CCH Accounts Production 2023.3: Release Notes

Release Highlights

This release provides a maintenance and compliance update for many entities, with specific focus on the Charity FRS 102 Master Pack. Support for the UK Charity and Irish FRC 2023 taxonomies. In addition there are a number of enhancements and other usability improvements.

User Guides are available in Help here and the earlier Release Notes can be found here.

Prerequisites

Installing CCH Accounts Production 2023.3

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licenced are installed in the correct sequence. Click here to learn about the Central Suite Installer.

Legislative & Compliance Updates

Packs updated

The following master packs have been updated for this release. These are discussed in more detail in the following sections.

- Limited (FRS 102) – pack 48.00

- Consolidated (FRS 102) – pack 40.00

- Limited Micro Entity (FRS 105) – pack 31.00

- Limited Liability Partnerships (FRS 102) – pack 35.00

- Limited IFRS – pack 40.00

- Consolidated (IFRS) – pack 14.00

- Charity (FRS 102) – pack 24.00

Key changes that apply to multiple packs

Small company reduced filing: We have corrected an inconsistency between the FRS 102 Limited pack and the IFRS , FRS 102 Group and Charity FRS 102 packs, where you were able to select the Small Reduced Company Print Selection even if the size was not set to small.

Exclude management schedules: We have also added the Exclude Management Schedules checkbox to the above entities to remove any management pages when you print.

Limited (FRS 102) Master Pack 48.00

Format amendments

Exrep - Exception report: VSTS 290499 - Amended audit information row.

Page5aud - Auditor's Report 2020: VSTS 290499 - Provide two unique formulae for tagging purposes to distinguish opinion on original accounts from that on revised accounts.

Note25 - Intangible Assets: VSTS 290499 - Remove option for comparatives in ROI.

Note26 - Tangible Assets: VSTS 290499 - Remove option for comparatives in ROI.

Note27 - Investment Property: VSTS 290499 - Removed option for comparatives in ROI.

Note28 - Fixed Asset Investments: VSTS 290499 - Removed option for comparatives in ROI.

Note99 - Audit Report Information: VSTS 290499 - Added date of amended audit report to audit information note; amended opinion formula to be the same as in full audit report.

Note112 - Biological Assets: VSTS 290499 - Removed option for comparatives in ROI.

Mgmtbs - Detailed Balance Sheet: VSTS 291295 - Correct print condition.

Mgmtvar4 - Schedule Of Variances In Detailed Trading And Profit And Loss Account: VSTS 291295 - Correct print condition.

Mgmtvar5 - Schedule Of Variances In Distribution Costs And Administrative Expenses: VSTS 291295 - Correct print condition.

Fmcos - Farms - Schedule Of Other Costs: VSTS 291295 - Correct print condition.

Farmpl1 - Farm Trading Account: VSTS 291295 - Correct print condition.

Paragraph amendments

Audit report - Auditor's responsibilities - Further description ROI: VSTS 290499 - Updated link to IAASA guidance.

Balance sheet - Audit exemptions Section 477: VSTS 290499 - Removed flexible ref to small companies since s477 doesn't apply to anything else.

Name range amendments

None.

Statutory database amendments

None.

Consolidated (FRS 102) Master Pack 40.00

Format amendments

Page6isman - Profit And Loss Account - Parent: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Note25 - Intangible Assets: VSTS 290499 - Removed option for comparatives in ROI.

Note26 - Tangible Assets: VSTS 290499 - Removed option for comparatives in ROI.

Note27 - Investment Property: VSTS 290499 - Removed option for comparatives in ROI.

Note28 - Fixed Asset Investments: VSTS 290499 - Removed option for comparatives in ROI.

Group Audit Trail - 15 Subsidiaries: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Grpmgmtdpl2 - Group Detailed Income Statement: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Grpmgmtdpl3 - Schedules To The Group Detailed Income Statement: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Paragraph amendments

Audit report - Auditor's responsibilities - Further description ROI: VSTS 290499 - Updated link to IAASA guidance.

Name ranges - new

STKOPEN Opening Stock 0500..059Z

STKCLOSE Closing Stock 0900..099Z

COSEXCLSTK COS excluding stock 0600..089Z+1000..199Z

Statutory database amendments

None.

