CCH Personal Tax IE : 2023.1

Prerequisites

Installing CCH Personal Tax IE 2023.1

Prior to installing this update, you must ensure that you have 2022.1 currently installed on your system.

Installation of the update is straightforward; however, we recommend that you take a moment to review the Installation Guide (Update Guide)

Introduction

As per Revenue guidelines and due to the implementation of the Finance Act 2022 and amendment in the taxonomy, we have made 46 changes in CCH Personal Tax Version 2023.1 for the Tax Year 2022. The major and minor changes have been made to CCH Personal Tax to comply with Revenue.

Major changes in Tax Year 2022

Major changes include new tax fields and subsections to be filled in where applicable under

PAYE/BIK/PENSIONS (2)

- Tax field under Allowable Deductions Incurred in Employment- Remote Working Relief already claimed via Real Time Credits in 2022

CHARGES AND DEDUCTIONS

- Tax field under Interest paid under deductions of Income Tax at a reduced rate or WITHOUT the deduction of- a. At a reduced rate of income tax please state the DTA relied on for both Self and Spouse

- Tax field under Interest paid under deductions of Income Tax at a reduced rate or WITHOUT the deduction of- The amount of interest paid for both Self and Spouse

- Tax field under Interest paid under deductions of Income Tax at a reduced rate or WITHOUT the deduction of- Amount of Income Tax deducted for both Self and Spouse

- Tax field under Interest paid under deductions of Income Tax at a reduced rate or WITHOUT the deduction of- b. Without the deduction of tax please state the DTA relied on for both Self and Spouse

- Tax field under Interest paid under deductions of Income Tax at a reduced rate or WITHOUT the deduction of- The amount of interest paid without the deduction of income tax for both Self and Spouse

PERSONAL TAX CREDITS

- Tax field under Employment and Investment Incentive: Shares issued on or after 8th of October 2021 and on or before 21st December- (b)(i) Amount subscribed for eligible shares on or after 8th of October 2021 and on or before 21st December 2021 for both Self and Spouse

- Tax field under Employment and Investment Incentive: Shares issued on or after the 8th of October 2021 and on or before 21st December- (b)(ii) Name of company in which investment was made for both Self and Spouse

- Tax field under Employment and Investment Incentive: Shares issued on or after 8th of October 2021 and on or before 21st December- (b)(iii) Tax reference number of company in which investment was made for both Self and Spouse

- Tax field under Employment and Investment Incentive: Shares issued on or after 8th of October 2021 and on or before 21st December- (b)(iv) Date of 'EII5' (Managers Cert) where the amount subscribed for eligible shares was through a designated fund for both Self and Spouse

- Tax field under Employment and Investment Incentive: Shares issued on or after the 8th of October 2021 and on or before 21st December- (b)(v) Date of the “Statement of Qualification (EII)” for both Self and Spouse

- Tax field under Employment and Investment Incentive: Shares issued on or after the 8th of October 2021 and on or before 21st December- (b)(vi) Amount of investment which qualifies for relief under Section 502(2A) for both Self and Spouse

- Tax field under Employment and Investment Incentive: Shares issued on or after the 8th of October 2021 and on or before the 21st of December- (b)(vii) Deduction from total income under Section 502(2A) for both Self and Spouse

- Tax field under Employment and Investment Incentive: Shares issued on or after the 8th of October 2021 and on or before 21st December- (b)(viii) Amount to be carried forward to future periods for both Self and Spouse

- Tax field under Shares Issues in 2021 where an Undertaking is not made under 502(3B): shares held for less than 7 years- (i) Amount subscribed for eligible shares in 2022 for both Self and Spouse

- Tax field under Shares Issues in 2021 where an Undertaking is not made under 502(3B): shares held for less than 7 years- (ii) Name of company in which investment was made for both Self and Spouse

- Tax field under Shares Issues in 2021 where an Undertaking is not made under 502(3B): shares held for less than 7 years- (iii) Tax reference number of company in which investment was made for both Self and Spouse

- Tax field under Shares Issues in 2021 where an Undertaking is not made under 502(3B): shares held for less than 7 years- (iv) Date of the 'Statement of Qualification (SCI)' for both Self and Spouse

- Tax field under Shares Issues in 2021 where an Undertaking is not made under 502(3B): shares held for less than 7 years- (v) Amount of investment which qualifies for relief under Section 502(2)(a) for both Self and Spouse

- Tax field under Shares Issues in 2021 where an Undertaking is not made under 502(3B): shares held for less than 7 years- (vi) Deduction from total income under Section 502(2)(a) for both Self and Spouse

- Tax field under Shares Issues in 2021 where an Undertaking is not made under 502(3B): shares held for less than 7 years- (vii) Amount to be carried forward to future periods for both Self and Spouse

- Tax field for “Other” Health Expenses- Real-Time Health Expenses already Claimed via Real Time Credits in 2022 for last and current year

- Checkbox for Rent Tax Credit- I confirm that I paid rent under a tenancy(ies) in the tax year 2022 for both Self and Spouse

- Checkbox for Rent Tax Credit- I confirm that, in respect of this tenancy(ies), I am not in receipt of any rent support payment from a government scheme/body or agency (for example, HAP/RAS/SHEP) for both Self and Spouse

- Checkbox for Rent Tax Credit- I confirm that the landlord is not a Government minister or a Commissioner of Public Works who owns the property in an official capacity, and is not a Housing Authority, or Housing Association for both Self and Spouse

