CCH Accounts and Corporation Tax

Introduction

This workflow covers the accounts preparation process and includes completion/submission of the Corporation Tax return (where the client is a Limited company).

click image to download enlarged version

Where the client is not a limited company, it will automatically follow a different path, prompting you to alert your tax department, who typically might use a different workflow to monitor the tax return. In the case of individuals, partnerships and trusts, the workflow will effectively end at this step.

click image to download enlarged version

If the client is an LLP however, it will continue to prompt for approval and filing of the accounts.

click image to download enlarged version

Alternative workflows

- See also "_CCH_Accounts" workflow which does not incorporate the corporation tax return completion.

How to use this workflow

This workflow attaches to a "job", which in turn attaches to an "assignment". If you are already using assignments and jobs, and the prerequisites below are fulfilled, you need to right-click on the job and select "start workflow". Select the workflow "_CCH Accounts and CT".

Prerequisites

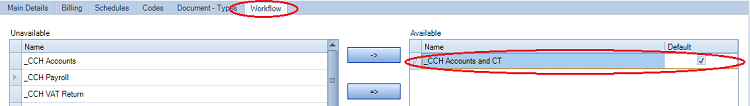

The relevant "assignment template" must show this workflow as available and as default.

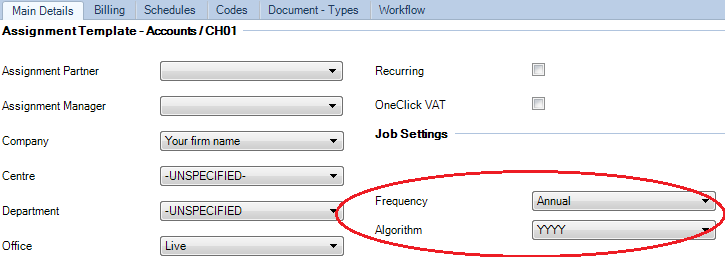

The "assignment template" must show the correct frequency and algorithm.

All instances of this assignment must also show the correct frequency and algorithm (this can be achieved using "bulk update" if required). The relevant job needs to have "Target date" completed with the accounts filing deadline (NB this only has to be completed for the first period).

Possible Enhancements

Responsibility for all tasks are currently allocated to the client partner. If you wish to use the "Tasks" homepage control, the workflow steps could be changed to reflect the responsibility types reflected in the assignment or client level responsibilities.