Surrendering losses as Group Relief

Use this feature for the losses you wish to surrender as group relief. You should complete this with form CT600C.

Surrendering a Loss as Group Relief

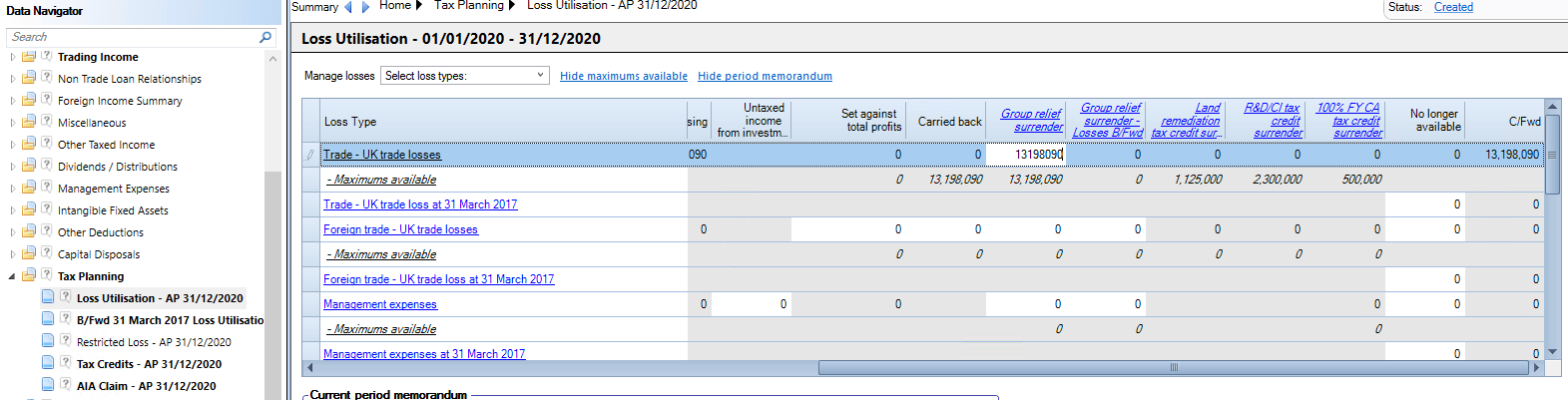

Select Tax planning > Loss Utilisation > AP within the Data Navigator.

To view the maximum available for surrender as group relief, select Show maximums available.

Enter amounts to be surrendered as group relief in the Group relief surrender column.

To complete the CT600C Form Group Relief - Surrenders, accessed by clicking the Group relief surrender link in the column header. Alternatively click Tax Return Information > CT600C > Surrenders > AP.

The Surrenders statement will show a validation Warning if the total losses surrendered in this window are not the same as the total losses surrendered as group relief in the Tax Planning > Loss Utilisation statement.