CCH Personal Tax 2023.1: Release Notes

Release Highlights

This release of Personal Tax is the annual compliance release. The following updated forms are included in this release:

- SA100 & supplementary forms

- SA800 & supplementary forms

- SA900 & supplementary forms

- R185

- Help sheets HS290, HS295, HS302 and HS304

- R40

The following compliance changes are also introduced:

- Capital allowance changes (SBA and AIA)

- A selection of quality improvements documented further in the release notes

Details of these and other changes are included in these release notes.

Prerequisites

Installing CCH Personal Tax 2023.1

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licenced are installed in the correct sequence. Click here to learn about the Central Suite Installer.

Items to be included in the next release

As in previous years, information provided by third parties is not made available until after April 5th; it is not possible to include these items as part of the main 2023.1 release. Subject to their timely provision, the following items are planned to be included as part of the next release:

- FTSE350 file

- Exchange Rates

- Double Tax Treaty rates

- Updated Specials & Exclusions for 2022/23 (See Specials & Exclusions for 2022/23)

Legislative & Compliance Updates

2023 Tax Forms

We have added the updated forms for the year ended 5 April 2023 for the following:

- SA100

- SA800

- SA900

- R40

- Forms R185

- Updated Help Sheets HS290, HS295, HS302 & HS304

SA100 - One off payments to registered pension scheme

HMRC have added a new box 1.1 to the Tax Return to capture any ‘one-off’ payments to registered pension schemes where basic rate tax relief at source is claimed by your pension provider.

The following changes to the Pension Contributions data entry window:

- Added a Is One-off Payment? check box to the grids on the following tabs:

- PPP and Stakeholder

- FSAVC’s

- Added a new field in the Summary section of the Pension Contributions data entry window, where the summary rather than detail information is entered:

SA102 - Changes to the Car Benefits Table

CO2 emissions and car fuel benefit multiplier

The Employment car fuel benefit multiplier has been updated as follows:

- 2024 to £27,800

- 2023 to £25,300

The latest car fuel emissions data to September 2022 is included with this release.

Note: The Car Benefit worksheet utilises the old style help sheet which was retired by HMRC in 2019. The values populated are correct.

SA109 - Changes to the Residence, remittance basis etc Supplementary Page

Box 11.1 Days spent in the UK at midnight but were in transit

HMRC has reinstated box 11.1 for the purpose of transit days:

The following changes have been made to CCH Personal Tax:

- Added a new column in the grid on the Time spent in UK tab of the Residence, Remittance Basis etc. data entry window, and populate this automatically where the Date of departure from the UK immediately follows the Date of arrival in the UK. This can be overidden by the user if the taxpayer was not in transit on the visit.

- Added a new field in the Summary section in the Time spent in UK tab of the Residence, Remittance Basis etc. data entry window, where the summary rather than detail information is entered:

-

Updated the Time spent in the UK backing schedule for Days spent in Country at midnight but were in transit.

Box 39.1 UK income or gains deemed to be foreign under qualifying asset holding company rules

To accommodate this, a new check box has been added to the Remittance basis tab of the Residence, Remittance Basis etc. data entry window:

Information Request

With the 2022.3 release, we introduced new Information Request Templates for the 2023 tax return season; these include details of any expenses claimed for rental income properties, both UK and Foreign. We show the total expenditure incurred for each category e.g., Rent, Repairs, Legal etc. For the sake of consistency, we have provided a full set of templates this year, all are prefixed 2023. The templates are:

- 2023 – CCH Information Request New Client

- 2023 – CCH Information Request No PY Details

- 2023 – CCH Information Request PY Details

- 2023 – CCH Trust - Information Request No PY Details

- 2023 – CCH Trust - Information Request PY Details

Note: With the changes to the template, the Income value declared is after the expenses have been deducted. As always, we recommend that when amending these for your own particular requirements that you open ‘our’ template and then save it under a different name. In this way if you need to refer back to our template it is always available.

Specials & Exclusions

HMRC has only recently made available their updated exclusions document for 2021/22, accordingly we have not added any new exclusions in this release. As per HMRC the following items have been corrected in the 2022/23 computation, we have added an end date of 5 April 2022 ensuring they will no longer appear from 2021/22 onwards:

|

Exclusion Number |

Detail |

|---|---|

|

121 |

A customer who has income within the higer rate band will be affected where their non-savings income is less than their reliefs/allowances, their savings income is above the startign rate band and the dividend income above the dividend allowance. |

|

129 |

A change was made in 2021/22 for the overlap issue where customers who had 2 or more trade pages of the same type, (eg 2 x SA103F or 2 x SA104F/SA104S), are claiming overlap relief against their profit on one, and have a loss to offset against the same year’s income on the other, had their overlap incorrectly added to their loss relief. This had the effect of giving the overlap relief twice. |

|

136 |

As part of the changes required to fix the 2020–21 Exclusion ID134, changes were made to stage 22 of the SA calculator (notional tax on Trust income). However that stage is no longer referenced in the rest of the calculation and as a result the calculator can allow more notional tax than is due. Stage 22 ensures that no more notional tax is allowed than the tax that is charged on that type of income (either TRU2 or TRU19). |

|

137 |

Where a customer remits to the UK in 2021–22 dividends that were first received between 5 April 2008 and 6 April 2016, they may qualify for the dividend tax credit. An entry will be made in FOR7.5 of the taxable amount of the qualifying dividend that had been included in FOR7.4. |

