Leased Cars

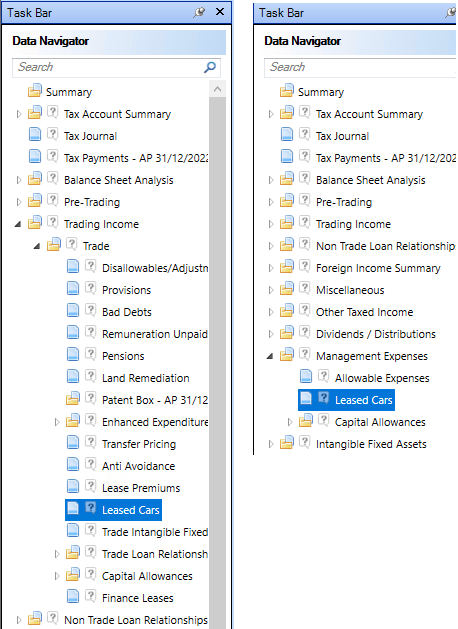

The Leased Cars inputs are found within the trade under Trading Income or the Management Expenses section of the Data Navigator.

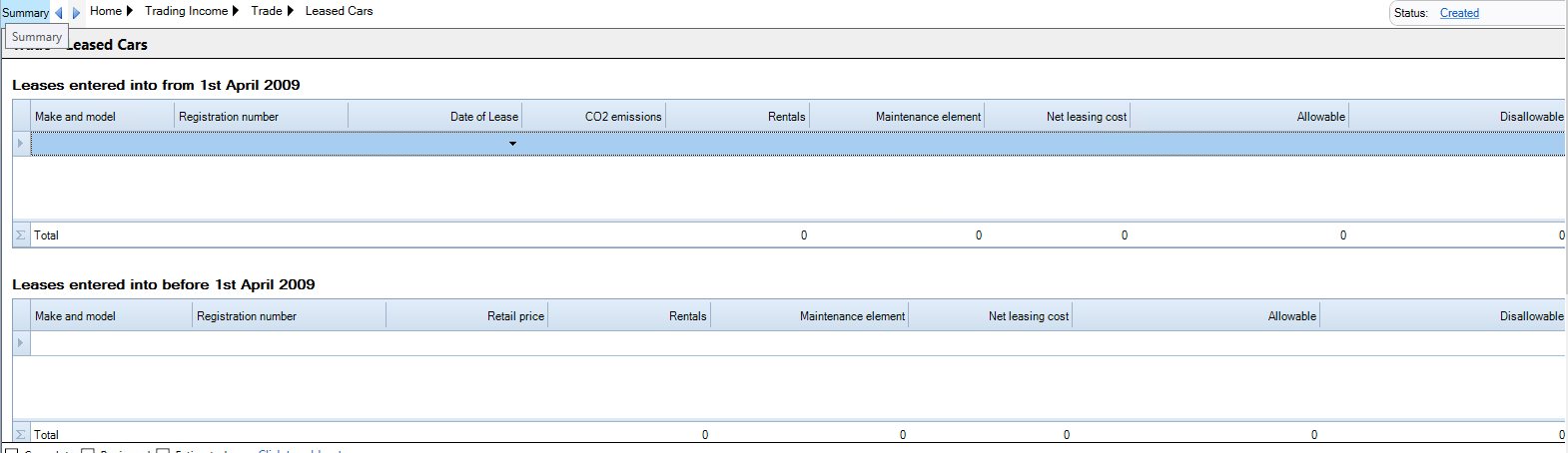

For Leases entered into from 1st April 2009, enter the Make and model and Registration Number.

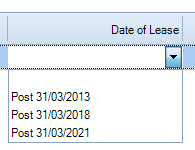

Select whether the lease was Post 31/03/2013, Post 31/03/2018 or Post 31/03/21 from Date of Lease drop down menu.

Enter the CO2 emissions, Rentals and Maintenance element and the Net Leasing cost, Allowable and Disallowable amounts will be calculated.

For Leases entered into from 1st April 2009, enter the Make and model and Registration Number.

Enter the Retail Price, Rentals and Maintenance element and the Net Leasing cost, Allowable and Disallowable amounts will be calculated.

If the trade is not the primary trade and there is some investment business present, a manual allocation of the disallowable rental adjustment will be needed between the trade and any non-trading activity.

In a period of account comprising multiple accounting periods, the software will automatically time apportion the disallowable adjustment between the accounting periods with additional fields to override.