Limited (FRS 105) Master Pack 31.00

Format amendments

Exrep - Exception report: VSTS 290499 - Amended audit information row.

Page7sofp - Balance Sheet: VSTS 297967 - Corrected balance sheet signatories formula and updated balance sheet signatories ixbrl tag to financial statement.

Paragraph amendments

Audit report - Auditor's responsibilities - Further description ROI: VSTS 290499 - Updated link to IAASA guidance.

Limited Liability Partnerships (FRS 102) Master Pack 35.00

Format amendments

Exrep - Exception report: VSTS 290499 - Amended audit information row; Removed items no longer relevant; Hid items that are optional for the company/LLP size.

Note99 - Audit Report Information: VSTS 290499 - Added date of audit report to audit information note.

Mgmtcvr1 - Management Front Cover: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Mgmtdpl2 - Detailed Income Statement: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Mgmtdpl3 - Schedules To The Income Statement: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Mgmtmthlypl6 - Monthly Profit And Loss Account: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Mgmtmthlyvar8 - Monthly Variance Profit And Loss Account: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Mgmtqtrly7 - Quarterly Profit And Loss Account: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Mgmtvar4 - Schedule Of Variances In Detailed Trading And Profit And Loss Account: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Mgmtvar5 - Schedule Of Variances In Distribution Costs And Administrative Expenses: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Mgmtdpl2f2 - Format 2 Detailed Income Statement: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Mgmtdpl3f2 - Schedule To Format 2 Detailed Profit And Loss Account: VSTS 290499 - Amended page setup to suppress when format 2 not chosen. VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Formattedtb - Formatted Trial Balance: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Taxlinksch - Tax Link Schedule: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Paragraph amendments

None.

IFRS Master Pack 40.00

Format amendments

Exrep - Exception report: VSTS 290499 - Amended audit information row; Removed items no longer relevant; Hid items that are optional for the company size.

Page4dir - Directors' report: VSTS 290499 - Added exemption paragraph.

Page6is - Income statement: VSTS 290499 - Corrected swapped references to F2CAP and F2STK on IFRS Format 2

Page7sofp: VSTS 290499 - Moved deferred tax asset to non-current assets for FRS 101 balance sheets (already there for IFRS).

Note34 - Trade and other receivables: VSTS 290499 - Removed deferred tax asset.

Note99 - Audit report information: VSTS 290499 - Added date of audit report to audit information note.

All management pages: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Paragraph amendments

Audit report - auditor's responsibilities - further description: VSTS 290499 - Updated link to IAASA guidance.

Balance sheet - audit exemption section 477: VSTS 290499 - Added exemption paragraph.

Director's report - small company exemption statement companies act 2014: VSTS 290499 - Added exemption paragraph.

Director's report - small or medium company exemption statement: VSTS 290499 - Added exemption paragraph.

Name range amendments

None.

Statutory database amendments

None.

Consolidated IFRS Master Pack 14.00

Format amendments

Page4dir - Directors' report: VSTS 290499 - Added exemption paragraph.

Page6is - Income statement: VSTS 290499 - Corrected swapped references to F2CAP and F2STK on IFRS Format 2

Note34 - Trade and other receivables: VSTS 290499 - Removed deferred tax asset.

Page17sofp - Company sofp: VSTS 290499 - Moved deferred tax asset to non-current assets for FRS 101 balance sheets (already there for IFRS).

Note34c - Trade and other receivables - co: VSTS 290499 - Added FRS101 tab; removed deferred tax asset.

All management pages: VSTS 291295 - Add print condition #mc3 to Exclude management pages.

Paragraph amendments

Audit report - auditor's responsibilities - further description: VSTS 290499 - Updated link to IAASA guidance.

Balance sheet - audit exemption section 477: VSTS 290499 - Added exemption paragraph.

Director's report - small company exemption statement companies act 2014: VSTS 290499 - Added exemption paragraph.

Director's report - small or medium company exemption statement: VSTS 290499 - Added exemption paragraph.

Name range amendments

None.

Statutory database amendments

None.

