Year End Rollback

There is the option on the client Nominal Ledger menu to perform a Year-end Roll Back.

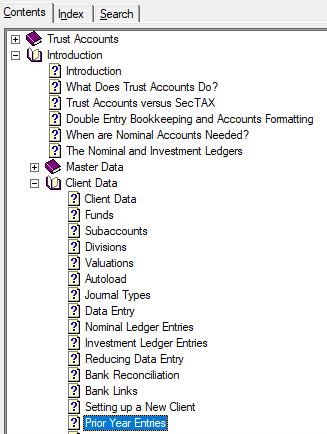

This reopens last year allowing a prior year to be modified without the need for prior year adjustments. This is an advantage because prior year adjustments can be complicated. For instance, they often require you to make matching Opening Balance adjustments. Prior year adjustments are documented in the main Trust Accounts Help under Introduction > Client Data > Prior Year Entries.

The Year-end Roll Back preserves all entries apart from the current year’s opening balance entry. After a roll back the old current year entries are still present, but they fall after the year-end and so are not included in a current year trial balance.

Care needs to be taken if prior year investment entries were made before the roll back. When the entries were made they had no effect on comparatives; but after the roll back they do affect the current year as the current year balances are recalculated from the entries.

The Year-end Roll Back performs the following operations:

- The year’s Opening Balance entry is deleted.

- The comparative balances become the current year balances and the pre-comparative balances are copied to comparative balances. The pre-comparative balances are then zeroed.

- Last year’s end date becomes the current year-end date and the previous year-end date becomes last year’s end date. The system requests a new date for the previous year-end date.

If you go into Accounts Formatting after rolling back a year:

- The year-end dates are rolled back just as they are in Trust Accounts.

- Accounts pages are unchanged. If the pages have been changed in the current year, the system cannot roll them back to last year’s version.

- Statutory Database information is unchanged. If the Statutory Database information has been changed in the current year, the system cannot roll it back to last year’s version.

- This means that while the Year-end Roll Back is useful for avoiding prior year adjustments, it may not be suitable if you wish to regenerate last year’s accounts as changes to the accounts pages or Statutory Database information could have been made since the year-end. It is therefore recommended that a PDF copy of the accounts is kept if needed.

After performing a roll back and correcting the data, you can perform a year-end to balance the data forwards again. It is also possible to roll back more than one year if required by performing the operation more than once.