CCH Personal Tax 2025-2 Release Notes

Release Highlights

This release of Personal Tax includes the following:

- Updated Forms R185

- Form R40

- Changes to CGT introduced in the budget

Prerequisites

Installing CCH Personal Tax 2025.2

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licensed are installed in the correct sequence. Click here to learn about the Central Suite Installer.

Legislative and Compliance Updates

Form R40

The updated Form R40 is included in this release; there are no changes to the form or entries required.

Updated Forms R185

We have implemented the updated Forms R185.

Beneficiaries data entry screen - R185E

If an Estate falls within the low-income estate rules (i.e. the total income is less than £500) we have updated the beneficiary data entry screen to allow the tax deducted to be overridden.

Note: If the trust is not taxable please consider whether an R185 is still required for the beneficiary.

Capital Gains Tax

Following the changes introduced by the Chancellor the following changes have been made to the CGT module:

- Change to the rate of tax to be applied (individuals and Trusts)

- Change to loss allocation

Change to the rate of tax to be applied to some gains

From 6 April 2024 to 29 October 2024, the following Capital Gains Tax rates applied:

- 10% and 20% for individuals in respect of gains on Q, U, L, O and C type assets (non-residential assets)

- 18% and 24% for individuals in respect of gains on R and N type assets

- 18% and 28% for individuals in respect of carried interest gains

- 10% in respect of gains qualifying for Business Asset Disposal Relief or for Investors Relief

- 20% for trustees in respect of gains on Q, U, L, O and C type assets

- 24% for trustees in respect of gains on R and N type assets

- 20% for personal representatives of someone who has died in respect of gains on Q, U, L, O and C type assets

- 24% for personal representatives of someone who has died in respect of gains on R and N type assets

- 28% personal representatives of someone who has died in respect of carried interest gains

From 30 October 2024 (in 2024/25), the following Capital Gains Tax rates applied:

- 18% and 24% for individuals in respect of gains on Q, U, L, O, R, N and C type assets

- 18% and 28% for individuals in respect of carried interest gains

- 10% in respect of gains qualifying for Business Asset Disposal Relief or for Investors Relief

- 24% for trustees in respect of gains on Q, U, L, O, R, N and C type assets

- 24% for personal representatives of someone who has in respect of gains on Q, U, L, O, R, N and C type assets

- 28% personal representatives of someone who has died in respect of carried interest gains

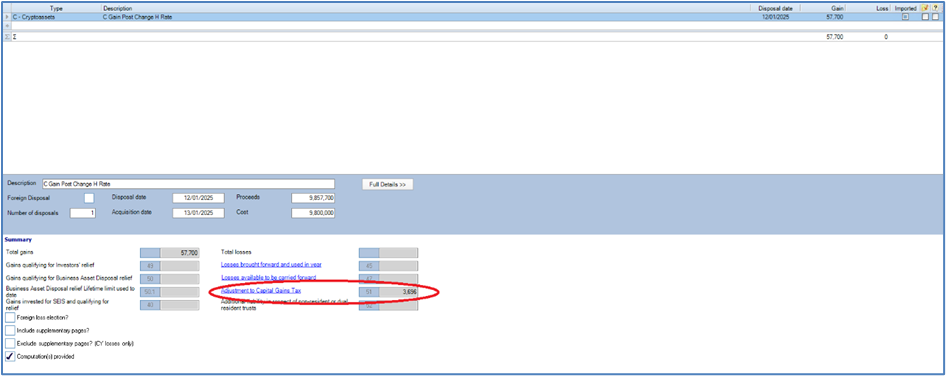

The HMRC tax calculations were changed to include adjustments to tax liability where a gain was realised on a non-residential asset after 29th October, ostensibly to account for the increase in rate of tax introduced on 30th October.

CCH Personal Tax calculates adjustments to liability according to HMRC tax calculations and HMRC Special ID 60 (see below), and populates the returns and relevant data entry screens.

Adjustments for SA108 need to be shown in Box CGT51.

The date entry for the adjustments is pon the main CGT data entry screen

Click the hyperlink beside the entry to go to entry screen to edit the adjustment if required.

Adjustments for SA905 need to be shown in Boxes 5.8B for residential property, 5.17B for other property, assets and gains and 5.37A for non-resident capital gains.