Charities (FRS 102) Master Pack 24.00

Key changes

This pack has been improved throughout. An updated User Guide is available in User Docs here.

The following changes are included:

- The Information page now has a table for disclosing key management personnel, as required by the Charities SORP for charities classified as "large".

- The Trustees report now has subheadings, plus a section for fund-raising standards as required by the Charities (Protection and Social Investment) Act 2016.

- The Balance sheet has been simplified and has additional checks for the completeness of information. The full pensions reserve is shown where it exists, and unnecessary separate reserves for hedging and revaluation have been removed.

- On the SOFA, line descriptions have been changed to match the SORP and unnecessary paragraphs have been removed or made optional. A dormant option has been introduced.

- On notes generally, the layout has been improved and standardised, enabling current+comparative to fit in portrait in most cases. Complicated name range formulae have been replaced by simple Excel-type formulae wherever possible. Keep together has been improved and columnflex has been applied throughout.

- Wrapping problems for headings have been fixed by replacing previous paragraph links with text entered in grids in the statutory database.

- The use of a separate "Material" fund has been clarified and simplified.

- Additional guidance has been added to many nodes in the statutory database.

- The Impairments note now discloses information in an automatic table rather than in paragraphs.

- The Tax note has been simplified and clarified for the user.

- A redundancy paragraph was added to the Employees note and the key management remuneration costs were moved here, from Related parties.

- For all the Fixed assets notes, the separate ROI version was removed because it is no longer relevant.

- Funds notes entries in the statutory database have been improved and now include a default row to pick up the unallocated balance, plus the display of the totals to reconcile to.

- The Net assets analysis now uses the same column headings as those in the SOFA and the comparatives have been moved to display below the current figures. In both the format and the entry grid in the statutory database, there are cross-checks to show agreement with balance sheet values for funds.

- Support and governance disclosure has been fully reworked and now offers a simple method for disclosure in line with the SORP, with a new option to analyse support by cost categories in a table, as the SORP suggests.

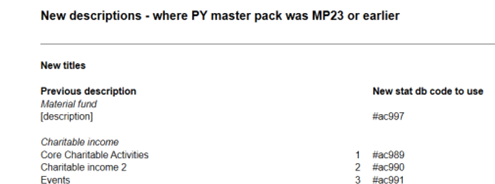

User input required

Various column headings/descriptions have been replaced by database grid entries in this master pack. Since it is not possible to carry forward these older style headings, there is a new page ("New descriptions") in the Management section of the Financial Statements, which lists the old headings and provides the statutory database reference for entering the new headings to replace them with. An example is shown below:

Format amendments

VSTS 289575 - Extensive review and improvement of all formats

All pages/notes: Added columnflex; Updated keep together.

Page2inf - Legal and administrative information: Added table for senior management.

Page4trr - Trustees' report: Added subheadings; Added paragraphs for Charities (Protection and Social Investment) Act 2016.

Page6sfa - Statement of financial activities: Simplified column calculations; Took into account the effect of a first year; Changed line descriptions to match SORP; Removed unnecessary duplicated lines: Replaced name ranges with SUM commands where possible; Removed separate para re gains and losses (not required); Removed para re I&E (already in the title); Made non-breaking page the default with new flags; Added optional dormant statement.

Page7sofp - Balance sheet: Removed separate hedging and revaluation funds; combined all pension funds into one; added check that the sum of funds row agree to the total; Corrected repeat of subtitles; Removed various blank rows; Removed deferred tax row and corrected provisions note ref to 50.

Note10 - Net movements in funds: Corrected capitalisation of Exchange Losses.

Note11 - Auditor's remuneration: Amended in line with other FRS 102 packs.

Note23 - Impairments: Removed the paragraphs for COS, selling, admin (not relevant). Corrected formatting and keep together.

Note25 - Intangible assets: Simplified column calculations; Added columnflex to notes tab; Removed inapplicable refs to #sce1 and #sce13; Removed link to ROI tab (no longer different).

Note26 - Tangible assets: Simplified column calculations; Added columnflex to notes tab; Removed inapplicable refs to #sce1 and #sce7; Removed link to ROI tab (no longer different).