Capital Allowances

Capital Allowances for Freeport Structures and Buildings and Zero-emission car have been updated, in addition the rate of Annual Investment Allowance remains £1 million after 31 March 2023.

Land & Property

Given the numerous changes announced for AIA during the year, HMRC has not updated the RIM artefacts for UK Property (SA105) for this change, we have retained the existing work around.

Tax Return Bundle, Disclosure Notes and Letter Paragraphs

We have updated the Tax Return Disclosure Notes, Tax Return Bundle and Letter Paragraphs to show the 2022/23 start and end dates. We have also updated the Data Dictionary supporting the Tax Return Disclosure Notes and Letter Paragraphs for the changes to the SA100 Tax Return and supplementary pages.

The following items have been added into the Data Dictionary under Personal Tax Data Items:

- Tax Return Year + 3

- Tax Return Year + 4

- Tax Return Year + 5

- Tax Return Year - 1

- Tax Return Year - 2

- Tax Return Year - 3

- Tax Return Year - 4

- Tax Return Year - 5

- Tax Year + 3

- Tax Year + 4

- Tax Year + 5

- Tax Year -2

- Tax Year - 3

- Tax Year - 4

- Tax Year - 5

Where for the year ended 5th April 2023 the Tax Return Year would be 2022/23 and the Tax Year would be 2023.

Expat

We have updated the Expat module within Personal Tax for the 2022/23 compliance changes. The user interface, computation and backing schedules have all been updated.

2023/24 Tax Year

We have enabled the 2023/24 Tax year within Personal Tax. The computations for Individuals and Trust are based on the 2022/23 tax calculation but using the 2023/24 rates and allowances. A warning message appears on the SA302 and the Trust Computation:

Treaty Rates

The Treaty Rates have been enabled for 2024

Return Review

The 2025 year has been created within Return Review.

Foreign Land & Property - Capital Allowances

For the SA100 and SA900, Zero Emission goods vehicles with Private Use, and Zero Emissions goods vehicles were included as part of the total Capital Allowances and not reported separately as 100% Zero Emissions goods vehicle allowances.

SA100 Estate Income and R185E

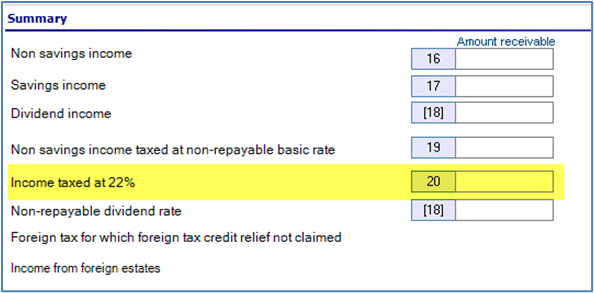

Following changes by HMRC for the year 2023 onwards, we have removed the row for Income taxed at 22%:

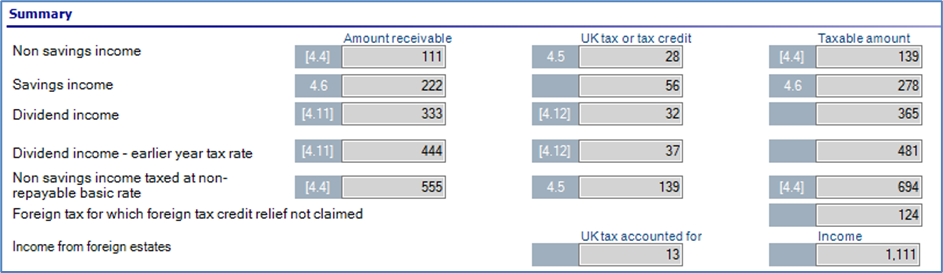

A new row Dividend Income – earlier year tax rate has been added:

The linking from the SA900 and R185E has also been updated to ensure that the correct values are mapped to the new box 18.1

Covid Receipts SA103/SA104

HMRC has removed references to Covid Receipts in the Self-Employed and Partnership pages, the following boxes have been removed:

|

Form |

Box Number |

|

SA103F |

70.1 |

SA100/SA900 - CGT - Qualifying Asset Holding Companies

Gains on excluded indexed securities, and gains and losses on share repurchases and security redemptions from a qualifying asset holding company (QAHC) are reported as part of the total gains/losses for the year and they are also required to be identified separately on the SA108 and SA905. This is for transactions on or after 6 April 2022.

