Restricted Loss

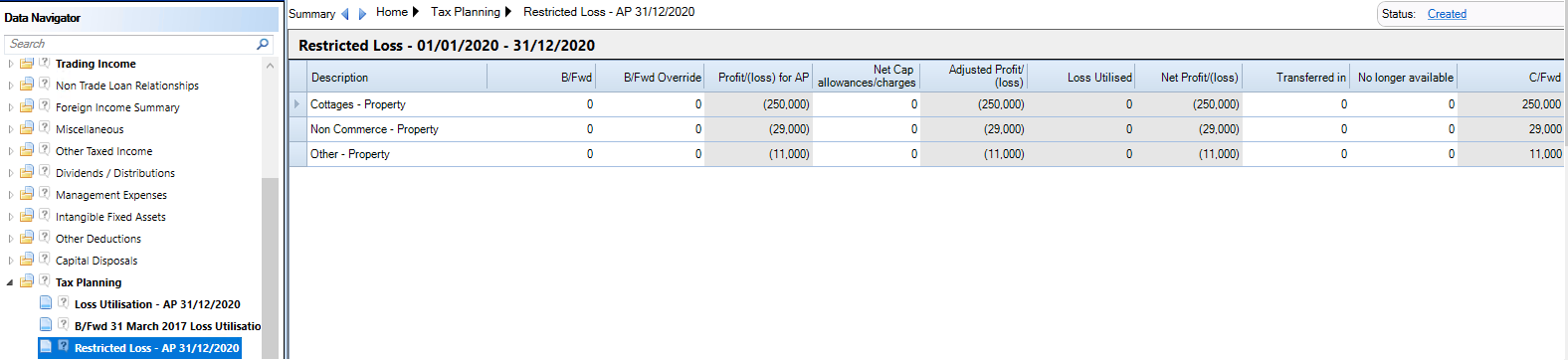

The Restricted Losses statement is located within the Tax Planning area of the Data Navigator.

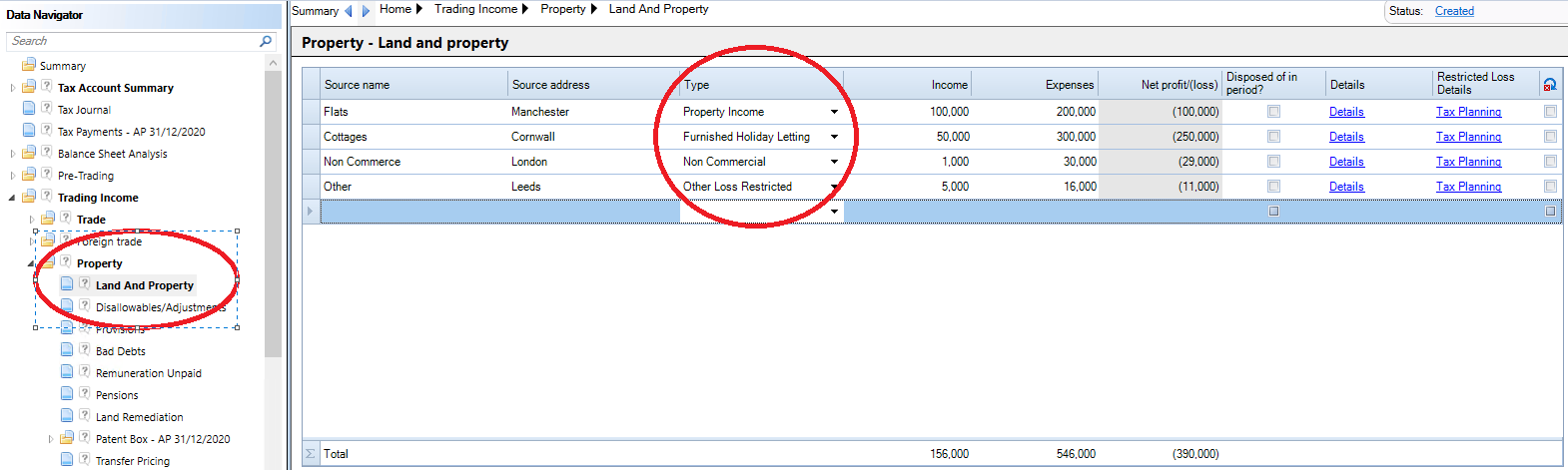

The Description will be automatically calculated from the entry made in the Land and Property details

Bfwd is manually completed for the first Accounting Period and will be automatically completed with the entry from the Cfwd column in subsequent Accounting Periods. This value can be manually overwritten in the calculations in this window by using the Bfwd override.

Net Cap Allowances/charges is for the individual claim for Capital Allowance for the property from the overall Capital Allowance claim made within the Property Business. An entry in this field does not make a claim for Capital Allowances within the Property Business. A claim for Capital Allowances should be made within the Capital Allowances section of the Property Business.

Adjusted Profit/(loss) is automatically calculated from the profit/(loss) for AP less capital Allowances.

Loss Utilised will be automatically calculated if the property type is a profit and there are losses brought forward from earlier Accounting Periods.

Net Profit/(loss) is the value used in the Property income report.