- Checkbox for Rent Tax Credit (It is stated that the user should select (a) and/or (b) as appropriate in order to apply for this credit. If neither of the options below applies, then it disqualifies the user from claiming the Rent Tax Credit)- I confirm that the rented property is my or my spouse’s principal private residence (PPR) in the year 2022, or rented property is not my PPR, but I use it for work or study, and I am not related to my landlord as parent/child, child/parent, or I am related to my landlord other than parent/child, child/parent, and the property is registered with the Residential Tenancies Board (RTB) and is not a license agreement such as the Rent-a-Room for both Self and Spouse

- Checkbox for Rent Tax Credit (It is stated that the user should select (a) and/or (b) as appropriate in order to apply for this credit. If neither of the options below applies, then it disqualifies the user from claiming the Rent Tax Credit)- ) I confirm that the rented property is used by my child for work or study purposes in the year 2022, and she or he was aged under 23 prior years to commencing a qualifying third level education and is not related to the landlord, and the property is registered with the Residential Tenancies Board (RTB) and is not a Rent-a-Room scheme for both Self and Spouse

- Tax field under Rent Tax Credit- Residential Tenancies Board registration number for both Self and Spouse

- Tax field under Rent Tax Credit- Address of the rented property you are claiming on behalf of (this property must be located within the State) for both Self and Spouse

- Tax field under Rent Tax Credit- Eircode for both Self and Spouse

- Tax field under Rent Tax Credit- Name of Tenant for both Self and Spouse

- Tax field under Rent Tax Credit- PPS No. of Tenant for both Self and Spouse

- Tax field under Rent Tax Credit- Tenancy Start date for both Self and Spouse

- Tax field under Rent Tax Credit- If tenancy ended in 2022, provide the end date for both Self and Spouse

- Tax field under Rent Tax Credit- Gross amount of rent paid for both Self and Spouse

- Tax field under Rent Tax Credit- Name and address of landlord or agency to whom rent is paid for both Self and Spouse

- Tax field under Rent Tax Credit- Agency or Landlord Eircode for both Self and Spouse

- Checkbox for Rent Tax Credit- Tick the box if your landlord is non-resident for both Self and Spouse

- Tax field under Rent Tax Credit- If paid to an agent, please provide the landlord’s name and address (optional) Landlord PPS No for both Self and Spouse

- Tax field under Rent Tax Credit- Landlord PPS No for both Self and Spouse

SELF-EMPLOYED INCOME

- Tax field under Credit for Professional Services Withholding Tax (PSWT) - Gross value of payments subjected to PSWT in basis period for 2022 for last year and current year

- Tax field under Credit for Professional Services Withholding Tax (PSWT) – Gross value of PSWT deductions in basis period for 2022. Do not include credit for Relevant Contracts Tax paid for last year and current year

- Tax field under Credit for Professional Services Withholding Tax (PSWT) – Gross value of interim refunds in basis period for 2022 for last year and current year

- Tax field under Credit for Professional Services Withholding Tax (PSWT) – Gross value of remaining credit to now be refunded in basis period for 2033 for last year and current year

Minor Changes in Tax Year 2022

Minor changes include new tax fields and subsections to be filled in where applicable under

- Personal Details

- Tax field under Chargeable Person- Reason to file a Form 11

- Checkbox under Chargeable Person- None of the above but you wish to file a Form 11

- Self-Employed Income

- Tax field under the link of Add Details under Farm Partnership Details- Your share of Succession Tax Credit under S.667D claimed in prior years

Please note it is very important that before running any database update you perform a database backup. CCH always advise that your practice takes regular backups in order to minimise any loss of data.

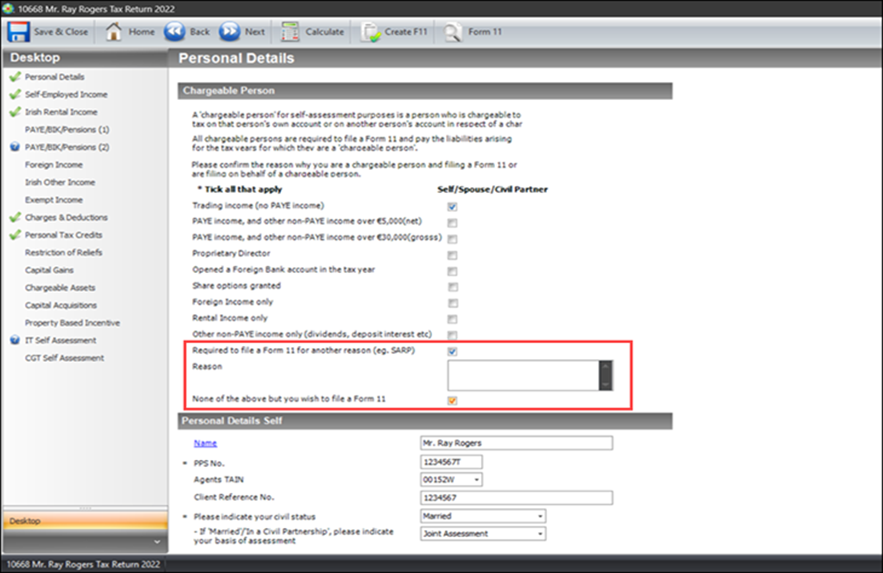

Personal Details

Personal Details and Status

The Personal Details section has new details added under Personal Details and Status. The changes have been made under the section Chargeable Person. Two new fields have been added. Firstly, a new field has been added that allows the user to mention the reason for filing Form 11, and secondly, another tax field that allows the user to tick the option, None of the above but you wish to file a Form 11. However, both these fields remain inactive unless the user ticks the checkbox Required to file a Form 11. The new additions are highlighted in Figure 1. The two Tax Fields added are listed below:

