Corporate and Non-resident Partners in a Partnership

Mixed partnerships

Personal Tax has been enhanced to allow the preparation of tax returns for mixed partnerships from April 2012.

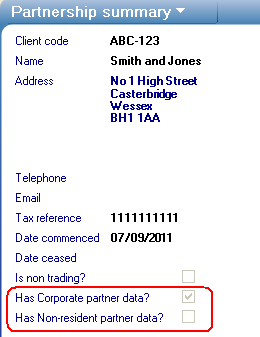

All partner types are supported: Individual, Corporate and Non-resident partners. While HMRC currently restrict the type of partnerships which may be filed online, paper returns can be prepared in all scenarios. The Partnership summary has been updated to display if Corporate or Non-resident partner data is present in the current year’s Return.

These flags will be updated automatically when a trading partnership has a Corporate or Nonresident accounting period in the year, or a when non-trading partnership has selected that any member is a company or a partner is not resident in the UK in the Tax Return Other Information data screen.

Business Tax

Accounts for Corporate and Non-resident partners may be prepared on a different basis; to support this, separate accounts covering the same accounting period can be entered in Business Tax for each partner type.

Accounting periods

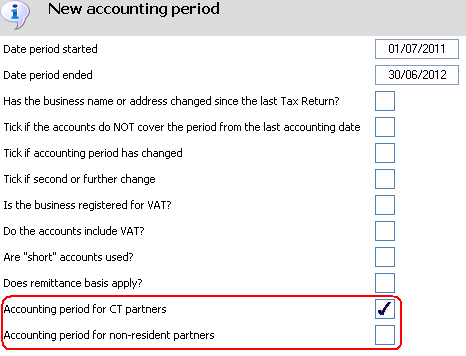

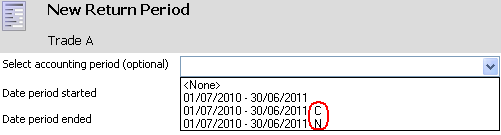

Accounting periods for Corporate and Non-resident partners are created following the existing process for Individual partners, using the Click here to create a new accounting period hyperlink to open the New accounting period screen.

From 2012 onwards this screen has two additional options to indicate if the new accounting period relates to Corporate or Non-resident partners.

So for example to create accounting periods for a Partnership which has Individual, Corporate and Non-resident partners:

- Select the create new accounting period hyperlink, then enter the period start and end dates for the Individual partners.

- Then select the create new accounting period hyperlink a second time, entering the period start and end dates for the Corporate partners and tick the Accounting period for CT partners box.

- Finally select the create new accounting period hyperlink a third time to enter the period start and end dates for the Non-resident partners and tick the Accounting period for non-resident partners box.

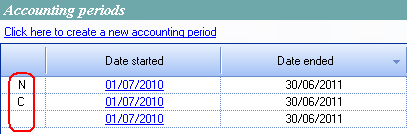

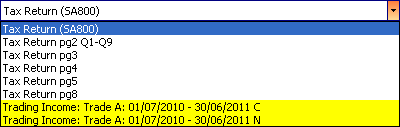

A column has been added to the Accounting periods table indicating the type of accounting period:

- C = Corporate accounting period

- N = Non-resident accounting period

- No details are displayed for Individual partners

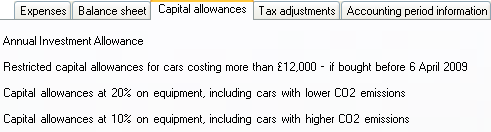

Data entry in detail level screens

At present only direct data entry is available for both Corporate and Non-resident accounting periods. Detailed entry for areas such as Capital allowances will not be available until a later release. Hyperlinks to detailed level screens have been removed from all accounting period tabs for these two partner types, but all calculations and validations have been retained.

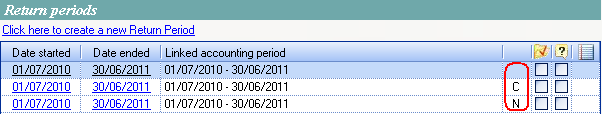

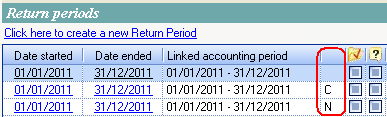

Return periods

When Corporate or Non-resident accounting periods exist, Return Periods should be created and linked to these accounting periods, so that details for those periods are displayed in the Partnership statement and also to enable data entry in certain investment income screens.

Creating the Return Periods follows the existing process for Individual Partners, but when selecting Corporate or Non-Resident accounting periods, these are signified respectively with a C or N suffix.

