Movement codes

Movement Codes

Every investment ledger entry bears a Movement Code, which describes the type of the entry, for example, BNI for Bonus Issue, DIV for Dividend, ACQ or PUR for Purchase etc. These Movement Codes also determine the CGT and Accounting Treatment of the entries using a CGT Rule Code and an Accounting Rule.

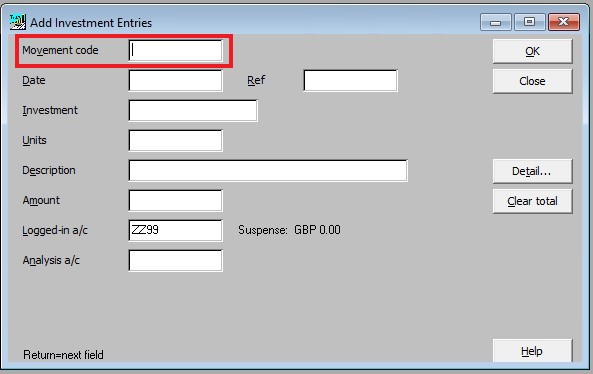

When entering an investment ledger entry the first field to be completed is the Movement Code.

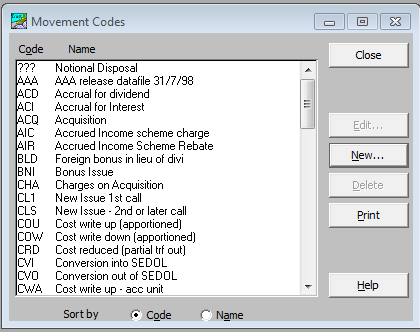

Clicking F2 in this field will open the Movement Codes screen:

Highlight an existing code and click Edit. The following window appears - eg DIG - Dividends paid Gross.

CGT Rules

In general, the rule codes starting with A are for acquisitions; the D rule codes are for disposals and the V movement codes are for income. However, cost write-downs often use a negative A rule code. For example, cash received as part of a sale of rights, which is to be treated as a cost write-down is handled using a negative A4 entry.

Further details about the individual CGT rules can be found here.

Accounting Rules

In many cases, the Accounting Treatment follows the CGT treatment. However, there are exceptions. For this reason, the accounting rule can be specified separately on a movement code from the CGT rule.

Further details about the individual accounting rules can be found here.

Attributes

Movement codes can have certain flags or ‘attributes’ set on them:

Nil Quantity

This attribute allows, but does not require, an entry to have a zero quantity. The quantity, if present, updates the holding for all A and D rule codes apart from A4 and D3.

Negative Addition

This is used on A rule codes, where the purpose of the rule code is to reduce the cost, for example on an A4 rule, which is being used as a cost write-down. It allows a positive amount to be entered, which is treated as a negative cost movement. Currently, it only has effect on a client with a nominal ledger.

Heldover Gain

This attribute enables a Heldover or Deferred Gain to be recorded on an entry. Heldover gains relate to additions of shares and unit trust units. Deferred gains relate to additions of fixed interest securities.

Heldover Gains:

Heldover gains can arise when an asset is transferred. Instead of the transferor paying CGT, the gain is calculated and heldover so that it becomes payable when the transferee sells the asset. When this final disposal occurs, the heldover gain is subtracted from the cost before the chargeable gain is calculated. So, the heldover gain cannot exceed the cost of the asset being sold.

Deferred Gains:

Deferred gains arise when a complex capital event gives rise to a qualifying corporate bond (QCB). The QCB itself is exempt from CGT. The gain on the parent security to date is calculated. A proportion of this gain is transferred to the QCB. However, the CGT on the gain that is transferred is deferred until the QCB is sold.

Although a deferred gain can be entered manually on an addition of a fixed interest security, in practice they are usually entered automatically by running the CCT Wizard.

The deferred gain is the untapered gain. The taper relief available depends on the time the parent security was held, not on the time the QCB was held. So, in addition to recording the deferred gain the application also requests the ‘Taper Percentage’. This is the percentage of the gain that is chargeable to CGT when the QCB is sold.

The parent security could be a normal asset, a business asset or an asset of mixed use. The deferred gain and taper percentage are therefore recorded for both personal and business use.

CGT Override

This is used on A rule codes to allow a CGT Override Date and a CGT Override Value to be entered on an entry. This is of use when the date and amount for CGT purposes differ from the date and amount for accounting purposes. This happens most often for a transfer between spouses, which can be entered as follows:

|

Transaction value: |

Market value at the time of the transfer. |

|

Transaction date: |

The date of the transfer. |

|

CGT override value: |

Original acquisition cost. |

|

CGT override date: |

Original acquisition date. |

Connected Person

When:

- there is a transfer between connected persons (typically spouses)

- who both have holdings in the same security, and

- this transfer includes bonus or rights issues

then a special movement code must be used with the Connected Person attribute set to ensure that the bonus continues to be attached to the same original acquisition.