- Reason to file Form 11

- None of the above, but you wish to file Form 11

Figure 1: New Section under Chargeable Person for the year 2022

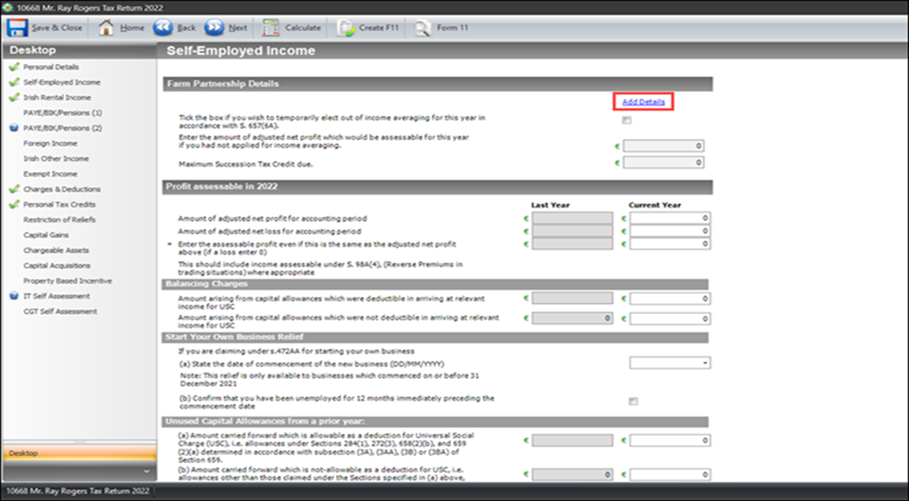

Self-Employed Income

Farm Partnership Details

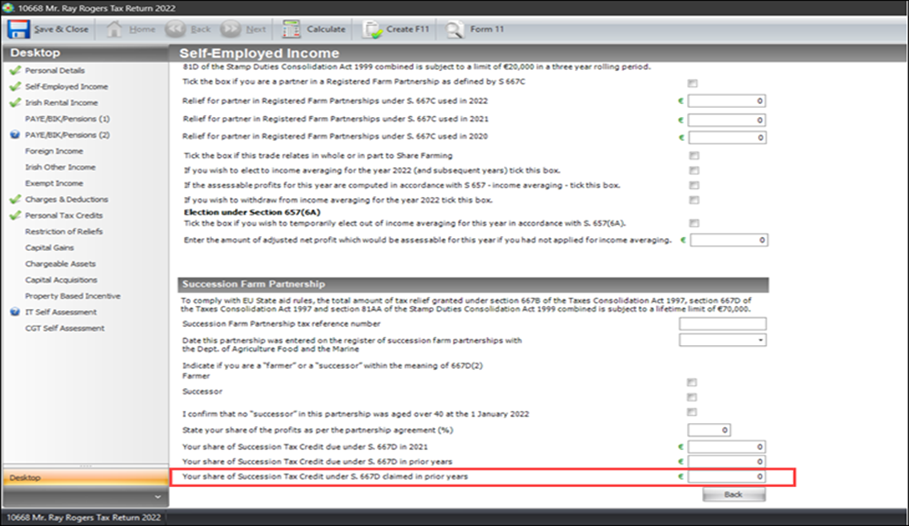

The Self-Employed Income section has new details added under Farm Partnership Details. The changes have been added under the Add Details hyperlink. The user needs to click on the Add Details hyperlink under the Farm Partnership Details to check out the new additions. The process of navigation can be identified below. The user of the same needs to click on the highlighted section of Figure 2 to reach Figure 3. Following this, the user can go ahead and add the new information that takes into consideration the share of Succession Tax Credit due under S.667D claimed in prior years. This can be found under Succession Farm Partnership. The Tax Field added is listed below:

- Your share of Succession Tax Credit due under S.667D claimed in prior years

Figure 2: Click on the 'Add Details' hyperlink under farm Partnership Details

Figure 3: New section under Succession Farm Partnership

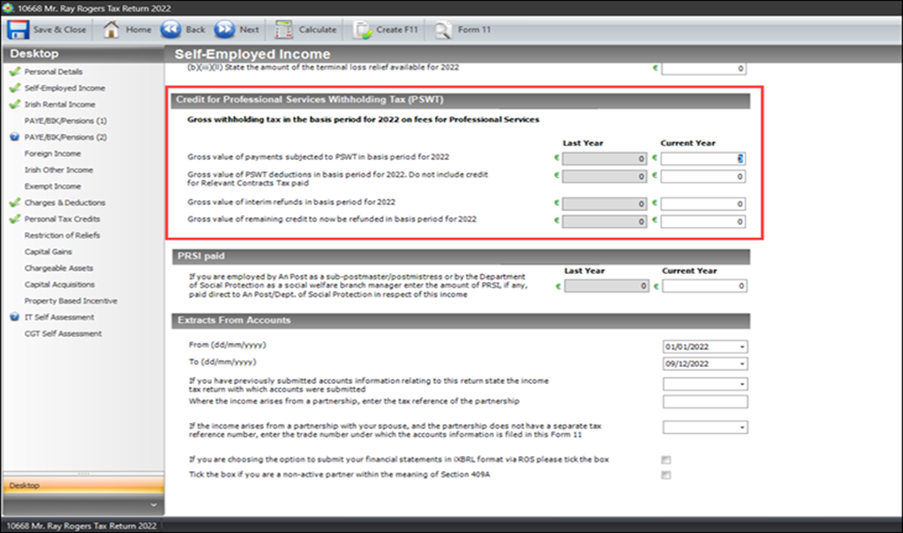

PSWT

The Self-Employed Income section has new details added under Credit for Professional Services Withholding Tax (PSWT). This section allows the user to calculate the gross withholding tax in the basis period for 2022 on fees for Professional Services. The new additions are highlighted in Figure 4. The two Tax Fields added are listed below:

