Supplementary Pages

This section provides you with information to assist in completing the CT600 supplementary pages. Each supplementary page is completed using the associated data entry window:

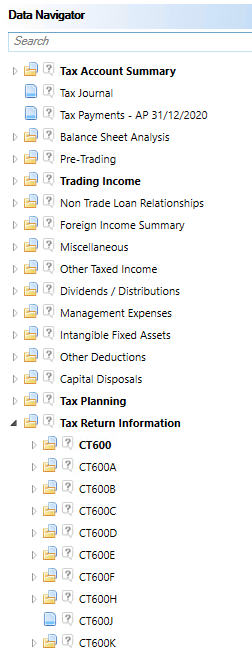

The supplementary page inputs are located within Tax Return Information in the Data Navigator.

CCH Corporation Tax allows input for CT600 supplementary pages;

- CT600A Loans to Participators

- CT600B Controlled Foreign Companies

- CT600C Group and Consortium

- CT600D Insurance (not supported)

- CT600E Charities

- CT600F Tonnage Tax

- CT600H Cross Border Royalties

- CT600J Disclosure of Tax Avoidance Schemes

- CT600K Restitution Tax

Guidance on how to complete the CT600 supplementary pages is contained in the CT600 Guide published by HMRC.