Overview

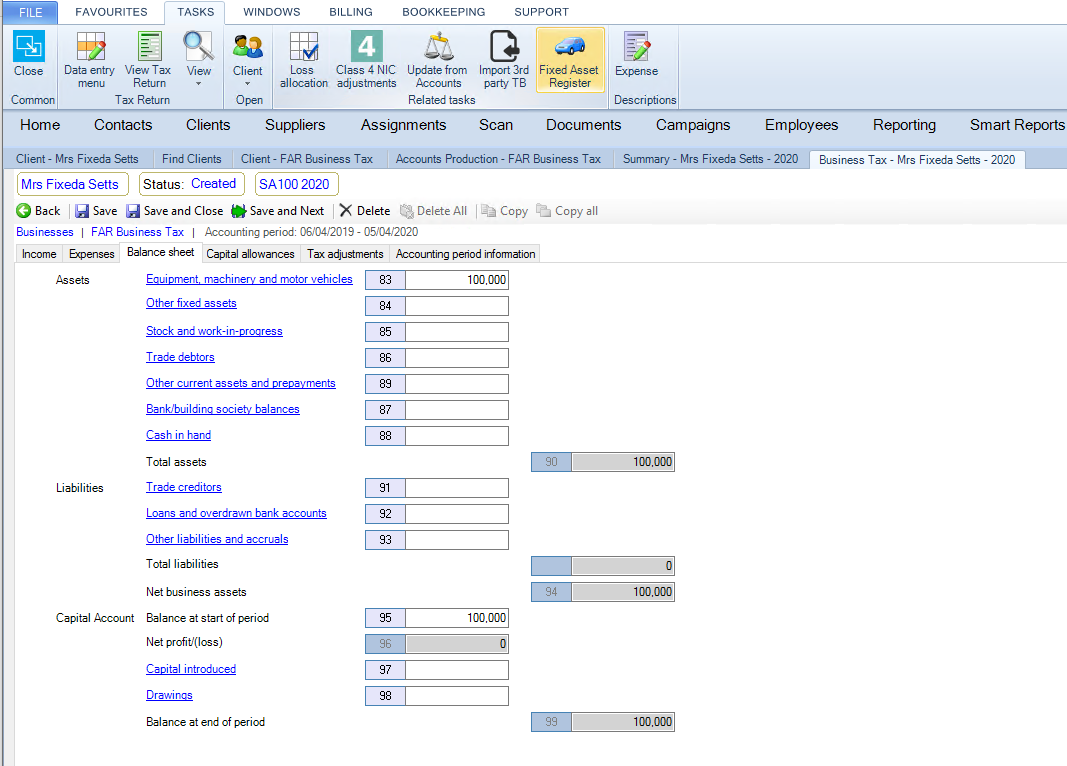

The Business Tax area of CCH Personal Tax summarises the Accounting Period balances. The screen is accessed by selecting Business Tax, clicking the link for the Business and clicking the link for the Accounting Period.

When CCH Accounts Production is in use, data can be imported from CCH Accounts Production and the Fixed Asset Register into the tabs on the Accounting Period screen

- CCH Accounts Production supplies the data for the Income, Expenses and Balance Sheet tabs.

- CCH Fixed Asset Register supplies the detailed Additions and Disposals which are accessed through the Capital Allowances tab.

Access the Fixed Asset Register from CCH Personal Tax using the Fixed Asset Register icon

This section discusses how the link from CCH Fixed Asset Register to CCH Personal Tax is set up and run;

- Setting Up the Tax Links screen This explains how the link between CCH Fixed Asset Register and CCH Personal Tax is set up.

- Exporting the data from CCH Accounts Production This explains how data is exported from CCH Accounts Production before it can be imported into CCH Personal Tax.

- Importing the data into CCH Personal Tax This explains how the data can be brought into CCH Personal Tax.

- Allocating Additions and Disposals in Personal Tax to an Asset/Pool type This explains how Additions and Disposals that have been imported into CCH Personal Tax need to be allocated to the correct Asset/Pool types using the Business Tax Movements screen.

- Movements screen This explains how the Business Tax Movements screen is used with imported Additions and Disposals.