- Gross value of payments subjected to PSWT in basis period for 2022; for both last year and current year

- Gross value of PSWT deductions in basis period for 2022. Do not include credit for Relevant Contracts Tax paid; for both last year and current year

- Gross value of interim refunds in basis period for 2022; for both last year and current year

- Gross value of remaining credit to now be refunded in basis period for 2022; for both last year and current year

Figure 4: New section under PSWT

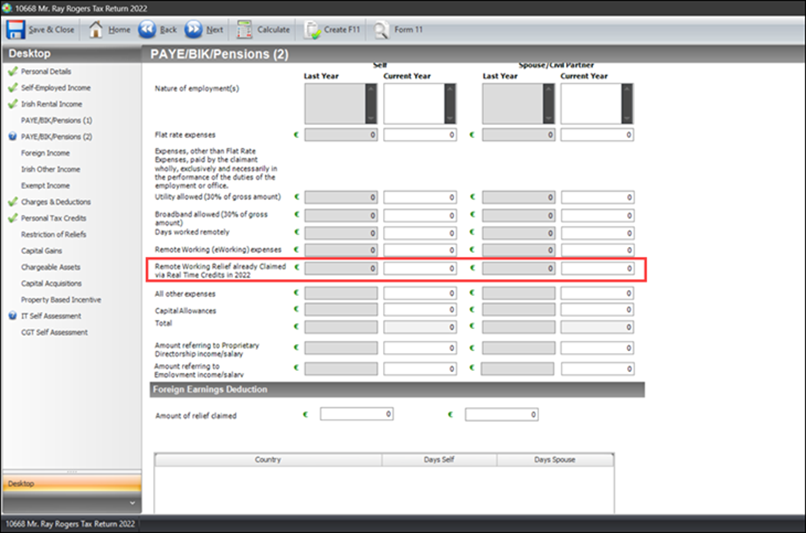

PAYE/BIK/Pensions (2)

Allowable Deductions Incurred in Employment

The PAYE/BIK/Pensions (2) section has a new field added under Allowable Deductions Incurred in Employment. The new placeholder added allows the user to declare the remote working relief that has already been claimed through real-time credits in 2022. It entails the user to declare the amount for both Self or Spouse/Civil Partner. The new additions are highlighted in Figure 5. The one Tax Field added is listed below:

- Remote Working Relief already Claimed via Real Time Credits in 2022 for Self (Current Year)

- Remote Working Relief already Claimed via Real Time Credits in 2022 for Spouse/Civil Partner (Current Year)

Figure 5: New section under Allowable Deductions Incurred in Employment

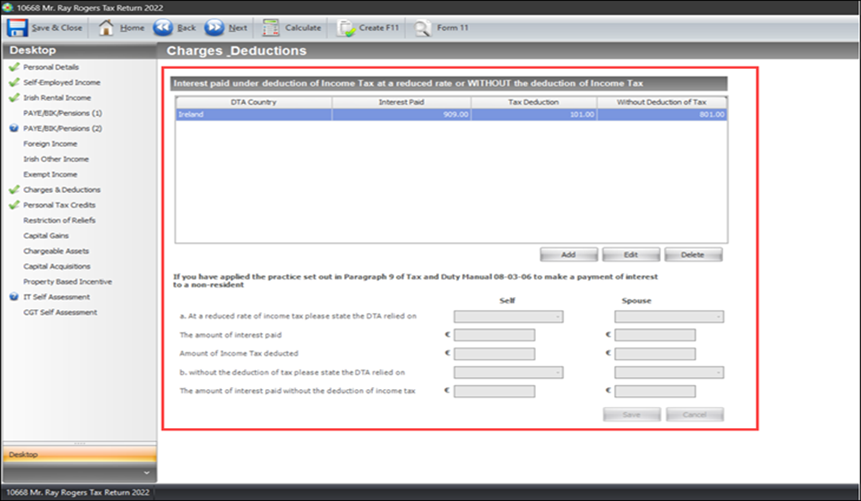

Charges and Deductions

Interest Paid under Deduction

The Interest paid under deduction of Income Tax at a reduced rate or WITHOUT the deduction of the section which is categorised below Charges and Deductions has had a new section added. The placeholders and the grids introduced allows the user to add, edit and delete information if they have applied the practice set out in Paragraph 9 of Tax and Duty Manual 08-03-06 to make a payment of interest to a non-resident. The major tax fields added are so that the user can declare the details for both Self and Spouse. The new additions are highlighted in Figure 6. The Tax Fields added are listed below:

- a. At a reduced rate of income tax please state the DTA relied on for both Self and Spouse

- The amount of interest paid for both Self and Spouse

- Amount of Income Tax deducted for both Self and Spouse - b. Without the deduction of tax please state the DTA relied on for both Self and Spouse

- The amount of interest paid without the deduction of income tax for both Self and Spouse

The new screen that is added, at the top, shows the added DTA country, Interest paid, Tax deduction, and without deduction of tax in a table format. The user can also edit the information saved and delete it as required.