A column has been added to the Return periods table indicating the type of return period:

- C = Corporate return period

- N = Non-resident return period

- No details are displayed for Individual partners

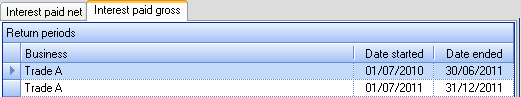

Investment income

When investment income is entered on a return period basis, with the exception of Land and Property, all data entry screens display the return period Date started and Date ended e.g. Interest from UK Banks etc

To minimise the amount of data entry required in these screens, only one return period will be displayed for Individual, Corporate and Non-resident return periods, if the return period is the same for each partner type.

For example if the following return periods exist:

- Corporate return period 01/07/2010 to 30/06/2011

- Non-resident return period 01/07/2010 to 30/06/2011

- Individual return period 01/07/2010 to 30/06/2011

The data screens will only display the period 01/07/2010 to 30/06/2011 once. The Partnership Statement will automatically display the details entered against each Return period.

Note: all details entered in any Foreign data entry screen are excluded from Nonresident partnership statements. Please also note that if only non-resident return period(s) exist, then no data entry is possible in any foreign data entry screen.

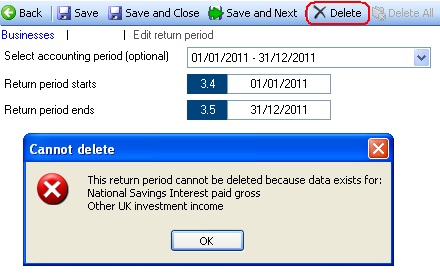

Deleting Return periods

A warning message is normally given when attempting to delete a Return period, if other data exists for that period.

However, if there are several return periods with the same start and end date for a combination of standard, corporate and non-resident partner types, then this message will only be given when the final period is deleted.

The only exception to this is when deleting a Corporate return period, if ‘Foreign: Land and Property (corporate partners)’ or ‘Land and Property (corporate partners)’ is present then the waning message will be given, even if the same return period exists for other partner types.

Note: this validation is only completed against the most recently saved Return periods, it may therefore be necessary to save the Business Tax screen before attempting to delete any Return period.

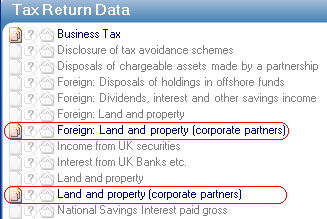

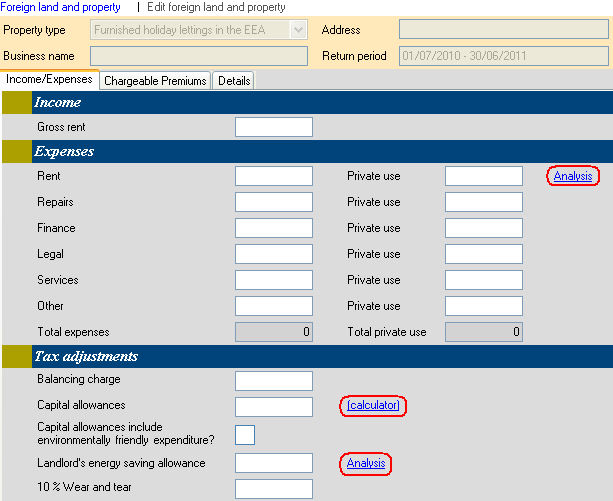

Land and Property

As with Business Tax, the calculation of Land and Property profits may differ between Individual, Corporate and Non-resident partners. When a Corporate return period exists, two new data screens are available to enter Corporate partners’ Land and Property income details.

Both Corporate Land and property data screens provide the same functionality as the original Land and property screens, with the exception that that Capital allowances and Expenses Analysis detail levels are not available.

Note: unlike investment income data screens, each property will need to be reentered in the Corporate Land and property screens.

Return periods

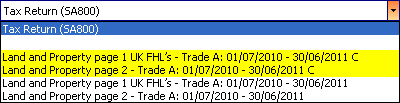

As with investment income, the Land and Property data screens will display only one period for Individual, Corporate and Non-resident return periods, if the return period is the same for each partner type as follows:

- Foreign: Land & Property - Only Individual return periods are displayed

- Foreign: Land & Property (corporate partners) - Only Corporate return periods are displayed

- Land & Property - Individual and Non-resident return periods are displayed

- Land & Property (corporate partners) - Only Corporate return periods are displayed

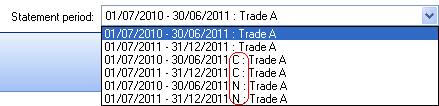

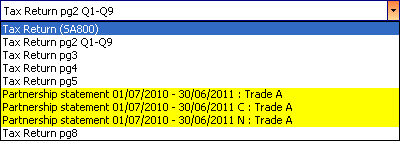

Partnership Statement

Corporate and Non-resident Return periods are displayed separately in the Partnership statement. When selecting the statement period they are signified respectively with a C or N next to the period end.

