Creating a Trust client

How to create a Trust Client

A trust client allows you to create a SA900 tax return.

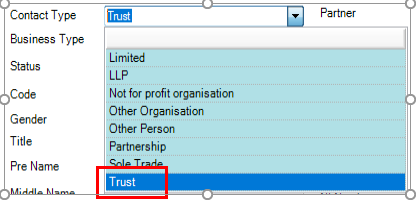

To create an SA900 tax return ensure that the client contact is set to trust. You do this during the client creation process. You must set the Contact Type to Trust in the Add New Client Wizard.

- From the menu select File > New > Client. The Add New Client Wizard appears.

- Select Trust from the Contact Type drop-down.

-

Enter a unique client Code and the Main Name for the client as they are mandatory. If necessary also enter the Pre Name.

-

Enter the Code and the Main Name for the client as they are mandatory. The Main Name normally includes the surname plus trust e.g. "Heston Discretionary Trust". If necessary also enter the Pre Name.

Note: The Main Name and Pre Name fields appear for organisations only. Use the Pre Name field if the organisation's name starts with 'A' or 'The'. Enter the main part of the name in the Main Name field, as searches are based on the main name. When results are displayed you will see suppliers listed in alphabetical order instead of seeing them all listed under 'T'.

-

Complete the remaining fields if necessary.

-

Click the Other Details tab to enter details about the trust. This includes:

- Tick if an Estate

- Date created

- Date wound up

- Reason wound up

Note: Tick if an Estate denotes that the client is an Estate Return.

-

Click Finish. The Client tab appears and then the Add Assignment message.

-

Click No. The Trust or Estate tab stores the details you previously entered.