Where the asset type is O, Q or U additional check boxes are enabled in the further details screen:

- Excluded Indexed Security

- Share repurchase or security redemption held in a QAHC

Note: HMRC have not made a change to the list of CGT reliefs published in the notes to SA108 and SA905 that can be used to reduce gains. It will be necessary to use one of the existing reliefs in order to reduce a gain made that is related to QAHC.

SA900 - Q13 worksheet

We have added in the new Q13 worksheet as supplied by HMRC - Income of beneficiaries not subject to the trustees' discretion.

SA905 - Pages 5 to 7

We have removed the checkbox to include the pages from data entry screen for 2023. The pages should be present whenever SA905 is present in a return from now on.

Social Investment Tax Relief

The relief ceases on 5th April 2023. Reference to it has been removed from 2024 Tax Return.

R185 changes for SA800, SA107 and R40

The latest versions of the R185(Estate Income), R185(Settlor) and R185(Trust Income) forms are included in this release and produced for tax year 2023 onwards.

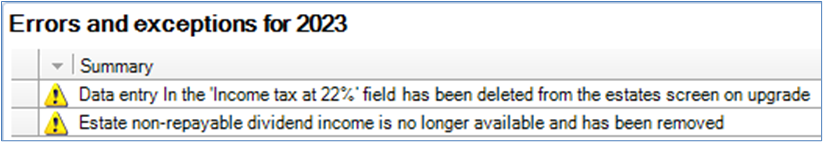

To support changes in the R185 forms, the following fields have been removed from the SA900 Estate > Beneficiaries data screen

· Income tax at 22%

· Non-repayable dividend rate

Where 2023 data was present in either of these fields, upon upgrade to 2023.1 the following Error and exception Warning messages appear:

When the Beneficiaries screen has been accessed and saved the messages are no longer visible.

The corresponding entries in the SA100 and R40 Estate income data screen have also been removed from the Non savings income and Dividend income tabs and the Summary area; the new Dividend income – earlier year tax rate has been added to the Dividend income tab and Summary areas.

The numbering of all fields in the Summary area has been updated to match the corresponding SA107 and R40 fields

As with SA900 clients, where 2023 data is present in either of the removed Estate income data fields on upgrade to 2023.1 the following Error and exception Warning messages appear:

These messages are removed when the Estate income data screen is accessed then saved.

Software Enhancements

HMRC Silent Log-In

Following the changes to the URL for the HMRC Agent Portal users were taken to the Log-in page but instead of ‘automatically logging in’ it required a manual action to click ‘Log In’. This has now been automated and White Listed users' credentials are passed through and automatically logged in replicating the previous silent log-in functionality.

Changes in MTD Threshold

Following the HMRC announcement regarding the delay to MTD and changes to the thresholds, we have created revised reports using the new thresholds. These have been automatically added on upgrade to 2023.1 and these can be found in the following location Reporting > Digital Tax > Income Tax > 2023 Reports:

Quality Improvements

The following items have been updated in this release.

ITS 56402 – SA900 Q9 not ticked

Box 9 was not ticked despite entries in Boxes 9.7 - 9.9 of SA900. This is fixed from 2023.

ITS 61673 - SA900 Vulnerable Beneficiary CGT relief

It was not possible to populate SA905 5.6 and 5.14 unless you ticked that beneficiary was non-resident. This is corrected from 2023. At same time, we have stopped R185 tab from being hidden for vulnerable beneficiaries.

ITS 56801/62787 - Reliefs claimed on page TC1 SA905 are not displayed for the first listed disposal

No entry was being made in column G of first row of disposals. This is fixed from 2023.

ITS 63891 - SA800 Business tax basis link to accounting period

The text (optional) has been removed from the return period screen in an SA800 partnership record.

ITS 66439 - Script errors when authorising the DTA

Some users had reported that when going through the HMRC screens to authorise for DTA, script error messages were received. This was due to Internet Explorer still being called. We now call Chrome by default.

ITS 66539 - Export Options

When exporting a client record further instructions have been added to the screen to give more precise instructions, the text Select 'Next >>' button to continue now appears e.g.:

Notable Issues

Top Slicing Relief and Online Filing

Whilst testing the interaction of Top Slicing Relief and Online filing we discovered an anomaly with the new Box1A. The following error message was received:

If Box1A is present, it must not exceed AOI4 + AOI6 + AOI8 + FOR43.

As there is no trace of this in the schema supplied by HMRC it has been raised with HMRC. This is still subject to discussions with HMRC.

Disclosure Note rule based on new field NRD11_1

Whilst completing final testing it was found that when attempting to add a business rule for the new box 11.1 – Days spent in the UK at midnight but were in transit, when attempting to close the Disclosure Notes window an error message appears. We plan to fix this in an upcoming release.