Trade Cessation

Trade cessation date

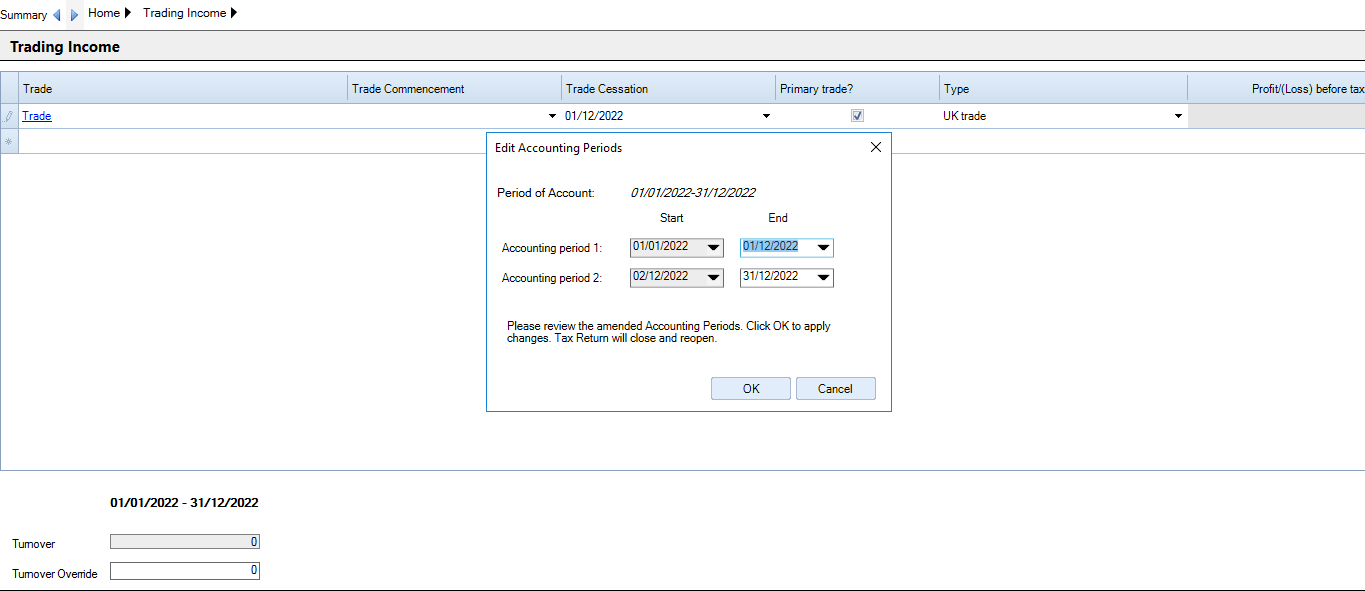

To input the trade cessation date, navigate to the Trading Income window and input the date in the Trade Cessation column.

The Accounting Period end dates can be changed by either typing a date in the box or selecting the arrow to access the calendar. There must be an Accounting Period date which agrees with a trade (or all trades) starting or ceasing for the OK button to be available.

Capital allowances

Inputting a trade cessation date will force each capital allowances window to treat all assets as disposed of in the final period.

At this stage, each asset is treated as having a disposal value of nil.

Balancing allowances will be calculated for all assets with a TWDV.

To calculate the actual tax position on cessation, manually enter any actual disposal proceeds into each asset window.