Assets Qualifying for AIA

This section details how to input capital assets qualifying for Annual Investment Allowances.

Either input the total cost of the assets into the relevant pool(s):

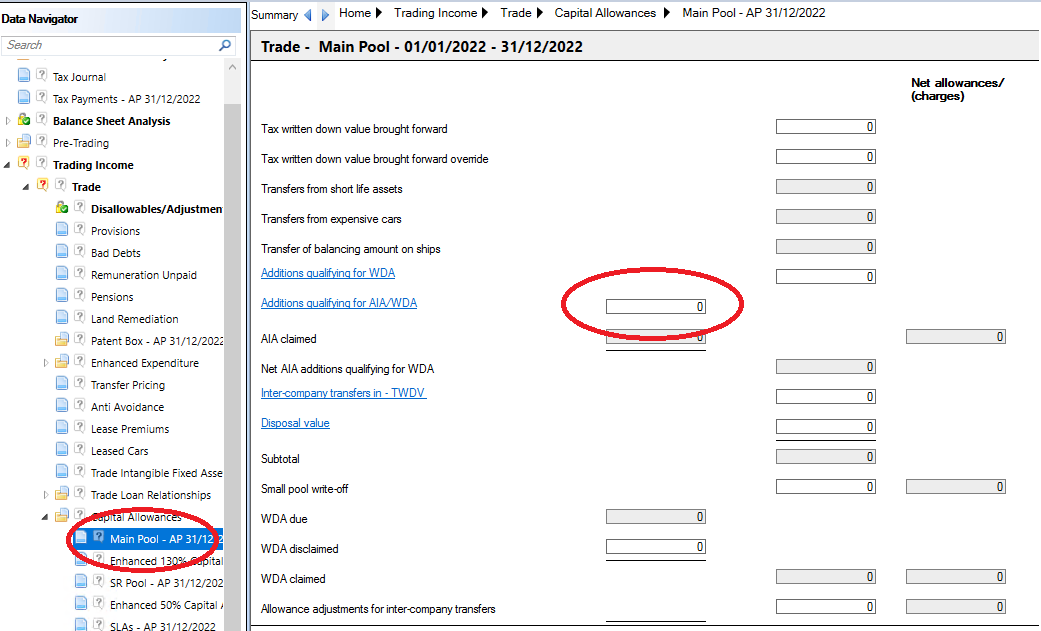

- Trading Income>Trade name> Capital allowances >Main Pool> Additions qualifying for AIA/WDA.

