Setting up a Tax Rate

Set up a Tax Rate

-

Select File > Maintenance > Client/Supplier > Tax Rates.

-

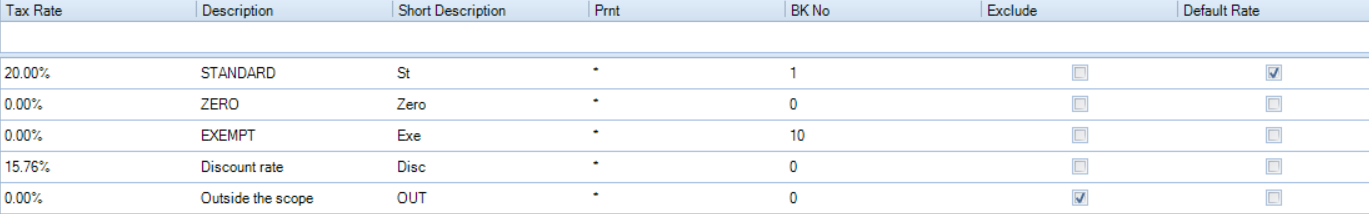

In the Tax Rates window, in the blank row at the top, enter the tax rate as a percentage.

-

Enter a Description of the tax rate you are setting up.

-

Enter a Short Description of the tax rate you are setting up.

-

In the Prnt cell, enter a description of the tax rate that will appear on the bill when it is printed.

-

In the BK No. cell, enter edit the Bookkeeping tax reference for the tax rate.

The ID No. is generated by the system. -

Select the Exclude check box to exclude this tax rate from the Exceptions report that is generated when an accounting period is closed.

The ID No. is generated by the system. -

If required, enter another tax rate by following steps 2 to 7.

-

To edit any of the above fields, modify the text directly.

-

When you have finished, click OK to save the changes and close the Tax Rates window.