead, enter them minus the loss brought forward in box FSE75 within the Total taxable profits tab.

- In the Losses screen, add a negative Adjustment to losses b/fwd for the amount used.

- Add a white space note to advise that the workaround has been used.

- Special 56 - Affects taxpayers with a positive adjustment in boxes FPS10/FPS11 and a transition loss that creates or increases an overall loss, who want to use brought forward losses against the positive adjustments. Validation rules will result in an inaccurate maximum restriction of brought forward losses that can be claimed in box FPS17.

- Remove the adjustments from boxes FPS10/FPS11 and instead, enter them minus the loss brought forward in box FPS19, Enterprise allowance etc.

- In the Losses screen, add a negative Adjustment to losses b/fwd for the amount used

- Add a white space note to advise that the workaround has been used.

- Special 57 - Affects taxpayers with a positive adjustment in boxes FPS10/FPS11 and a transition loss that creates or increases an overall loss. Validation rules will result in the transition loss being used to incorrectly reduce the positive adjustments in FPS18.

- Remove the adjustments from boxes FPS10/FPS11 and instead, enter them in box FPS19, Enterprise allowance etc.

- Add a white space note to advise that the workaround has been used.

Foreign Tax Credit Relief Working Sheet - Tax due on transition profit

Where the Tax Return has multiple sources of double taxed income and transition profit, then the Tax due on transition profit on the second and subsequent Foreign Tax Credit Relief Working Sheets may be incorrect where the calculation involves a phase out of personal allowances.