Creating a Partnership or LLP client

How to create a Partnership or LLP client

A partnership or LLP client allows you to create a SA800 tax return.

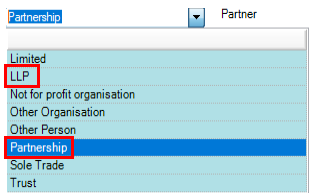

To create a SA800 tax return ensure that the client contact is set to partnership or LLP. You do this during the client creation process. You must set the Contact Type to Partnership or LLP in the Add New Client Wizard.

- From the menu select File > New > Client. The Add New Client Wizard appears.

- Select Partnership or LLP from the Contact Type drop-down.

-

Enter a unique client Code and the Main Name for the client as they are mandatory. If necessary also enter the Pre Name.

Note: Compulsory fields contain a small red triangle  and you cannot move forward until you complete these fields.

and you cannot move forward until you complete these fields.

-

Complete the remaining fields if necessary.

-

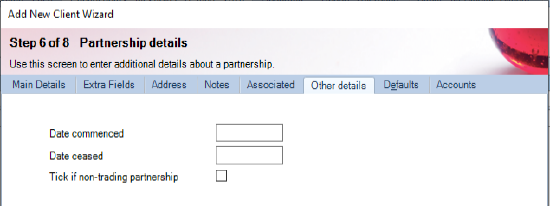

Click the Other Details tab to enter details about the partnership. Please note if you don't enter this information whilst in the wizard, you can enter this information upon creation of the clients central record via the partnership tab.

This includes:

- Date commenced

- Date ceased

- Tick if non-trading partnership - Selecting this option determines the sources that appear for the tax return.

Note: You can complete the remaining tabs now or later.

Click Finish. The Client tab appears and then the Add Assignment message appears. Click No.

-

Click the

tab. This tab displays the details you have just completed.

tab. This tab displays the details you have just completed.

-

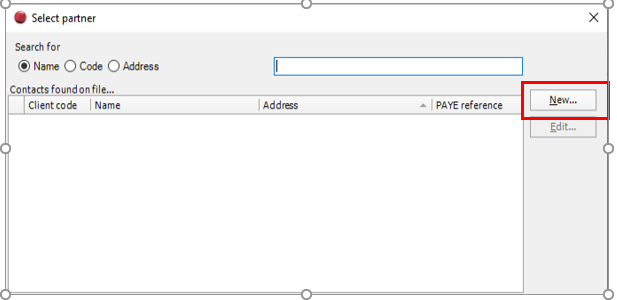

Click

to assign the partners. The Select partner window appears.

to assign the partners. The Select partner window appears.

-

Add additional partners if necessary by double clicking on them and click the Save button once all partners have been added.

Note: A partner can be an individual or organisation and you specify this during the assigning of the partner.