CCH Personal Tax Return

Introduction

This workflow covers the preparation and submission of Personal, Partnership and Trust Tax returns. Note that it requires the module CCH Personal Tax to be installed in your system.

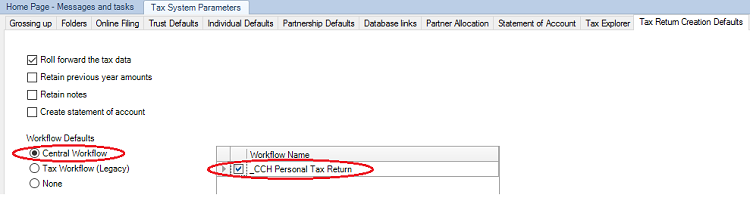

click image to download enlarged version

How to use this workflow

This workflow attaches to an individual, partnership or trust tax return in CCH Central. When you create or roll forward a tax return, from the wizard select "Central Workflow" and tick the box next to "_CCH Personal Tax Return".

Note: if the tax return has already been created, you can open the return and select the "Start Workflow" button on the ribbon bar.

To set this workflow as the default for all individual, partnership and trust tax returns select:

- File > Maintenance > Tax settings > Personal Tax > Tax system parameters

- Go to the tab "Tax Return Creation Defaults" and select the CCH Central Workflow "_CCH Personal Tax Return".

Possible Enhancements

Responsibility for all tasks are currently allocated to the client partner. If you wish to use the "Tasks" homepage control, the workflow steps could be changed to reflect the responsibility types reflected in the assignment or client level responsibilities.