Figure 6: New section under Charges and Deductions

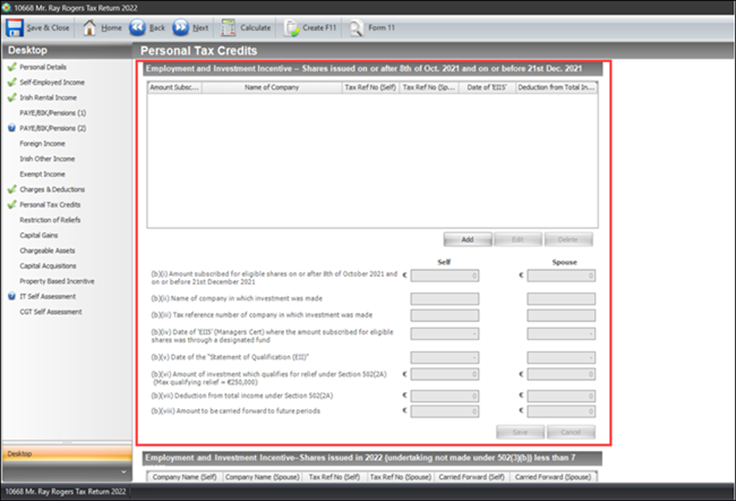

Personal Tax Credits

Employment and Investment Incentive

The Employment and Investment Incentive- Shares issued on or after the 8th of October 2021 and on or before the 21st of December section which is categorised below Personal Tax Credits have had a new section added. The placeholders and the grids introduced allows the user to add, edit and delete information on their investments. The major tax fields added are so that the user can declare the details for both Self and Spouse. The new additions are highlighted in Figure 7. The Tax Fields added are listed below:

- (b)(i) Amount subscribed for eligible shares on or after the 8th of October 2021 and on or before the 21st of December 2021 for both Self and Spouse

- (b)(ii) Name of company in which investment was made for both Self and Spouse

- (b)(iii) Tax reference number of company in which investment was made for both Self and Spouse

- (b)(iv) Date of 'EII5' (Managers Cert) where the amount subscribed for eligible shares was through a designated fund for both Self and Spouse

- (b)(v) Date of the '“Statement of Qualification (EII)' for both Self and Spouse

- (b)(vi) Amount of investment which qualifies for relief under Section 502(2A) for both Self and Spouse

- (b)(vii) Deduction from total income under Section 502(2A) for both Self and Spouse

- (b)(viii) Amount to be carried forward to future periods for both Self and Spouse

The new screen that is added, at the top, shows the added Amount Subscribed, Name of Company, Tax Ref No (Self), Tax Ref No (Spouse), Date of “EII5”, and Deduction from Total Income in a table format. The user can also edit the information saved and delete it as required.

Figure 7: New section under Personal Tax Credits

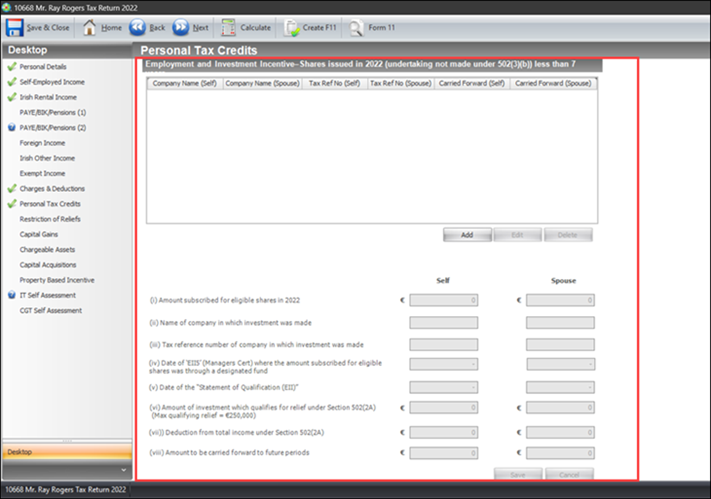

Start-Up Capital Incentive (SCI)

The Shares Issues in 2021 where an Undertaking is not made under 502(3B)- shares held for less than 7 years section which is categorised below Personal Tax Credits (Start-up Capital Incentive (SCI)) have had a new section added. The placeholders and the grids introduced allows the user to add, edit and delete information on shares that are held for less than 7 years. The major tax fields added are so that the user can declare the details for both Self and Spouse. The new additions are highlighted in Figure 8. The Tax Fields added are listed below:

- (i) Amount subscribed for eligible shares in 2022 for both Self and Spouse

- (ii) Name of company in which investment was made for both Self and Spouse

- (iii) Tax reference number of company in which investment was made for both Self and Spouse

- (iv) Date of the “State of Qualification (SCI)” for both Self and Spouse

- (v) Amount of investment which qualifies for relief under Section 502(2)(a) for both Self and Spouse

- (vi) Deduction from total income under Section 502(2)(a) for both Self and Spouse

- (vii) Amount to be carried forward to future periods for both Self and Spouse

The new screen that is added, at the top, shows the added Investment (Self), Investment (Spouse), Tax Ref No (Self), Tax Ref No (Spouse), Company Name (Self), and Company Name (Spouse) in a table format. The user can also edit the information saved and delete it as required.

