Pre validating the submission

Pre validation messages

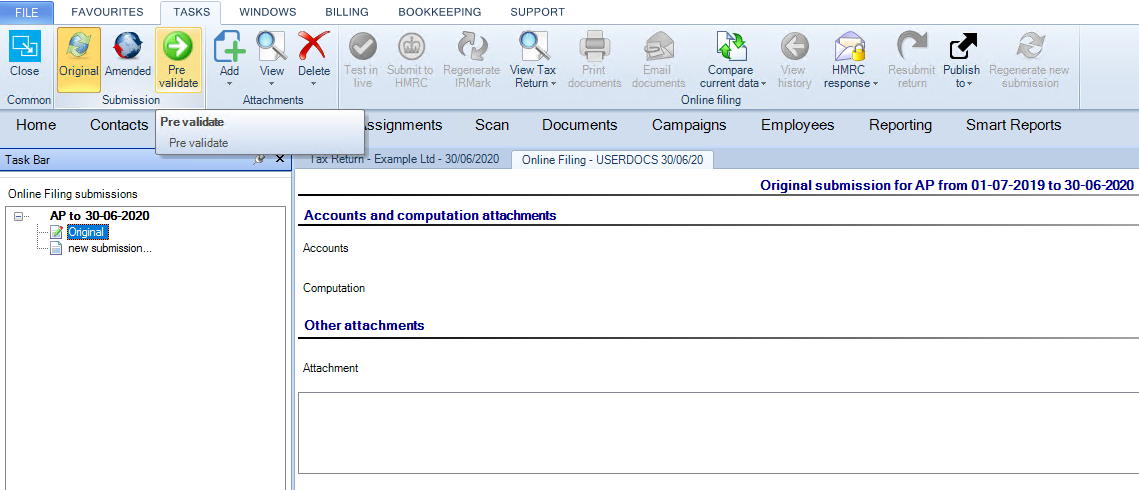

Once the relevant documents have been selected and attached to the submission the submission needs to be pre validated.

Click on Pre-validate.

Any errors encountered will be displayed in the panel.

Once the errors are resolved in the Corporation Tax period, Go back into Online filing and click on the Pre-validate the CT600 hyperlink again.

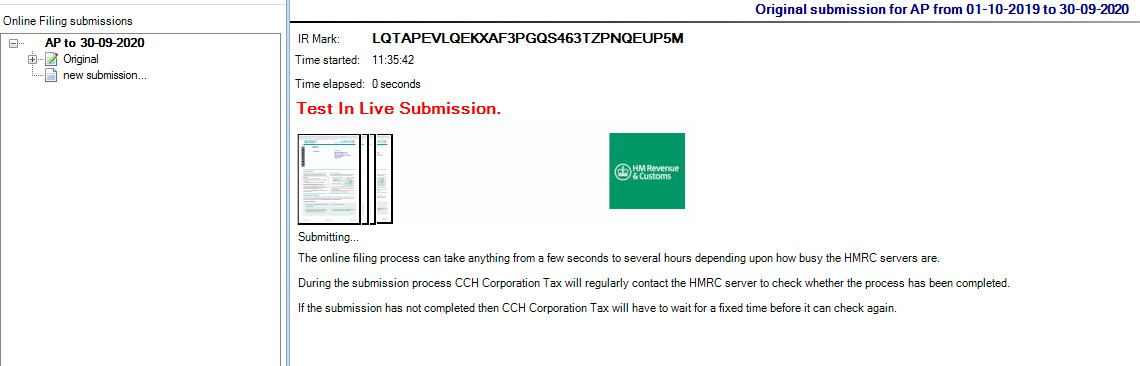

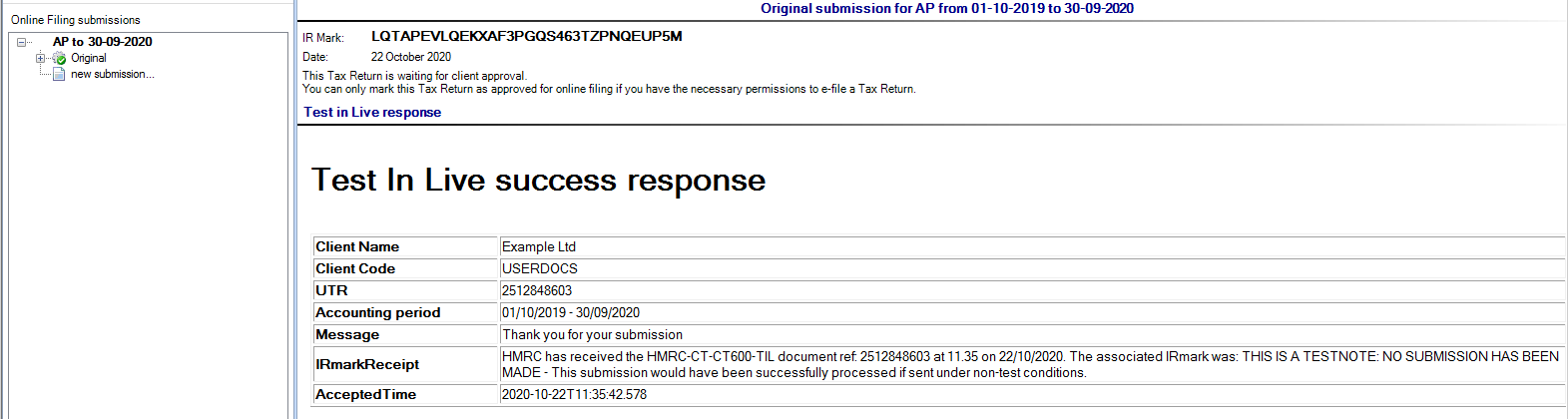

A Test in live submission will be carried out automatically if no pre validation failures are encountered. A Test-in-Live submission submits a test submission to HMRC which is not actually recorded as being received by HMRC.