Corporate and Non-resident return periods display details for the following fields from the linked accounting periods:

- Profit from a trade or profession

- Adjustment on change of basis

- Loss from a trade or profession

- CIS25 deductions made by contractors on account of tax

- Other tax taken off trading income

- Partnership trade charges

- Annuities paid to former partners

Corporate return periods only display Land and property (corporate partners) details for the following fields:

- Profit (or loss) on land and property in the UK

- Profit on UK and/or EEA furnished holiday lettings

- Loss on foreign let property

Non-resident return periods do not display any foreign details in the following fields:

- Income from untaxed foreign savings

- Foreign dividends

- Other untaxed foreign income

- Income from offshore funds

- Loss on foreign let property

- UK notional income tax

- Foreign tax paid or treated as paid

Tax Return pages

Main Partnership return – SA800

For mixed Partnerships, if Individual accounting periods are present, these are always displayed on the SA800.

If Individual accounting periods are not present, then the Corporate or Non-resident period is displayed on the SA800.

Partnership Statement (Short) and Full - SA800(PS)

For mixed Partnerships, separate Individual, Corporate and Non-resident partnership statements are displayed, with Corporate and Non-resident periods signified respectively with a C or N next to the period.

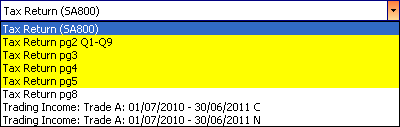

Trading and Professional Income – SA800(TP)

For mixed Partnerships, if Individual accounting periods are present, details of the Corporate and Non-resident periods are displayed on separate SA800(TP) pages.

Corporate and Non-resident periods are signified respectively with a C or N next to the period.

UK Property – SA801

When Land and property (corporate partners) data exists, a separate set of Land and Property pages are produced, with the Corporate period(s) signified with a C next to the period.

Foreign – SA802

If data is present in both the Foreign: Land and property and also the Foreign: Land and property (corporate partners) data screens, then an additional set of SA802 pages will be produced.

The first set of pages will display all foreign details, including the Foreign: Land and property

The second set of pages will also display all foreign details, including the Foreign: Land and property (corporate partners)

Tax Return Other Information

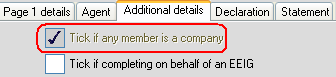

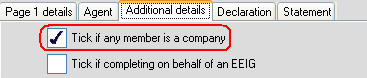

Corporate return periods

If a Corporate accounting period has been created in Business Tax, then the Tick if any member is a company box is ticked automatically and made read only.

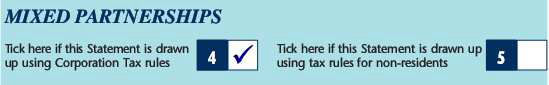

Note: When ticked, this box updates the corporate partner’s Partnership statement (short) and (full) Box 4

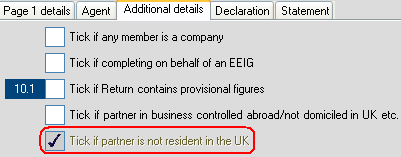

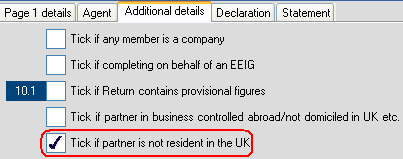

Non-resident return periods

If a Non-resident accounting period has been created in Business Tax, then Tick if partner is not resident in the UK box is ticked automatically and made read only.

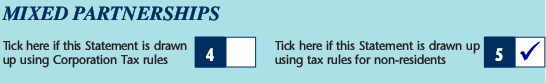

Note: When ticked, this box updates the non-resident partner’s Partnership statement (short) and (full) Box 5

Non-trading partnerships

Corporate partners

If a non-trading partnership has corporate partners, then the Tick if any member is a company box should be ticked.

Ticking this box enables the two new corporate partner Land and property data screens. A Partnership statement will also be created for the Corporate tax year return period where appropriate.

Note: If this box is subsequently un-ticked, then any data entered in the corporate partners’ Land and property screens will be deleted and the Partnership statement will need to be refreshed.

Non-resident partners

If a non-trading partnership has non-resident partners, then the Tick if partner is not resident in the UK box should be ticked.

Ticking this box creates a Partnership statement for the non-resident tax year return period.

Online filing

Please note that HMRC do not currently accept Returns filed online in the following scenarios:

- Exclusion ID 3 Non-trading partnership with non-resident partners

- Exclusion ID 5 Mixed partnerships

- We have also found that ‘CT Partnerships’ with turnover between £73,000 and £15m will receive a validation error code 8200 if the Partnership return is completed according to the SA850 notes “…as for a partnership whose annual turnover exceeds £15m…” A workaround for this is to un-tick the ‘Tick if this is a CT partnership’ box in the Tax Return Other information data screen.

Useful Information! CCH iXBRL Review & Tag Known Issue