Note27 - Investment property: Split UK tab in two to accommodate the need for comparatives; Removed depreciated cost option; Removed link to ROI tab (no longer different).

Note28 - Fixed asset investments: Simplified column calculations; Removed ROI tab (no longer different).

Note30 - Financial instruments: Removed rows for disclosure of non-FV instruments.

Note31 - Stocks: Removed reference to #sce1 in page setup.

Note33 - Financial lease receivables: Removed rows for #bn999558 and #bn999560 (not required).

Note34 - Debtors: Removed reference to #sce16 in page setup.

Note41 - Finance lease commitments: Removed defunct 2nd tab.

Note48 - Deferred taxation: Deleted.

Note50 - Provisions for liabilities: Removed line for deferred tax.

Note51 - Grants and deferred income: Suppressed sections where there were no figures.

Note69 - Operating lease commitments: Brought all onto one tab and updated line suppression.

Note70 - Capital commitments: Updated row suppression and totals.

Note74 - Related party transactions: Moved key management remuneration to employees' costs.

Note111 - Donations and legacies: Simplified column calculations; Added repeating subtitles; Moved all notes to the end; Replaced formulae with subtotals; Replaced headings with new links to stat db grid; Amended title.

Note112 - Income from charitable activities: Added alternative layout more suitable for single activity; Moved Grants detail and Notes to separate tabs; Replaced headings with new links to stat db grid.

Note113 - Income from trading activities: Simplified column calculations; Replaced formulae with subtotals; Replaced headings with new links to stat db grid.

Note114 - Investment income: Simplified column calculations; Replaced formulae with subtotals; Replaced headings with new links to stat db grid.

Note116 - Other income: Simplified column calculations; Moved all notes to the end; Replaced formulae with subtotals; Replaced headings with new links to stat db grid.

Note117 - Fundraising costs: Simplified column calculations; Moved all notes to the end; Replaced formulae with subtotals; Added repeating subtitles; Replaced headings with new links to stat db grid.

Note118 - Charitable expenditure: Removed option to suppress this note when all expenditure is by grants because that would mean the support costs are not shown; Simplified column calculations; Moved all notes to the end; Replaced formulae with subtotals; Replaced headings with new links to stat db grid.

Note119 - Description of charitable activities: Replaced headings with new links to stat db grid.

Note120 - Grants payable: Simplified column calculations; Moved all notes to the end; Replaced formulae with subtotals; Replaced headings with new links to stat db grid.

Note121 - Support and governance costs: Created new option showing detailed or summary allocation, with optional disclosure of governance analysis; Removed #cy66 (audit fees) - disclosed elsewhere; Replaced headings with new links to stat db grid.

Note122 - Other expenses: Simplified column calculations; Replaced formulae with subtotals; Replaced headings with new links to stat db grid.

Note123 - Gains and losses on investments: Simplified column calculations; Replaced formulae with subtotals; Amended title; Replaced headings with new links to stat db grid.

Note124 - Endowment funds: Simplified column calculations; Moved all notes to the end; Replaced formulae with subtotals; Simplified user input where there is only one endowment; Moved comparative to display after current; Replaced headings with fixed descriptions.

Note125 - Restricted funds: Simplified column calculations; Moved all notes to the end; Replaced formulae with subtotals; Simplified user input where there is only one fund; Moved comparative to display after current; Added pension fund row; Replaced headings with fixed descriptions.

Note126 - Unrestricted funds: Simplified column calculations; Moved all notes to the end; Replaced formulae with subtotals; Simplified user input where there is only one fund; Moved comparative to display after current; Added pension fund row; Replaced headings with fixed descriptions.

Note127 - Analysis of net assets between funds: Simplified column calculations; Replaced AP formulae in Totals rows with Excel subtotals; Added cross-check to balance sheet values; Moved comparatives to display below the current figures; Replaced column headings with those used in SOFA.

Note129 - Gains and losses on revaluations: Simplified column calculations; Replaced formulae with subtotals; Corrected title; Replaced headings with new links to stat db grid.

Note130 - Material other expenses: Replaced headings with new links to stat db grid.

Note131 - Other gains and losses: Simplified column calculations; Replaced formulae with subtotals; Corrected title; Replaced headings with new links to stat db grid.

