Creative Industry Relief

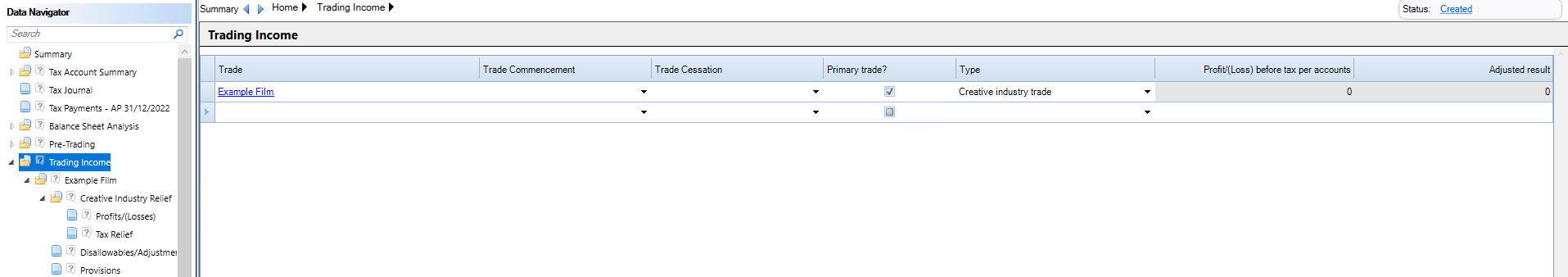

A trade should be created for each trade and film in the Trading Income section of the Data Navigator and Films and any qualifying activity under the Creative Industry Scheme should be selected as Creative Industry Trades from the Type dropdown.

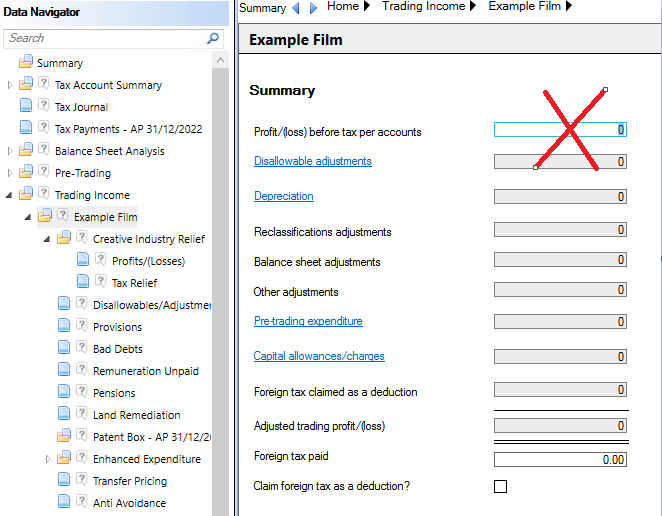

Do not enter the Profit/(loss) before tax per accounts for the film in the Film Summary statement

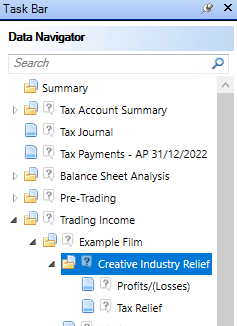

Instead open the creative industry trade within the Data Navigator and select Creative Industry Relief and complete the Profits/(Losses) and Tax Relief input screens.

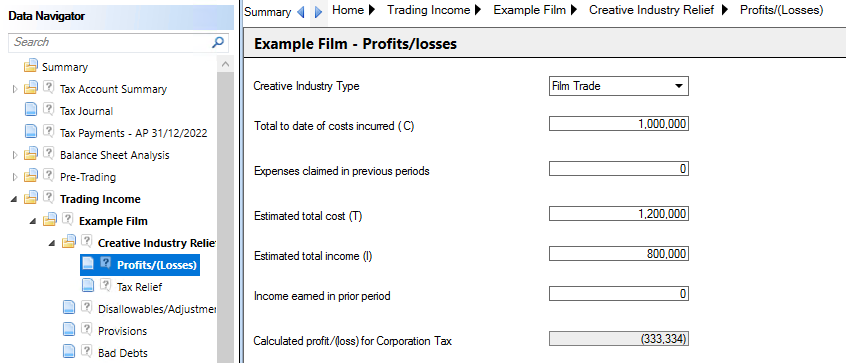

Profits/(Losses)

Select the Creative Industry Type from the drop down menu.

The options available are;

· Film Trade

· Video Gaming

· Television

· Theatre Touring

· Theatre Non Touring

· Orchestra

· Museums and Galleries

Complete the Profits/losses statement by entering;

- Total to Date of costs incurred (C)

- Expenses claimed in previous

- Estimated total cost (T)

- Estimated total income (I)

- Income earned in prior Period

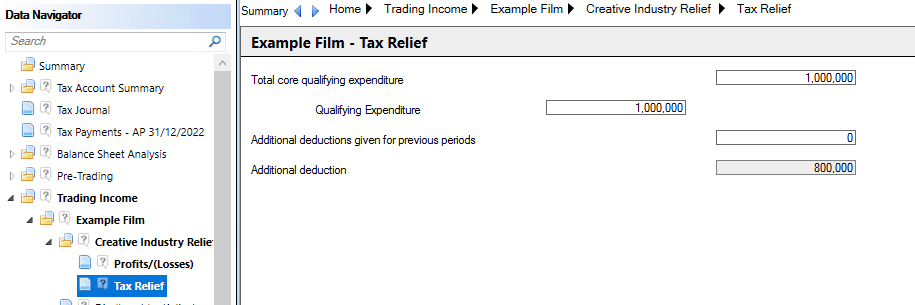

Tax Relief

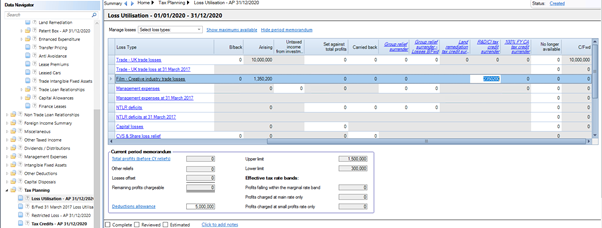

Creative Industry losses can be utilised in the Loss Utilisation input screen.

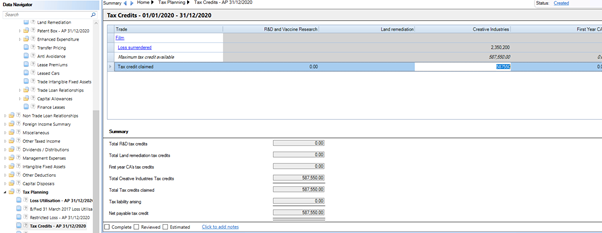

And any credits can be claimed in the Tax Credits input screen where the Tax Credit input is available (dependent on tax position).

In the 2021 Budget, HMRC made a temporary change to the rate of tax credits that can be claimed by surrendering losses from certain creative industries. The tax rates is effectively a sliding scale based on the date the expenditure is incurred and the type of creative industry. We have amended the warning message to advise the Tax credit claimed can be manually overwritten if the amount due is different.