The data entry for the adjustments is on the main CGT data entry screen (3 places).

Click the hyperlink beside the entry to go to entry screen to edit the adjustment if required.

In 2024/25 and previous years, if none of an individual’s income for a tax year is chargeable to income tax at a higher income tax rate, but the individual is chargeable to capital gains tax for the tax year on an amount that exceeds the unused part of the individual’s basic rate band, the HMRC calculation before adjustment taxed gains on N or R type assets are at 18% where possible and then 24% and the other gains at 10% where possible and 20%.

The Residential property higher CGT rate was reduced from 28% to 24% on 6th April 2024. This means that it is sometimes more beneficial to tax other gains at lower rates before addressing the rates for residential property, even on gains realised before 30 October 2024.

This would change if there were gains qualifying for Business Asset Disposal Relief or Investors’ Relief.

HMRC have recognised the above and issued Special ID60 to cover this scenario in 2024/25.

|

60 |

SA108 |

CG1 CG2 CG4 |

CGT6 CGT13.4 CGT17 CGT26 CGT34 CGT52.1 CGT52.2

|

Where a customer has gains from residential property and Other gains and there is basic rate band available to those gains (this would be after any BADR/IR gains and Carried Interest deductions), the SA calculator will allocate the residential property gains to that band first. However, it is more beneficial to allocate it to the Other gains first. An adjustment to the tax calculated will be required in box 51.

|

To calculate the adjustment to enter in box CGT51, follow Annex C of the Tax and NIC calculation v2.4.1.

|

This can be identified when

CGT6 + CGT52.1 > 0 (zero) And CGT52.2 + CGT13.4 + CGT17 + CGT26 + CGT34> 0 And c18.27.1 > 0 (zero) And c18.28 > 0 (zero) And c18.45 > 0

|

Fixed for 25-26 |

CCH personal tax calculates tax on gains as per the special and you should not need to make manual adjustments.

You may expect CGT adjustments not to occur if all gains are dated before 30th October or to be a straight percentage of gain for affected later transactions; the scenario outlined in the special means this might not be the case.

A CGT adjustment will not refresh until you save the CGT data entry screen. Please make sure that you save the CGT Data Entry Screen when finalise a Tax Return when you have made other entries that change the tax computation.

Changes to loss allocation

Where there are both gains on different asset types and losses, either same year or brought forward, we look to offset the losses against gains that carry a higher tax rate that other gains. With the change of tax rates on different asset types, you may find that the ordering of gains for loss set off is different in 2024/ 25 than in previous years.

As before, you can change the order in which gains have loss set for individuals.

SA900 - Box 9B.1

Following a recent clarification by HMRC, Box 9B.1 must be completed where Box 8.16 is ticked. We have updated the XML file for all Trust cases to ensure that a value is included when the online submission is made.

Quality Improvements

The following quality improvements are addressed in this release:

ITS 68032 - Trust link not working for muiltiple linked trusts

Customers have reported that where a beneficiary has received income from more than one trust, that when clicking on the pink ribbon to update the income from the trust not all trusts are being updated.

ITS 68094 - National Savings Interest in the wrong box on R185

Customers have reported that National Savings Interest from the SA900 was appearing as non-savings income instead of savings in the RAT grid and consequently the R185.

ITS 68143 - Trust link not working for multiple trusts with the same settlor

Customer have reported that where an individual is a member of more than one trust and is a settlor of all those trusts, when the data is imported into the individual, all but one trust record in the individual's Trust income chargeable on Settlors data screen was deleted.

ITS 68146 - Losses brought forward being increased where there is FTC claim

Work has been undertaken in capital gains to reduce the instance of losses brought forward being increased where there is both losses brought forward set off and a claim to foreign tax credit relief on the same gain. The issue is reduced but not fully removed and we will continue to look to improve this area.

The workaround is to reduce losses brought to zero on losses brought forward data entry screen and use the override losses brought forward screen instead.

Notable Issues

Importing client notes

Users have reported that when importing an XML file that includes Client Notes, these were not importing. This has been rectified however we identified late in the testing phases that the Is Complete flag is not imported. We are looking to address this in the upcoming 2025.210 service pack.