Note132 - Heritage assets: Simplified column calculations; Replaced formulae with subtotals; Amended row suppression calculations; Corrected page setup suppression formula to take into account PY balances.

Note133 - Programme related investments: Simplified column calculations; Replaced formulae with subtotals; Amended row suppression calculations; Corrected page setup suppression formula to take into account PY balances.

Note134 - Mixed motive investments: Simplified column calculations; Replaced formulae with subtotals; Amended row suppression calculations; Corrected page setup suppression formula to take into account PY balances.

Note136 - Employees: Added redundancy paragraph; Moved key management remuneration into this note.

Note137 - Material funds: Simplified column calculations; Moved all notes to the end; Replaced formulae with subtotals; Simplified user input where there is only one fund; Moved comparative to display after current; Added pension fund row; Replaced headings with fixed descriptions. MP16.00 Changes Enforce use of comparatives from pc 5/10/18, while allowing option of earlier use. Replace column suppression with ColumnFlex command MP15.00 Changes Amend row and column suppression Amend sign of difference line and some totals.

Note144 - Cash flow - net debt analysis: Added blank line before statement that the charity had no debt.

Paragraph amendments

All VSTS 289575:

Accounting policies - restricted funds: Added reference to grantors.

Audit report - auditors responsibilities further description: Updated link to IAASA guidance.

Balance sheet notes - retirement benefit - db intro: New paragraph.

SOFA - material fund disclosure: Moved to charity info

Independent examiners report – description of independent examiner’s qualification: Amended to warn user that the accounting body has not been entered.

Other notes - capital commitments - introduction: Applied standard FRS 102 wording.

Other notes - material funds introduction: Simplified

Other notes - restricted funds introduction: Simplified and clarified.

Other notes - revaluations, gains and losses headed (various): No longer used.

Other notes - unrestricted funds introduction: Simplified and clarified.

SOFA - charitable expenditure heading 1-7: No longer used

SOFA - charitable income heading 1-7: No longer used

SOFA - continuing activities and gains/losses: Brought together the statements about continuation and gains/losses, and made optional.

SOFA - dormant statement: New para.

SOFA - investment income: Corrected description.

SOFA - raising funds heading: Simplified heading

Charitable income 1: Amended to clarify goods, not services.

P&l / SOCI notes - impairments (various): Deleted.

SOFA notes - employees - redundancy: New paragraph.

SOFA notes - key managment remuneration - introduction: Moved to employees note

SOFA notes - taxation default text: Replaced with more appropriate wording.

SOFA notes - trustees' expenses: Corrected spacing.

Cash flow statement - no net debt: Amended to specify no "material" debt.

Name range amendments

New name ranges:

RFPR RF Pension reserve 3970

MFPR MF Pension reserve 2970

SAGCTOT Gov alloc from support total 5380..5389

SAGTOTAL Total governance for reallocation 5300..5449

URMOS UF: Material Other Expenditure support 1901

EFMOS EF: Material Other Expenditure support 4901

MFMOS MF: Material Other Expenditure support 2901

RFMOS RF: Material Other Expenditure support 3901

TOMOS TO: Material Other Expenditure support 1901+2901+3901+4901

Statutory database amendments

Charity information: Moved material fund flag into this section and added its description to the Designations grid; Added table for key management information; Removed defunct comparatives options; Removed chairman's report information into trustees report section.

Trustees report: Added chairman's report designations in a new grid; Added paragraphs for fund-raising standards.

Quality Improvements

CCH Accounts Production

ADO 293915 - Speed up processing iXBRL tags in database upgrade

The 2023.2 AP database upgrade was slow due to adding iXBRL tags for the new FRC2023 taxonomies to accounts pages. The processing of iXBRL tags has now been speeded up which will improve the database upgrade for releases in which new taxonomies are introduced.

ADO 298848 - In a consolidation, if an officer is deleted from the Parent it is not being deleted from the Group

In a consolidation, the officers on the Group company are taken from the Parent company. On the Group company you can neither add nor delete officers. If an officer is added to the Parent then it is automatically added to the Group. But the reverse was not working. If an officer was deleted from the Parent it was not being deleted from the Group. This is now fixed.

