CCH VAT Return

Introduction

This workflow is for monitoring the VAT return process.

click image to download enlarged version

There is the ability to skip the preparation and submission if necessary (for example if your client has chosen to submit the return themselves), however it will still roll forward to the next period to ensure future control of the process.

How to use this workflow

This workflow attaches to a "job", which in turn attaches to an "assignment". If you are already using assignments and jobs, and the prerequisites below are fulfilled, you need to right-click on the relevant job and select "start workflow". Select the workflow "_CCH_VAT_Return".

Prerequisites

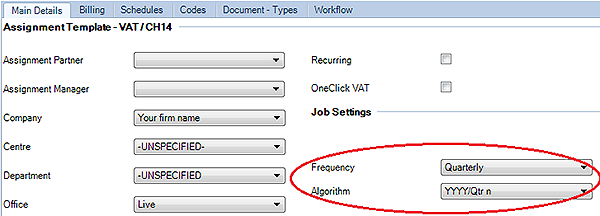

The relevant "assignment template" must show this workflow as available and as default.

The "assignment template" must show the correct frequency and algorithm.

This is typically quarterly, however different time periods can be used if necessary.

All instances of this assignment must also show the correct frequency and algorithm (this can be achieved using "bulk update" if required).

Note: that if you have exceptional cases where the frequency is different, this can be catered for by changing the frequency and algorithm on the individual assignment instances (i.e. in those specific clients).

The relevant job needs to have "Target date" completed with the VAT return filing deadline (NB. this only needs to be completed for the first period).

Possible Enhancements

Responsibility for all tasks are currently allocated to the client partner. If you wish to use the "Tasks" homepage control, the workflow steps could be changed to reflect the responsibility types reflected in the assignment or client level responsibilities.