Editing Periods

Editing Accounting Periods

You can edit both Accounting Periods (APs) and Periods of Account (POAs). It is possible to edit periods at any point during tax return preparation, before sign-off and submission to HMRC. There are certain conditions which apply to changing periods. Some data is mandatory (warnings are displayed). Some data may be lost (warnings are displayed).

- Selected and open the client you wish to edit

- Navigate to the Tax Returns Tab

- Click the Edit APs link alongside the P:OA you wish to Edit.

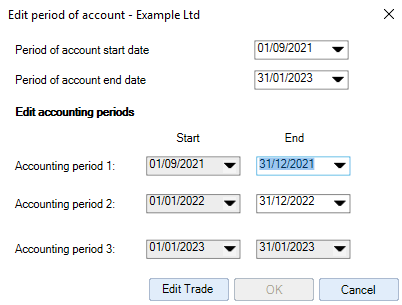

- In the Editing Accounting Periods window, edit the dates.

- The period end dates can be edited.

If your changes create two or three accounting periods, additional rows appear in this window.

Edit Trade

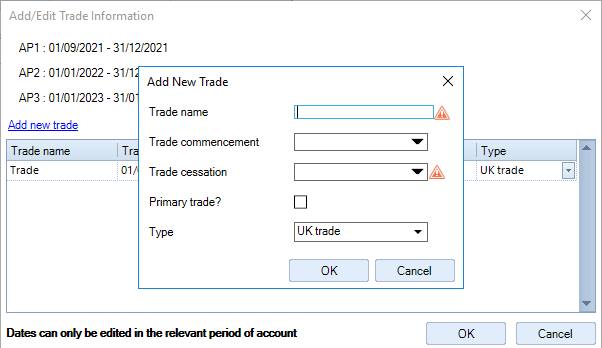

If your changes create three accounting periods, the Edit Trade button is activated.

If you have created three accounting periods you cannot progress without either:

- Creating a trade (in a new client) or

- Editing an existing trade (in an existing client)

The Edit Trade button will open the Add/Edit Trade Information window.

If no trade exists, add a new trade with a start or end date which ensures only 2 trading APs exist

If there is already a trade, amend the start or end dates to ensure only two trading accounting periods exist

- Once the acceptable dates have been input, the OK button will be activated.

- Click OK - this navigates back to the 'Editing Accounting Periods' dialog box.

- Click OK to accept the AP date changes and the dialogue will close.

- You are then ready to click on the Period of account dates hyperlink to access the tax return.

Note: Actions can be cancelled at any time by clicking the 'Cancel' button in the relevant screen.