Linking CCH Trust Accounts to CCH Personal Tax

Overview

CCH Central is a central database of client names and addresses. CCH Personal Tax runs from within CCH Central. The CCH Personal Tax screens appear on tabs within CCH Central. Trust Accounts clients can be linked to CCH Central clients so that either a CCH Personal Tax client or a Trust Accounts client can be accessed using a consistent client code. They then both share the same client code and name and address.

Multiple Trust Account clients can be linked to a single Trust Tax Return. This may be required if separate accounts are being prepared for each beneficiary, and therefore separate clients are created in CCH Trust Accounts, but the Trust Tax return requires details of Investments, movements and income, from each beneficiary account.

Investment transactions can be automatically transferred from Trust Accounts into CCH Software’s tax software, CCH Personal Tax. This saves entering income and chargeable disposals twice, once into an accounts package and a second time into a tax package.

What is transferred:

- Investment income and capital gains details required for either the Personal Return (SA100) or the Trust Return (SA900).

It has been specifically designed to ensure that it should not be possible to print the return form unless these details are consistent with those contained in Trust Accounts.

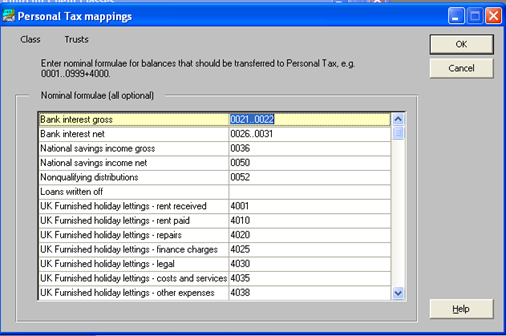

Mapping Nominal Code information from CCH Trust Accounts

CCH Trust Accounts allows transferring nominal balances (e.g. bank interest, property income) to CCH Personal Tax using PT mappings and the "Import nominal balances" option.

CCH Trust Accounts set up

CCH Trust Accounts passes investment entries into CCH Personal Tax. This includes investment income and disposals for Capital Gains Tax. However bank interest and property income are usually posted only to the nominal ledger and so are not imported into CCH Personal Tax. There is a facility in CCH Trust Accounts to transfer these nominal balances into CCH Personal Tax. It involves changes in both CCH Trust Accounts and CCH Personal Tax.

In CCH Trust Accounts nominal codes containing the balances to import can be specified in Edit Client Class.

- Go to Activities > Common/Shared Data > Client Classes > Trusts > Edit > PT mappings:

Account codes can be selected from the Master Chart by pressing the F2 key. The following operators can be used:

|

.. |

The sum of a range of accounts, e.g. 0021..0025 |

Subaccounts can be entered in the usual way, e.g. 0021/01

Where CCH Personal Tax requires a net e.g. Bank interest net. The CCH Trust Accounts balance is transferred into CCH Personal Tax as the net amount in CCH Personal Tax and the tax figure is calculated automatically as in manual Data Entry in CCH Personal Tax. However some users post the gross amount into Trust Accounts and post the tax to a separate expense account. Suppose bank interest paid net is posted as:

|

0026 |

Bank interest net |

100CR |

In this case posting account 0026 into CCH Personal Tax would give the wrong result. The nominal formula should be 0026+1002 so that the net figure is posted to CCH Personal Tax.

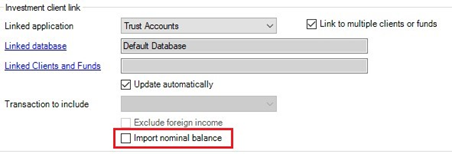

CCH Personal Tax- Tax Links tab

The Tax Links tab in CCH Central has a tick box called Import nominal balances. If ticked then the nominal balances are brought across from CCH Trust Accounts when the link is run.

Notes!

- The CCH Trust Accounts financial year does not need to correspond to the CCH Personal Tax, tax year. The link will run the Trial Balance for the appropriate period or display an error if this is not possible.

- The option to Import nominal balances is only available if Income is being imported and only functions for tax years 2011 on. Individual transactions are not imported, only the nominal balances. Imported balances are described as “Imported from Trust Accounts” in CCH Personal Tax. Income from Land and Property is rounded before being imported. Income is rounded down and expenses up.

- If you go back to CCH Trust Accounts and make changes then the next time you go back into the CCH Personal Tax, you are prompted to reimport the data.

- If multiple CCH Trust Accounts clients are linked to a single CCH Personal Tax client then the nominal balances are imported from all of them if Import nominal balances is ticked.

Setting up the link between CCH Trust Accounts and CCH Personal Tax at client level

Linking the Trust Accounts Database to CCH Personal Tax at a client level is required to enable the ability to transfer capital transactions, income transactions, or both, from CCH Trust Accounts to CCH Personal Tax.

Link set-up

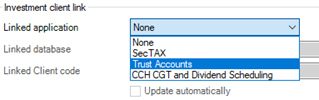

To do this:

- Select the Client in CCH Central.

- Select the Tax Links tab.

- Select Linked application:

- Choose Trust Accounts from the dropdown list.

- Then click on Linked database, if there is only one CCH Trust Accounts database then Default database will be automatically entered, otherwise choose the appropriate database from the list.

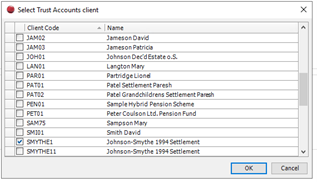

- Then click on Linked Client code to select the Linked client from the list.

Click OK when the correct CCH Trust Accounts client is ticked.

- Tick the Update automatically box for the data to be imported automatically.

- However if the box is left un-ticked a pink ribbon will appear on the Tax Return data entry screen to prompt you to update. Click on the ribbon to import the data.

- Nominal balances and Foreign income can be included or excluded as appropriate. See later for how to set up the nominal balances option in CCH Trust Accounts.

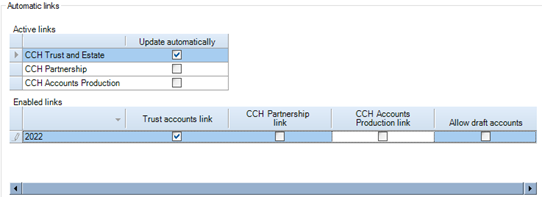

Active Links

- If the Update automatically option is selected all data is automatically updated, otherwise a message is displayed advising the data is not up to date. Selecting this message updates the CCH Personal Tax data.

Enabled links

- The link between CCH Personal Tax and other CCH Central suite products is enabled automatically upon creation of the return. It may be disabled separately for each tax year if required.

- When the link is removed, no messages are displayed or data updated on opening that year’s Tax return, regardless of the Update automatically setting.

Link to Multiple clients or funds

Sometimes it is necessary to produce more than one set of accounts for a trust. For instance, after an accumulation and maintenance trust has vested the income (but not the capital) on a beneficiary it is usual to produce a separate set of accounts for the beneficiary. This involves creating a separate CCH Trust Accounts client for the beneficiary. However although some of the investments are transferred out of the main trust client into the beneficiary client, the disposals for both clients must be combined on to a single trust tax return.

- Select the appropriate client and fund. Select what type of transaction you want to link.

- If required the clients/funds can be consolidated into the first fund.