Figure 8: New section under Personal Tax Credits

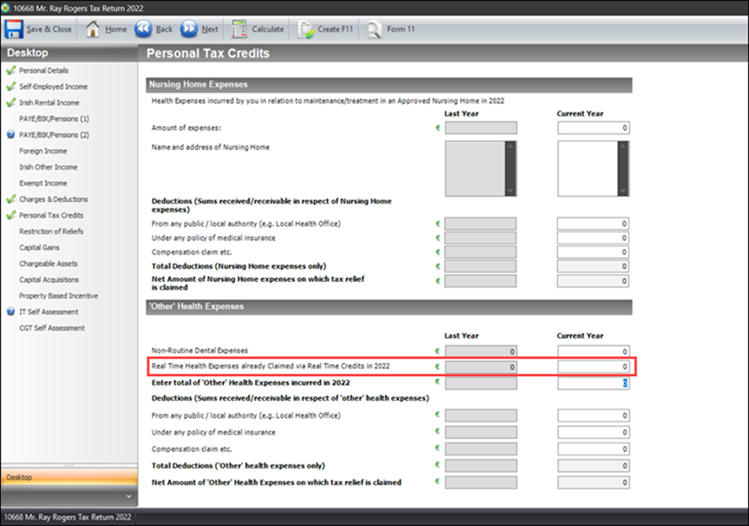

Other Health Expenses

The Personal Tax Credits section has a new placeholder added under Other Health Expenses. The tax field added allows the user to enter the Real-time health expense that have been claimed through Real Time credits in 2022 for the current year. The new additions are highlighted in Figure 9. The new field is listed below:

- Real-time Health Expenses already Claimed via Real Time Credits in 2022 for the Current Year

Figure 9: New section under Personal Tax Credits

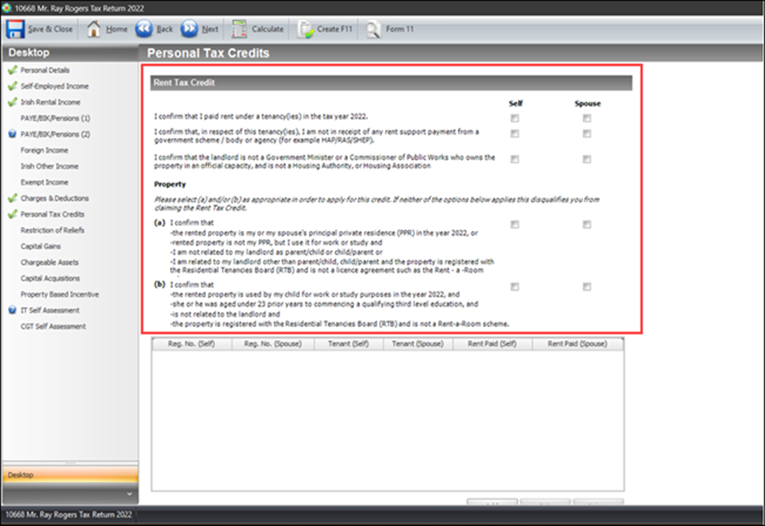

Rent Tax Credit

A new screen has been added for Rent Tax Credit under Personal Tax Credit. This page has been introduced for the user to put in all the required details for their rent, in order to claim the rent tax credit. It requires basic details on rent and property guidelines in the form of checkboxes. It allows the user to fill in the details for both Self and Spouse. The checkbox guidelines introduced can be highlighted in Figure 10. The new fields are listed below:

- I confirm that I paid rent under a tenancy(ies) in the tax year 2022 for both Self and Spouse

- I confirm that, in respect of this tenancy(ies), I am not in receipt of any rent support payment from a government scheme/body or agency (for example, HAP/RAS/SHEP) for both Self and Spouse

- I confirm that the landlord is not a Government Minister or a Commissioner of Public Works who owns the property in an official capacity, and is not a Housing Authority, or Housing Association for both Self and Spouse

Under Property: It is stated that the user should select (a) and/or (b) as appropriate in order to apply for this credit. If neither of the options below applies, then it disqualifies the user from claiming the Rent Tax Credit:

- (a) I confirm that:

- The rented property is my or my spouse’s principal private residence (PPR) in the year 2022, or

- Rented property is not my PPR, but I use it for work or study, and

- I am not related to my landlord as parent/child, child/parent, or

- I am related to my landlord other than parent/child, child/parent,

and the property is registered with the Residential Tenancies Board (RTB) and is not a license agreement such as the Rent-a-Room - (b) I confirm that:

- The rented property is used by my child for work or study purposes in the year 2022, and

- She or he was aged under 23 prior years to commencing a qualifying third-level education, and

- Is not related to the landlord, and

- The property is registered with the Residential Tenancies Board (RTB) and is not a Rent-a-Room scheme

