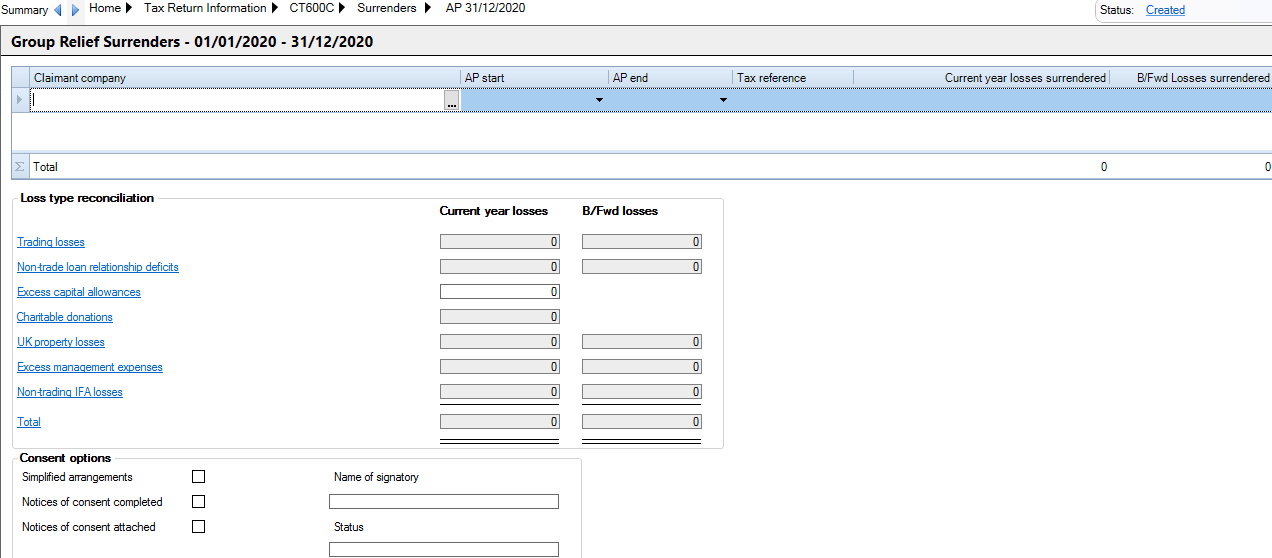

Group Relief - Surrenders

Entering Group Relief Surrender details

The Surrenders input screen can be found under CT600C within Tax Return Information in the Data Navigator.

The input screen can be updated from the Tax Group if using the CCH Corporation Tax Group Module or input directly;

The name of the Claimant company can be added manually or searched through Central

Only complete AP start and AP end fields if the accounting period of the claimant company is different from the accounting period of the surrendering company.

The Tax reference entered should be the 10 digit Unique taxpayer reference for the claimant company which is mandatory for online filing purposes.

When entering the amount surrendered in either the Current Year Losses Surrendered or B/Fwd Losses Surrendered columns, ensure the total amount being surrendered from group companies does not exceed the total profits available.

In the Loss Type Reconciliation, losses calculated will be displayed but Excess capital allowances is a manual entry.

Ensure that the appropriate consent options are completed. Any mandatory missing information will be highlighted in the errors and exceptions panel at the foot of the data entry area.