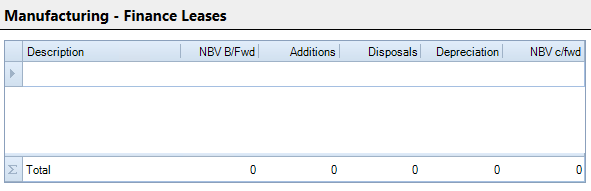

Finance Leases

This is for payments made for assets under Finance Lease where tax relief is granted for the entries shown in the accounts and not as a Capital Allowance.

This is located at Trading Income, Trade Name, Finance Leases

The data entry is made on a Period of Account basis and is as follows:-

- Description Enter a unique description for each asset

- NBV B/fwd This is the Net Book Value of the Asset at the start of the Period of Account. This is automatically populated with the NBV C/fwd value from the previous Period Of Account. This can be overwritten if appropriate.

- Additions This is for the cost of any assets acquired under Finance Lease during the Period of Account

- Disposals This is for the disposal proceeds received on the Finance Lease on its disposal

- Depreciation This is for the depreciation charge as shown in the accounts. This should also incorporate any amount shown as either a profit or loss on disposal of the Finance Lease Asset.

- NBV C/fwd This is the Net Book Value of the Asset at the end of the Period of Account. This is automatically calculated based on the previous data entries made.