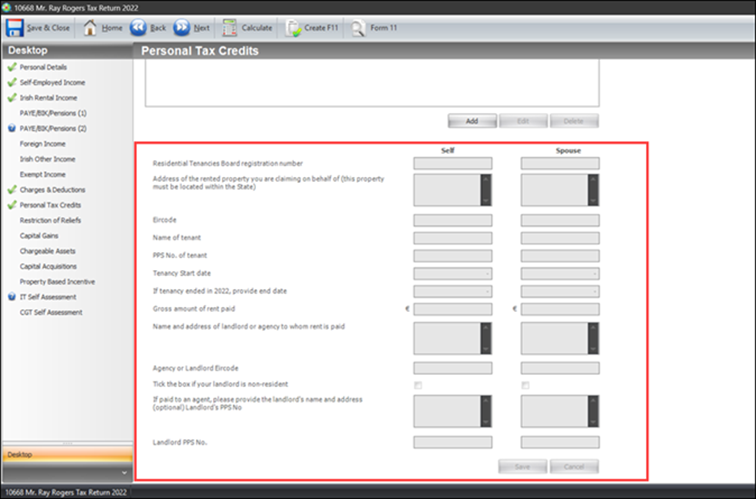

The Rent Tax Credit section which is categorised below Personal Tax Credits has also a new section added. The placeholders and the grids introduced allows the user to add, edit and delete information on shares to claim Rent Tax Credit. The major tax fields added are so that the user can declare the details for both Self and Spouse. The new additions are highlighted in Figure 11. The Tax Fields added are listed below:

- Residential Tenancies Board registration number for both Self and Spouse

- Address of the rented property you are claiming on behalf of (this property must be located within the State) for both Self and Spouse

- Eircode for both Self and Spouse

- Name of Tenant for both Self and Spouse

- PPS No. of Tenant for both Self and Spouse

- Tenancy Start date for both Self and Spouse

- If tenancy ended in 2022, provide the end date for both Self and Spouse

- Gross amount of rent paid for both Self and Spouse

- Name and address of landlord or agency to whom rent is paid for both Self and Spouse

- Agency or Landlord Eircode for both Self and Spouse

- Tick the box if your landlord is non-resident for both Self and Spouse

- If paid to an agent, please provide the landlord’s name and address (optional) Landlord PPS No for both Self and Spouse

- Landlord PPS No for both Self and Spouse

The new screen that is added, at the top, shows the added Reg. No (Self), Reg. No (Spouse), Tenant (Self), Tenant (Spouse), Rent Paid (Self), Rent Paid (Spouse) in a table format. The user can also edit the information saved and delete it as required.