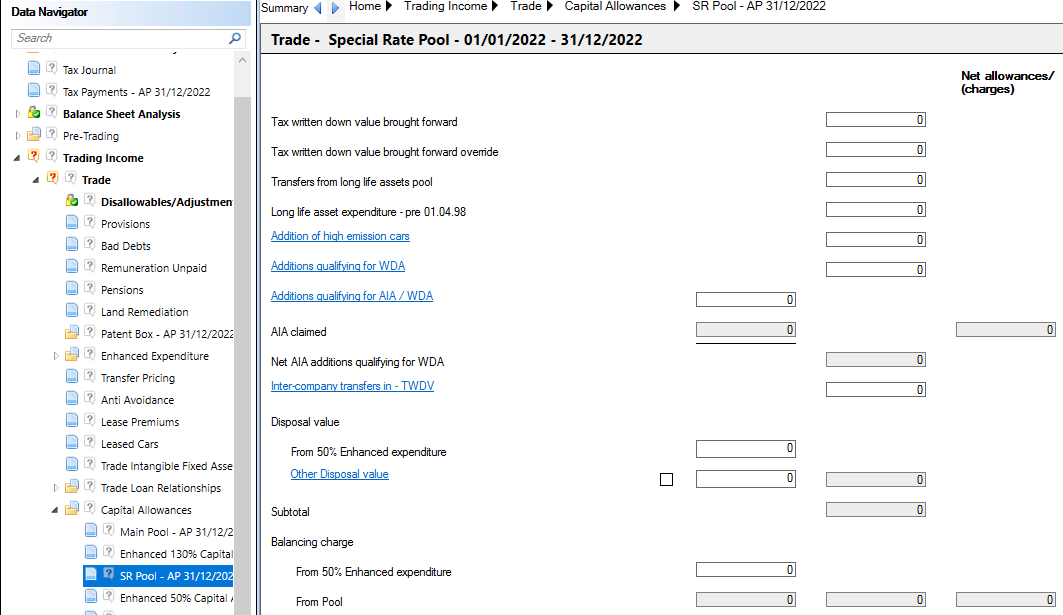

- Trading Income>Trade name> Capital allowances >Special Rate Pool> Additions qualifying for AIA/WDA.

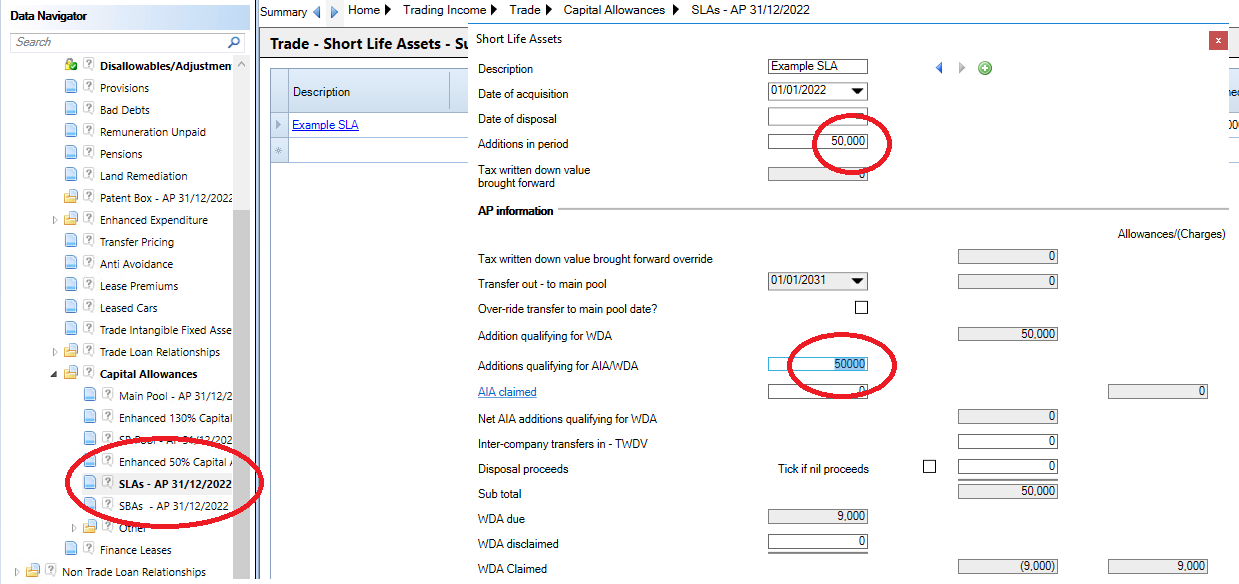

- Trading income>Trade name> Capital allowances>SLAs> Additions qualifying for AIA/WDA.

- Management Expenses> Capital allowances >Main Pool> Additions qualifying for AIA/WDA.

- Management Expenses> Capital allowances >Special Rate Pool> Additions qualifying for AIA/WDA.

- Management Expenses> Capital allowances >SLAs> Additions qualifying for AIA/WDA

and the software will assume the assets have an acquisition date of the first date of the Accounting Period,

Or input your capital acquisitions into the relevant Fixed Asset Additions screen:

- Trading Income> Trade name> Capital allowances>FA Additions> Allowance Type "Qualifying for AIA".

- Management Expenses> Capital allowances>FA Additions>Allowance Type "Qualifying for AIA".

and input the acquisition dates before linking.

Claim the annual investment allowance using the AIA Claim input within the Tax Planning area of the Data Navigator.