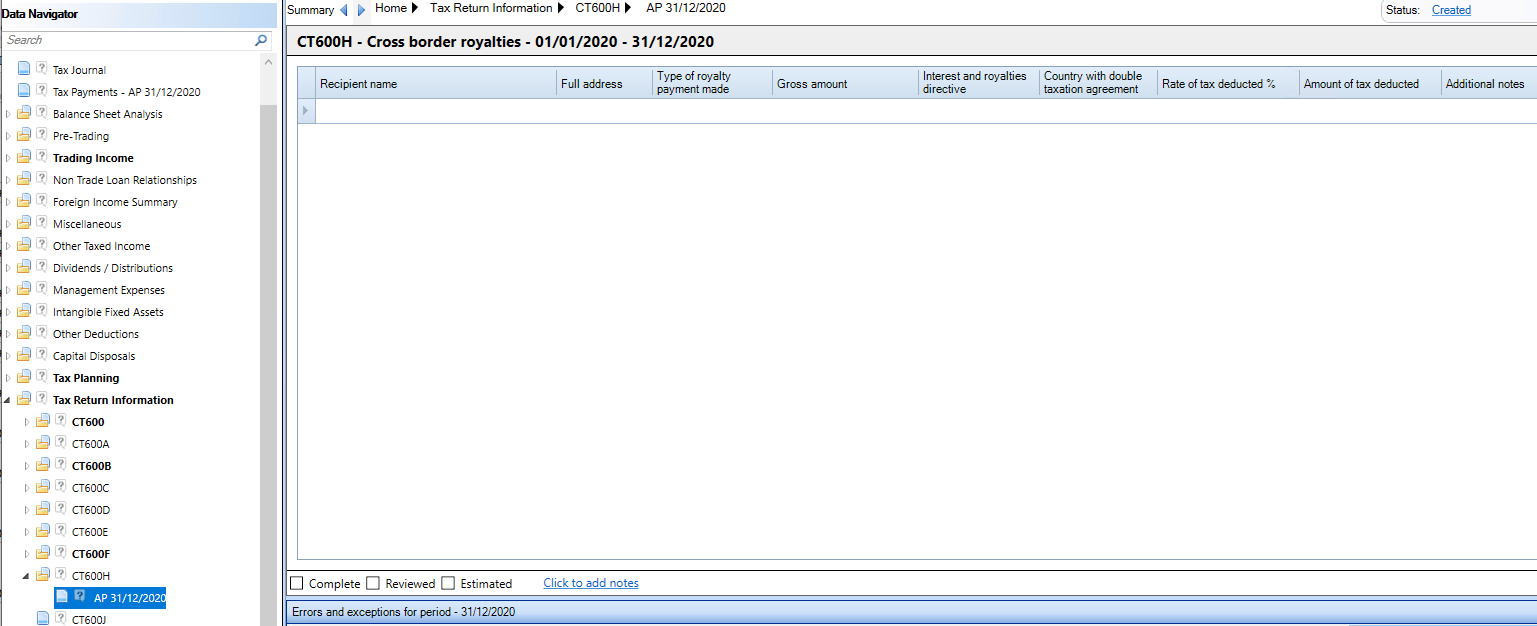

CT600H Cross Border Royalties

This section explains how to use the CT600H Cross Border Royalties data entry window.

The CT600H input screen for Cross Border Royalties is located under Tax Return Information in the Data Navigator.

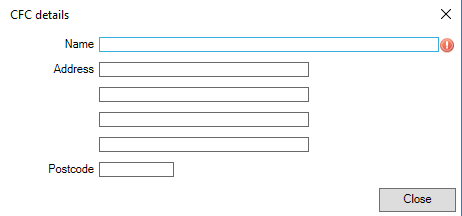

Click into the Recipient name field and complete the Name and Address and select Close.

Enter the Type of Royalty payment made.

Enter the Gross amount.

Enter the Interest or royalties directive or Country with double taxation agreement.

Enter the rate of tax deducted to calculate the Amount of tax deducted.

Enter any Additional notes.

Notes

Notes can be added to this window. All notes will appear as an appendix to the Corporate Tax computation. Click the click to add notes link at the foot of the data entry area.