CT600K - Tax on Restitution Interest

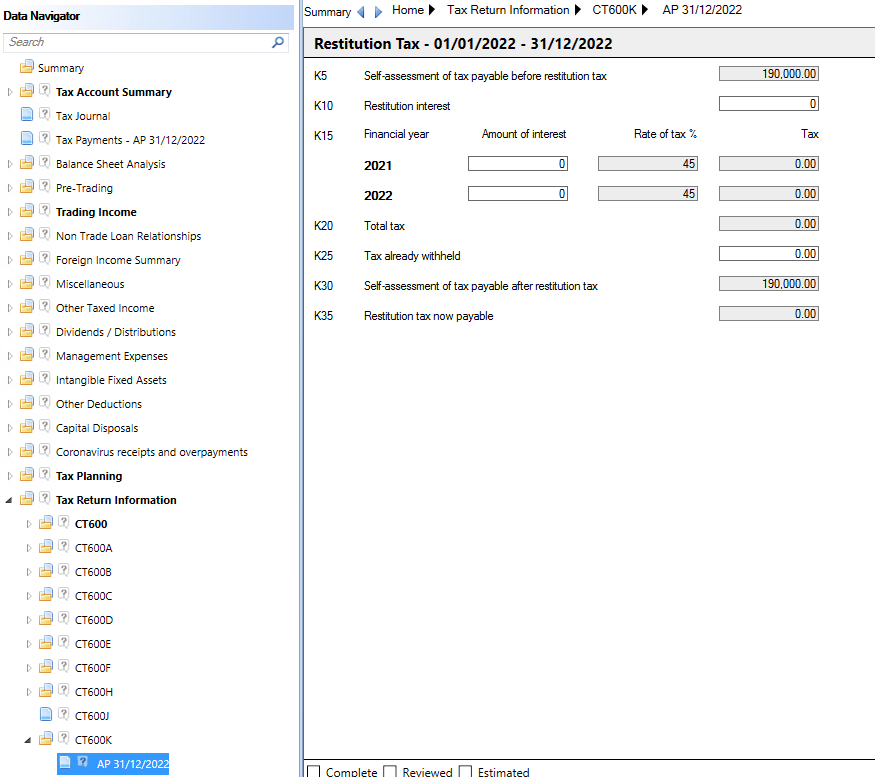

To complete the CT600K on Restitution Tax, from the Data Navigator, select Tax Return Information > CT600K > Accounting period.

The restitution interest received is reported at K10.

The amount of interest is automatically allocated between the financial years covered by the Accounting Period at K15.

The tax charge on the restitution interest is automatically calculated at K20.

Any tax withheld from the restitution interest is entered at K25.

Note: The tax withheld value should not exceed the tax charge at K20.