Items included in the 2025.110 Service Pack

Legislative and Compliance Updates

Updated FTSE350 File

The 2024/25 FTSE350 file is included in this release.

Average Exchange Rates

The average exchange rates file is produced from the official HMRC average exchange rates. The file is now included in this release.

Tip: Please be aware that from 2023/24, HMRC are producing exchange rates to 4 decimal places rather than 6 decimal places as in prior years.

Double Tax Treaty Rates

The 2025 and 2026 Double Tax Treaty Rates are included in this release. The following countries have been updated:

- San Marino (effective from 2024/25)

- Ecuador (effective 2025/26)

- Belarus (effective 2025/26)

- Russian Federation (effective 2025/26)

Specials and Exclusions

Exclusions

As documented in the 2025.100 release notes Exclusion 138 is no longer valid after 5 April 2024, it has therefore been end dated and no longer appears for 2025 returns.

Specials

HMRC has amended and introduced the following Specials for the SA100:

| Special Number | Detail |

| 38 (Updated) |

SA108 - Page – CG3 – Box Numbers – CGT50 and CGT50. The maximum qualifying net gains which may benefit from Business Asset Disposals’ Relief is restricted to a lifetime limit of £1 million. This applies to qualifying disposals made on or after 11 March 2020 and to certain disposals made before 11 March 2020. There is validation on boxes CGT50 and CGT50.1 from 2020-21 to ensure that no entry can be made in those boxes that is greater than £1m. In the scenario where the customer claimed remittance basis in a previous year and the gain is taxed when it is remitted, the LL that would be applicable is determined by the LL in the earlier year. These cases are expected to be very rare but if they occur then the customer will be faced with an error message upon making an entry of more than £1m. Work around: The return can still be filed online by capping the amount of Business Asset Disposal’ Relief claimed in boxes CGT50 and CGT50.1 at £1m and then using box CGT51 to make an adjustment. E.g., a customer with £20,000 remitted gains over the LL and who would be due to pay Capital Gains at the 20% rate would require an adjustment at box CGT51 of minus £2,000 (£20,000 x (20% minus 10%). |

| 47 (Updated) |

SA108 - Page – CG1 and CG2 – Box Numbers - CGT21, CGT29 and CGT37Updated to include Crypto Assets Where the Real Time Transaction (RTT) service has been used to report and pay Capital Gains Tax on disposals of assets to be declared in any of the sections ‘Cryptoassets, Other property, assets and gains,’ ‘Listed shares and securities,’ or ‘Unlisted shares and securities,’ the gains or losses reported in the RTT boxes CGT13.7, CGT21, CGT29 or CGT37 should also be included within the total gains or losses boxes (CGT13.4 (CGT13.5 for losses), CGT17 (CGT19 for losses) CGT26 (CGT27 for losses) and CGT34 (CGT35 for losses) respectively). If the gains or losses have been overestimated their when using the RTT service and their actual gain or loss is less than what they need to enter in boxes CGT13.4, CGT13.5, CGT17, CGT19, CGT26, CGT27, CGT34 or CGT35 they may get a validation error. CGT13.7, CGT21, CGT29 or CGT37 cannot exceed Workaround: If a claim is made for Extra Statutory Concession A14 to apply to UK Dividends, the income is treated as retaining the character as if received directly rather than via an estate. It is possible to claim Double Taxation and other reliefs and the income should not be entered in TRU18/TRU18.1. It should be shown in the DT relief claim in HS304. (Non-residents – relief under double taxation agreements |

| 58 (New) |

SA103S and SA103F - Page – SES2/SEF3 – Box Numbers – FSE49/SSE23 when greater than £1.5m Where a customer has an accounting period that exceeds 547 days and calculates their Annual Investment Allowance (AIA) from their plant or machinery investments made in the capital allowance chargeable periods covered by that accounting period, the AIA threshold (and allowable claim) may exceed £1,500,000. This affects self-employed customers where for 2023/34 the validation for boxes FSE49 and SSE23 is set at £1.5m. An entry above will result in a validation failure and the return would be blocked from successful online submission. A customer wishing to claim over £1.5m AIA can still do so and successfully file online by capping the entries at boxes FSE49 and SSE23 to £1.5m and then entering the remaining balance of the AIA amount at either box FSE55 or SSE25 as appropriate, for other capital allowances. Workaround: In these circumstances enter £1.5m in box FSE4/ SSE23 and the excess in box FSE55/SSE25 · A note should be included in the Additional Information box of the online return and advise that the workaround has been used. |

NRCGT Information messages SA108 and SA905

For the year 2025 and onwards, we have amended the message that appears when an NRCGT transaction is entered and the NRCGT reference is blank. This is now a warning message as opposed to an error.