Figure 10: New section under Personal Tax Credits

Figure 11: New section under Personal Tax Credits

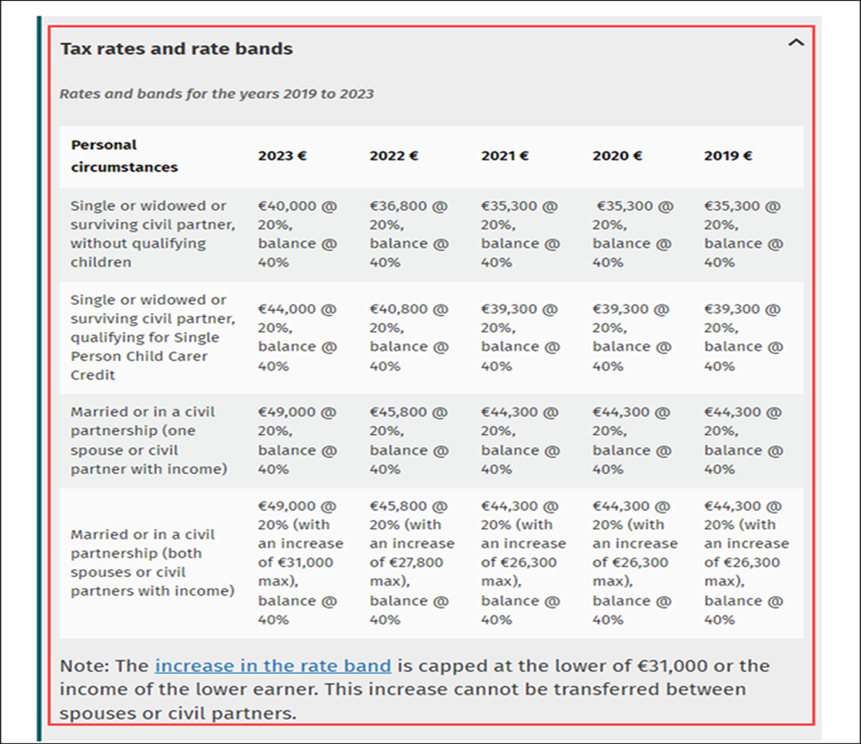

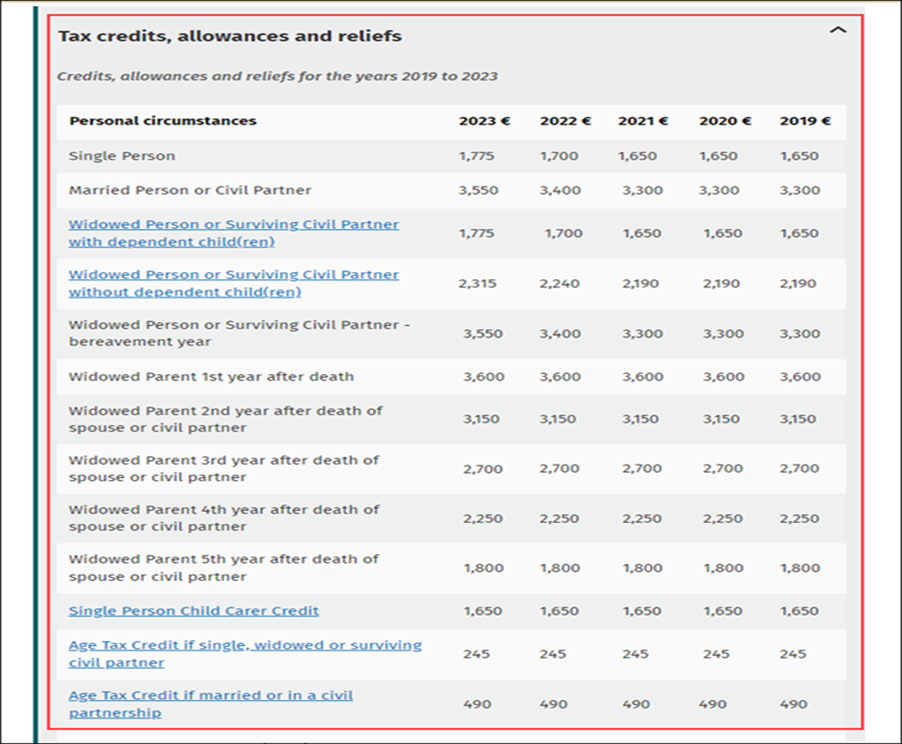

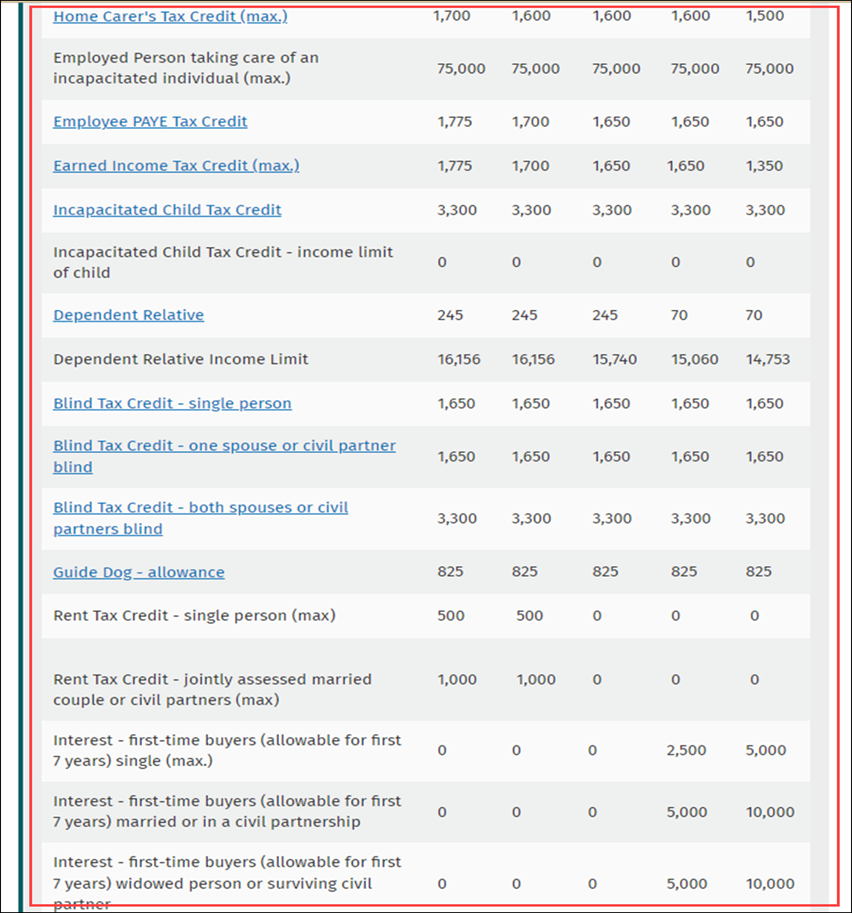

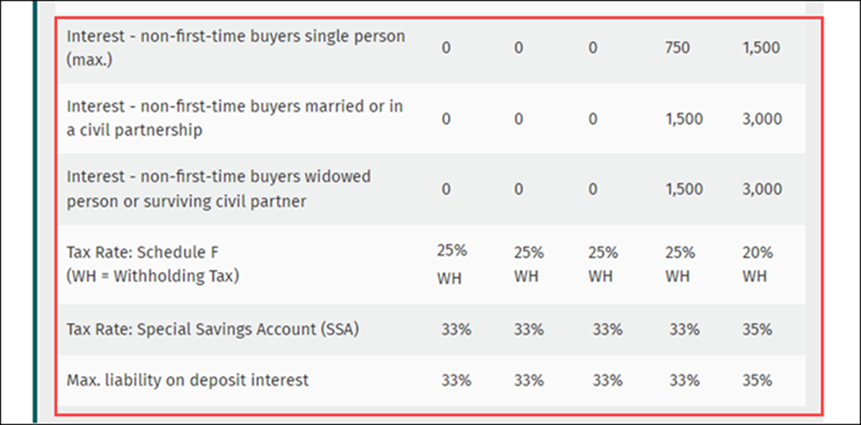

Tax Rate and Tax Bands

As per Revenue guidelines and due to the implementation of the Finance Act 2022 and amendment in the taxonomy, there has been changes in the Tax rate and Tax bands and also Tax credits, allowances and reliefs. The tax rates and tax bands for the years 2019 to 2023 can be seen in Figure 11. The credits, allowances, and reliefs for the year 2019 to 2023 can be seen in Figure 12, Figure 13, Figure 14 and Figure 15.

Link for Tax Rate and Tax Bands: Tax Rates, Bands and Relief

Link for Tax Credits, Allowances and Reliefs: Tax Credits, Allowances and Reliefs

Figure 12: New Tax rate and Tax Bands

Figure 13: New Tax credits, allowances, and relief

Figure 14: New Tax credits, allowances, and relief

Figure 15: New Tax credits, allowances, and relief