CCH Personal Tax 2024.1 SP: Release Notes

Release Highlights

This release of Personal Tax includes the following items:

- Updated FTSE350 file

- Updated Exchange Rates

- Double Tax Treaty rates

- Changes to the Silent Login Functionality (as required by HMRC)

Please ensure to watch the Release Video available on the My Learning Portal for an overview of the latest updates

Prerequisites

Installing CCH Personal Tax 2024.1 SP1

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licenced are installed in the correct sequence. Click here to learn about the Central Suite Installer.

Legislative and Compliance Updates

The 2023/24 FTSE350 file is included in this release.

Average Exchange Rates

The average exchange rates file is produced from the official HMRC average exchange rates. The file is now included in this release.

Note! Please be aware that from 2023/24, HMRC are producing exchange rates to 4 decimal places rather than 6 decimal places as in prior years

Croatia has now migrated to the Euro. In addition, the currency code for the Sierra Leone, Leone changed from SLL to SLE. These changes are reflected in this update.

Double Tax Treaty Rates

The 2024 and 2025 Double Tax Treaty Rates are included in this release. The following countries have been updated:

- Kyrgyzstan (effective from 2023/24)

- San Marino (effective from 2024/25)

Changes to HMRC Silent Login

In September 2023 HMRC advised of changes to its terms and conditions to the silent log in service and advised that these new terms and conditions are planned to come into force on 24 June 2024. We have made the necessary changes to CCH Personal Tax to continue to support the Silent Login functionality.

- HMRC plan to contact agents on or after 24 June 2024 to get their formal agreement to the terms and conditions. HMRC requires Silent Login users to:

- Provide HMRC with contact details for an employee within the User’s organisation who is responsible for the use of Silent Login within the User’s organisation.

- Notify HMRC within 72 hours in the event of any data breach in relation to Silent Login, in particular when access credentials have been used in an unauthorised way or used outside of the intended scope of Silent Login

- Keep a log of user details which records when Silent Login is used, by whom, and on what device. HMRC requires this log to be kept for 12 months (to be agreed) following each use of Silent Login, and this log to be provided to HMRC on request

- Set and maintain permissions for staff access to ensure that only staff needing access to specific client data may access that data.

- Refresh credential passwords within 72 hours of a data breach (N.B 72 hours is the time requirement for notification of a data breach under ICO rules) or if someone who has access to the credential passwords leaves your organisation

Note: If you do not agree to these terms and conditions, HMRC will remove access to Silent Login. Similarly if you fail to comply with these terms and conditions, access to Silent Login will be removed.

HMRC has also advised that where credentials are unused for 18-months or more, they will remove access to Silent Login.

If you have any queries please direct these to agent.login@hmrc.gov.uk

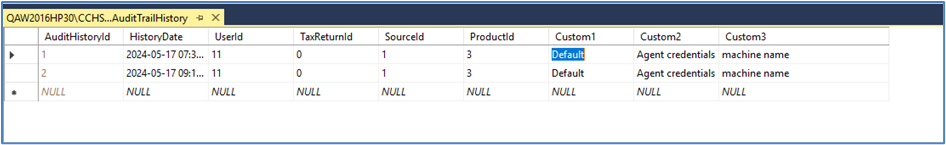

As a result of these changes in requirements, we have updated the table Audit Trail History. When a login attempt is successful the following details are appended to the data table:

To view the full details as required by HMRC a SQL script, SilentLogIn.sql, is available from support. Please ask your system administrator to run the script using SQL Management Studio and the login details are then available:

Note: It is not possible to show exact details in the above picture as we do not include any ‘live’ data as part of the release notes.

Specials & Exclusions

HMRC has only recently made available their updated specials and exclusions document for 2023/24. HMRC has advised the following items have been corrected in the 2023/24 computation; we have added an end date of 5 April 2023 ensuring they no longer appear from 2023/24 onwards:

| Exclusion Number | Detail |

| 138 |

A new box AOR6.1 was added to the return to ensure that pre-incorporation losses are not incorrectly restricted, as they had been prior to the introduction of the new box. An end date has been added to the old criteria for this exclusion. |

| 141 | Calculation of disregarded income for amount B had been including high income child benefit charge incorrectly. |

Quality Improvements

The following quality improvements are addressed in this release:

- ITS 68015 – Incorrect tax rate used for Trust / Estate dividends.

For 2024 returns, Dividend income from Estates and IIP Trusts were incorrectly carrying a 10% tax credit rather than the correct 8.75%. This was affecting Estates, Trusts and Individuals where that income type was present. - ITS 68017 - SA800 Business Tax backing schedule not produced.

Users had reported that when trying to produce a Business Tax backing schedule for partnership returns, they received a message ‘There is no data for this report’. The backing schedule is now present. - ITS 68032 – Trust link not working for multiple trusts

Some users have reported that following the upgrade to 2024.100, where a beneficiary is in receipt of income from more than one linked trust/estate, only the income from one trust populates the return, and the remainder are removed from the data screen.

Notable Issues

- ITS 68015 – Incorrect tax rate used for Trust / Estate dividends. R40

We are reviewing the impact on the R40 - Settlor Interested dividend income taxed at dividend rate and plan to include this fix in the 2024.2 release.