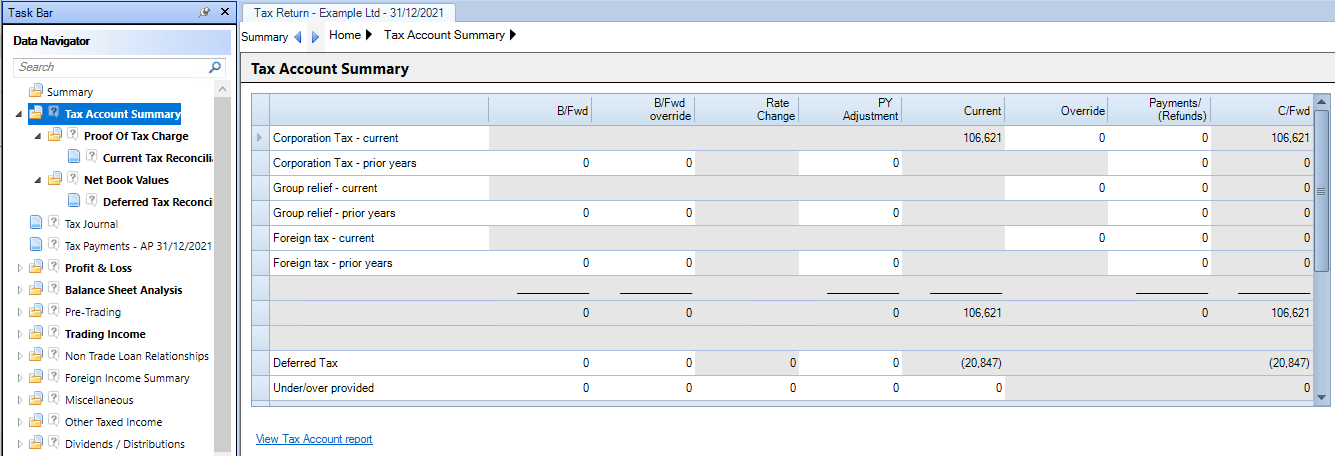

Tax Account Summary

The Tax Account Summary represents the Tax Account as shown in the company's financial statements. It shows the overall tax position for the company, including the current and prior corporation tax liabilities and the deferred tax arising on timing differences.

Tax Account Summary

Grey fields are automatically calculated and white fields are data entry.

The Current Corporation Tax charge is automatically calculated for the period based upon the information held within CCH Corporation Tax .

Enter a value in the Override box if an alternative amount should be used in calculating the tax account charge.

The Deferred Tax is calculated from inputs within the computation and underlying tax account input screens and there is a Under/over provided input cell for any deferred tax under or over provision.

Tax Account Report

The deferred tax report does not form part of the corporation tax computation report and can be viewed and printed by the View Tax Account Report link at the bottom of the screen.