There are still other circumstances where a user may find they have an officer on the Group that is not on the Parent. But this change offers a simple workaround for this situation. Add the officer to the Parent and delete it again. It will then be deleted from the Group.

ADO 299782 - Change the Task Permission required to Change the Sequence of accounts pages

Previously the permission required was Business Type# Financial Statements #Edit Format. But it has been pointed out that changing the order of pages is a safer operation than editing the formats themselves. So this function is now controlled by Business Type# Financial Statements #Edit Format Pagination. #Edit Format Pagination lets you open a page and insert page breaks at appropriate points. Changing the order of the pages seems to be more similar to inserting page breaks than actually editing a format.

CCH Review and Tag

The following quality improvements have been made to licensing in this release.

VSTS - 299901 - ProfitLoss tag

Correction to the xml document generated from AP, due to the incorporation of the Detailed Profit & Loss taxonomy into the main FRS taxononies, the ProfitLoss tag was not being set correctly

This issue caused the following error when trying to submit to Companies House

VSTS 296260 - Tagging corrections

Corrected tagging for UK & Ireland LTD FRS102 - Directors Remuneration note, Company pension contributions to defined contribution schemes now tagged with Company contributions to money purchase plans, directors

Ireland - LTD FRS102 - corrected tag for Date of signing of Auditors Report

IFRS - Corrected tag for Company Registration number

VSTS - 266912 - More Tagging corrections

LTD FRS105 - Not tagging the balance sheet date correctly

ROI LTD FRS102 - bus_LegalFormEntity moved to Other data and removed tag from format.

LLP FRS105 - Companies House number incorrectly tagged

ROI FRS102 - DPL Mandatory tags added to MgmtDPL2 format

VSTS/299407 - "Attach to CT Return" button is not enabled in Review and tag

The inclusion of the DPL taxonomy caused the "Attach to CT" button to be disabled in error. The button will now be permanently enabled.

Notable Issues

CCH iXBRL Review & Tag - Known Issues

| Date Raised | ITS | Description | Workaround ( If applicable) | Scheduled/Resolved |

|---|---|---|---|---|

| 24/03/2021 | 62820 | Companies House credentials are reset after a CSI upgrade. We have had a small number of reports that the Companies House online filing credentials are being removed/reset after an upgrade using the CSI installer. |

Re-enter the credentials using the reviewandtagsettings.exe located in the Deploy folder. | TBC |

| 08/01/2021 | 61714 | IFRS accounts produced in Accounts Production errors on Information Page. Certain address and 3rd party information cells on the Info page on the IFRS format have updated to create duplicate tags. This will show as duplicate fact value errors when exported to CCH iXBRL Review & Tag. |

In CCH iXBRL Review & Tag double-click on the duplicate fact value error within the Exceptions tab. This will take you to the tagged area that has the error. Left-click on the tagged area and amend the dimension to the correct value. |

TBC |

| 24/12/2020 | 61704 | Companies House submission database showing Client Code as NA The submission database was updated in 2020.3 to include the client code from CCH Central to enable users to report on filings by client code. This code is obtained by matching the company name within the CCH iXBRL Review & Tag file to the database within CCH Central. If, however your client's name in CCH Central does not match the Company name reported within the accounts, the entry will be logged as NA. |

Ensure that you client name in CCH Central and the Company name reported in the accounts match. | TBC |

| 15/12/2021 | 61694 | Micro Entities set to Full accounts when using reduced filing option. When accounts produced in CCH Accounts Production for FRS105 Micro entities the option to use reduced filing sets the accounts type in CCH iXBRL Review & Tag as (Full Accounts). This is due to there being no legal form of accounts recognised as filleted so the option defaults to Full. |

