Setting up the link between CCH Trust Accounts and CCH Personal Tax at client level

Linking the Trust Accounts Database to CCH Personal Tax at a client level is required to enable the ability to transfer capital transactions, income transactions, or both, from CCH Trust Accounts to CCH Personal Tax.

Link set-up

To do this:

- Select the Client in CCH Central.

- Select the Tax Links tab.

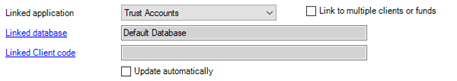

- Select Linked application:

- Choose Trust Accounts from the dropdown list.

- Then click on Linked database, if there is only one CCH Trust Accounts database then Default database will be automatically entered, otherwise choose the appropriate database from the list.

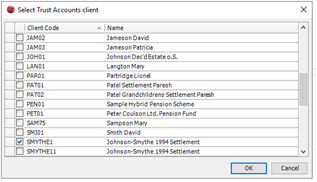

- Then click on Linked Client code to select the Linked client from the list.

Click OK when the correct CCH Trust Accounts client is ticked.

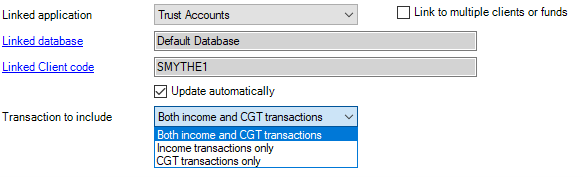

- Tick the Update automatically box for the data to be imported automatically.

- However if the box is left un-ticked a pink ribbon will appear on the Tax Return data entry screen to prompt you to update. Click on the ribbon to import the data.

- Nominal balances and Foreign income can be included or excluded as appropriate. See later for how to set up the nominal balances option in CCH Trust Accounts.

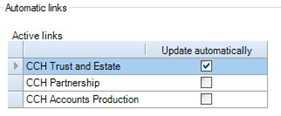

Active Links

- If the Update automatically option is selected all data is automatically updated, otherwise a message is displayed advising the data is not up to date. Selecting this message updates the CCH Personal Tax data.

Enabled links

- The link between CCH Personal Tax and other CCH Central suite products is enabled automatically upon creation of the return. It may be disabled separately for each tax year if required.

- When the link is removed, no messages are displayed or data updated on opening that year’s Tax return, regardless of the Update automatically setting.

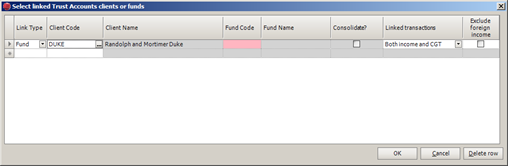

Link to Multiple clients or funds

Sometimes it is necessary to produce more than one set of accounts for a trust. For instance, after an accumulation and maintenance trust has vested the income (but not the capital) on a beneficiary it is usual to produce a separate set of accounts for the beneficiary. This involves creating a separate CCH Trust Accounts client for the beneficiary. However although some of the investments are transferred out of the main trust client into the beneficiary client, the disposals for both clients must be combined on to a single trust tax return.

- Select the appropriate client and fund. Select what type of transaction you want to link.

- If required the clients/funds can be consolidated into the first fund.