This means that an IRMark can be generated even if the reference is missing and it is still able to be filed online.

Any messages previously created as errors for 2025 or 2026 are updated after opening the tax return.

CCH iFirm integration

We have added the following task permissions to support the CCH iFirm suite of cloud products:

MTDfIT

A new task permission has been created to allow firms to select which employees can access MTDfIT

Note! By default this permission is turned off on upgrade and needs to be activated if required.

CCH iFirm Personal Tax

A new task permission has been created to allow firms to select which employees can access CCH iFirm Personal Tax

Note! By default this permission is turned off on upgrade and needs to be activated if required.

Please note that in both cases if the task permissions are not set, the icons are inactive in the ribbon bar, and appear greyed out, e.g

Quality improvements

The following quality improvements are addressed in this release:

ITS 56443 - SA108/SA905 Residential property gain not updating the loss grid

Customers have previously reported that any CGT gain for a residential property disposal was not appearing in the Income tax losses grid screen to allow set off of trading losses against the gain. This affects both individuals and trusts.

This also impacts any gain with Entrepreneur's relief.

ITS 68249 - Q20 Tick not appearing on Form SA900

Customers had reported that for 2025 tax returns the tick in box 20 was not appearing on the Tax Return, despite being ticked in the data entry screen. The entry was also missing from the XML submission for online filing.

ITS 68265 - The rounding for 'Income tax due calculated including transition profit' is incorrect

Customers have reported that for 2025 the Tax due on transition profit exceeds the expected value by as much as 80p. This is because we were rounding down the Income tax due calculated including transition profit to 0dp rather than 2dp.

Legal Notice

Disclaimer : Wolters Kluwer (UK) Limited has made every effort to ensure the accuracy and completeness of these Release Notes. However, Wolters Kluwer (UK) Limited, its staff and agents will not be liable for any errors or omissions and use of the software is subject to the customer’s licence with Wolters Kluwer (UK) Limited. These Release Notes should not be relied upon as a detailed specification of the system or the software. Wolters Kluwer (UK) Limited may make changes to these Release Notes from time to time. This is provided for informational purposes only. The information reflected in this document may be changed or updated without notice. Wolters Kluwer (UK) Limited may also make improvements and/or changes in its products, practices, and/or programs described in this document at any time without notice. This document should not be seen as a contractual agreement, a modification or amendment of any existing contractual agreement with Wolters Kluwer (UK) Limited, or an indication of terms of service. All technical data, specification and other information contained in this document is confidential and the proprietary intellectual property of Wolters Kluwer (UK) Limited and/or its licensors. No reproduction, copy, alteration, or distribution thereof may be made without the express written consent of Wolters Kluwer (UK) Limited.

Copyright: These Release Notes may not be copied, altered, edited, disposed of, or distributed without the prior consent of Wolters Kluwer (UK) Limited. The content is confidential. Unless indicated otherwise all elements of this software product are owned by Wolters Kluwer (UK) Ltd. © 2025 Wolters Kluwer (UK) Limited

Trademark Rights: Microsoft, Windows, Windows NT, Windows for Workgroups, Windows 98, 2000, XP, MSDOS, Windows Vista, Windows 7, Windows 8, Windows 10, Windows Server, Microsoft SQL Server, and Microsoft Office, are either registered trademarks or trademarks of Microsoft Corporation. Novell and NetWare are trademarks of Novell Inc. Citrix MetaFrame is a registered trademark or trademarks of Citrix Systems, Inc. All rights reserved. All other trademarks are the property of their respective owners.

Wolters Kluwer (UK) Limited, Wolters Kluwer House, 145 London Road, Kingston Upon Thames, Surrey, KT2 6SR