If you are producing reduced filing accounts for Micro entities to file at Companies House. Leave the entity type as Micro Entities (Full Accounts). Do not change to Small Companies Reduced filing. | TBC |

| 25/08/2020 | 59571 | FRS102 Sec1 A small Companies - Full Accounts filing throws an error “Document missing mandatory tag Statement on quality and completeness of information provided to auditors" is reported when Customers try to file an FRS102 Sec1A Full accounts to Companies House. The majority of the FRS102 Sec1A Small Companies file Small company reduced filing version, there is nothing to prevent filing of a full accounts to CCH. The entity type is set to full in error and this causes the error. | The error can be ignored, and accounts filed. To prevent the error, change the entity type in document information to Small Companies Reduced filing. If after making this change, another exception on Applicable Legislation appears, you need to add this tag in other data and select Small Companies Regime. | TBC |

| 01/12/2017 | TBC | FRS 105 Audited – reduced filing Companies House Submissions in CCH iXBRL Review & Tag We do not currently support iXBRL filing for audited 105 accounts. The concept of audited 105 is still in its infancy; please paper file until we receive more guidance on this issue. |

For Information only | |

| 01/10/2020 | 60609 | Charity FRS 102 -Filing exception on Directors responsibilities note from balance sheet for charitable companies The paragraph on directors’ responsibilities on the balance sheet is not switching the word items #wd18 and #wd3 for charitable companies where a single director is marked as the balance sheet signatory. It is not switching to the singular term 'acknowledge' and 'his/her ' from 'acknowledges' and 'their'. This causes a fatal 9999 error in CCH IXBRL Review & Tag when filing to Companies House. |

This is an issue in CCH Accounts Production but CCH iXBRL Review & Tag users need to be aware. Workaround -Update/edit the tag in review and tag to the correct wording and submit. When editing it is good practice to edit the content, copy to a note pad and then copy back and apply the tag. |

For Information only |

| TBC | FRS 102 Limited - Statement of Changes in Equity (Page7SOCE) A minor tagging issue affecting 1st year only financial statements. This results in a a tagging error for FRS102 that includes as SOCE |

This is an issue in CCH Accounts Production but CCH iXBRL Review and Tag users need to be aware. Open the format, click Draft and Show iXBRL Tags on the ribbon bar. Then on Row 47 right-click and use the Suppress Tag option on the numeric cells. Alternatively, you can delete the Prior Year tags in CCH iXBRL Review and Tag. |

For information only |

CCH Working Papers

Our current Notable issues list is available from Customer Communities on UserDocs.

CCH Accounts Production

ITS/67726 – Management Collection - showing cost of sales and selling costs on separate schedules

This release contains a new option to show the cost of sales and selling costs on separate schedules. The option only applies to the Format 1 Profit and Loss account, but it also appears for the Format 2 Profit and Loss account. If selected for Format 2, it has no effect.

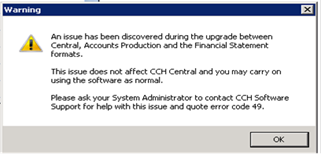

207516 – Error 49 on upgrade

When logging into Central following a release, the error message “error code 49” is shown.

This indicates that the Central database and the Document Store database are no longer in sync.

Please contact CCH Support for assistance.

237416 - Transferring fixed assets from CCH Accounts Production to CCH Corporation Tax for IFRS

The link from CCH Accounts Production to CCH Corporation Tax for Tangible Fixed Assets does not work for IFRS clients.

The data must be entered manually in CCH Corporation Tax.

Unable to travel images

Any images stored in the Image Library will not be available in the travelled database.

Unable to load accounting period if server data format is MM/DD/YY

An issue has been identified that prevents CCH Accounts Production from loading the Accounting Period if the date format in your environment is not dd/mm/yyyy. There is no solution to this at present, other than to amend your Date/Time settings in Windows.

206581 - FRS 102 – Countries that are incorporated in region 3

We have an issue with the Directors Report and Investment Property note not printing correctly. The majority of users are unaffected as accounting periods incorporated in England and Wales, Scotland and Northern Ireland are all set to region 1. Republic or Ireland and Eire are set to region 2. Other countries fall into region 3 and there may be a format issue caused by the print condition or row conditions incorrectly testing on either region 1 or region 2.

234971 – Text entered into paragraph is more than one page in length

We have an issue where text entered into a paragraph node in the statutory database does not print correctly if it is more than one A4 page in length. The bottom of the text ‘falls off’ the A4 page and is not continued on the following A4 page. The workaround is to split the text across two or more nodes, or if that is not possible, enter the text directly into the format cell and make the format local.