A successful validation is indicated by the creation of an IRMark and a success response will be seen in the panel at the foot of this window.

If the Test-in-Live submission encountered errors you will need to resolve the failures before being able to submit a live submission to HMRC.

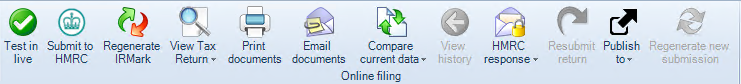

The top Ribbon contains icons which perform different functions.

Test-In-Live submission will perform a test submission to HMRC.

Submit to HMRC will perform live submission to HMRC.

Regenerate IR Mark will enable the Prevalidate icon.

View Tax Return will display the Tax Return in PDF or XML format.

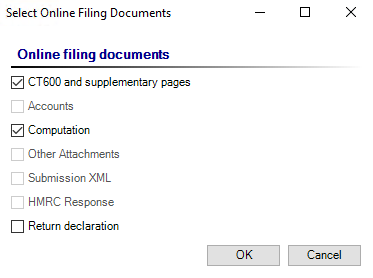

Print documents will allow print selection of

- CT600 and supplementary pages

- Accounts

- Computation

- Other Attachments

- Submission XML

- HMRC Response

- Return Declaration

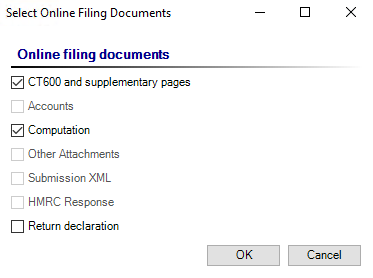

Email documents will allow selection of documents to be attached to an email.

- CT600 and supplementary pages

- Accounts

- Computation

- Other Attachments

- Submission XML

- HMRC Response

- Return Declaration

The documents will be bundled together into a zip file and attached to a draft email.

The email To field will show the email address currently held on file where applicable.

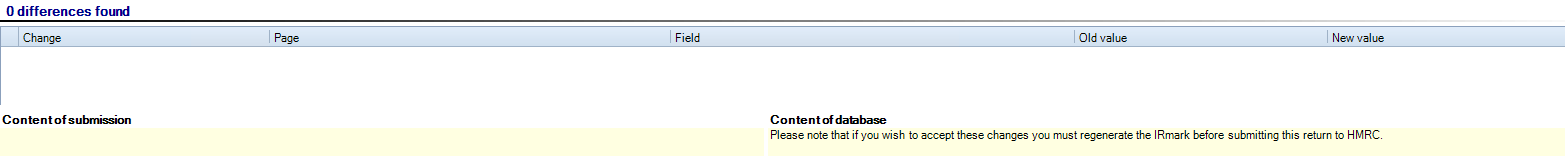

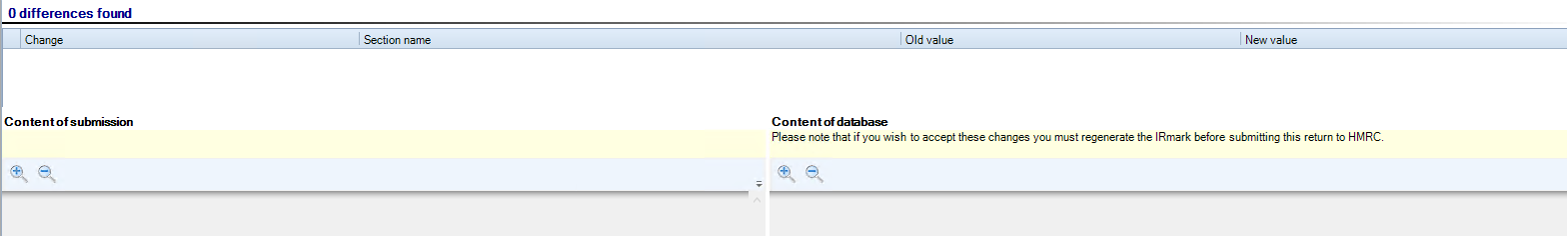

Compare current data will show any changes made since the last submission in the Tax Return and Computation.

Tax Return Differences shows the Change, Page, Field, Old Value and New Value.

Computation Differences shows the Change, Section Name, Old Value and New Value.

View History shows the history of any submissions for this period.

HMRC response allows the Print or Save of HMRC responses.

Resubmit Return will allow resubmission.

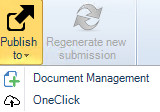

Publish to will publish the documents to CCH Document Management or OneClick.

Regenerate New Submission will allow the submission to be regenerated.

Following a successful Test-in-live submission you can proceed to submitting the live submission to HMRC.

Data has changed during creation

A message Data has changed may appear when accessing the online filing area for a given accounting period. This can occur when a Test-in-Live submission has been made and before the final submission of the Return is made information within the original submission has changed.

The changes are highlighted and can be easily reviewed before deciding to ignore the changes or restart the submission creation. Please see Data has changed - Review Changes