1. Creating a Fixed Asset Register

The Fixed Asset Register is generated from within CCH Accounts Production. Open an Accounting Period in CCH Accounts Production. This is usually the first period for which you wish to record assets, although the Fixed Asset Register does permit prior period entries in some cases.

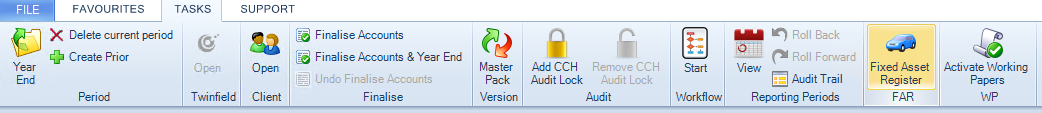

Accessing the Fixed Asset Register

From the Accounts Production Home screen, click the Fixed Asset Register FAR icon on the Ribbon.

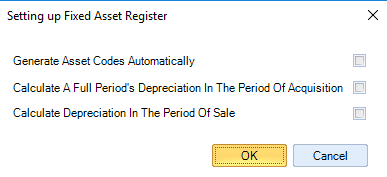

Select if you require the following;

- Generate Asset Codes Automatically?

- Calculate a Full Period's Depreciation in the Period of Acquisition?

- Calculate Depreciation in the Period of Sale

These defaults can be changed later on the Periods screen and are described in more detail here.

Click OK

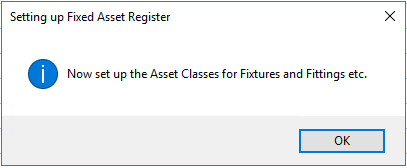

Click OK and you are taken to the Set Up screen where Asset Classes can be set up for each type of asset that is required on the client, e.g. for Fixtures and Fittings etc. The Asset Classes hold:

- The nominal accounts that act as control accounts for the Fixed Asset Register. When postings are made to these accounts in CCH Accounts Production, a Analyse in Fixed Asset Register? message appears so that the posting can be broken down into its effects on individual assets.

- The nominal accounts that are used for depreciation postings.

- Defaults that are used when a new asset is set up, e.g. the Depreciation Method.

The Asset Classes can be quickly set up using defaults from the Master Asset Classes.