FRS 102 User Guide

CCH Accounts Production - FRS 102 Master Pack

Overview

This master pack supports the preparation of financial statements that meet the requirements of:

- FRS 102 "The Financial Reporting Standard applicable in the UK and Republic of Ireland"

- Early adoption of the FRS 102 Periodic Review 2024 (see separate appendix)

- For the UK, the UK Companies Act 2006 and relevant statutory instruments

- For Ireland, the 2014 Companies Act as amended by the Companies (Accounting) Act 2017

iXBRL tagging and tax links

UK company filing: The FRS 102 pack can be used for iXBRL tagging and once the accounts are loaded into CCH Review & Tag, you should not need to apply any additional manual tagging.

Tax link : This pack contains the link to share balances with CCH Corporation Tax, via the Tax Link screen.

Client creation

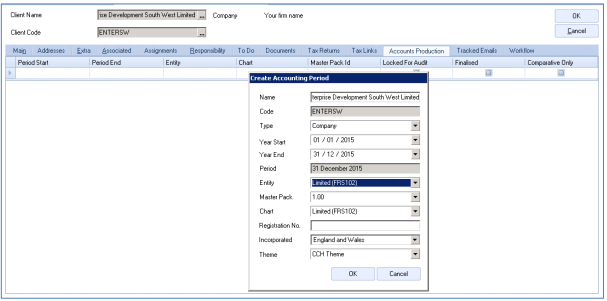

Once you have installed CCH Accounts Production, you can set up a new FRS 102 Client as follows:

1) Create the Client in Central if it does not already exist.

2) On the Accounts Production tab, click in the grid to create a new accounting period:

- Type: select 'Company'.

- Entity: select 'Limited (FRS 102)'.

- Set other fields as required and click OK.

3) Double-click the accounting period row on the grid to load the accounts production screen.

Accounting periods

FRS 102 3.23 An entity shall clearly identify each of the financial statements and the notes and distinguish them from other information in the same document. In addition, an entity shall display the following information prominently, and repeat it when necessary for an understanding of the information presented:

(c) the date of the end of the reporting period and the period covered by the financial statements

1 Where an entity has the same period end date for each year (eg 31 December for both the current and comparative years), the information required will be shown automatically by the combination of the page headings (which will specify eg 31 December) and the years (eg 2022 and 2021) shown in the column headings.

2 Where an entity has different period end dates (eg 30 December in the current year and 31 December for the comparative):

- The change in period end should be disclosed and explained within the introductory paragraph of the directors' report and within accounting policies.

- The period end dates will be shown automatically on the balance sheet because a separate row will be triggered, to show the day and month as well as the year for both current and comparative. The day and month for the balance sheet are picked up from #cd61 in the General information section of the statutory database (the "Period end" box in the screenshot below).

- References to the period length in the column headings are entered by the user using #cd59 (the "Period" box in the screenshot above).

- References in text that would normally return "year" can be changed to "period" using #cd9 (the "Period Description" box in the screenshot above). This will affect the main title at the top of each page, the text in rows that refer to periods, and text paragraphs (eg, it will now refer to "Depreciation charged in the period")

The result of the above can be seen in the income statement, balance sheet and notes below:

Note that the column headings for notes do not repeat the day and year of the period ends, or the length of the period. It is not compulsory to do this.

3 Where the first accounting period is being reported, the period end will be shown automatically. It might however be necessary to clarify the period start and period length.

- The period length is disclosed using #cd9 as set out above.

- The period start would normally be disclosed by adding that information to the directors' report.

4 Where the user wishes to override the main descriptions shown as page headers, this must be done as follows.

- For each "page" affected - ie, all formats except for notes: Apart from the cover page (where the text is shown on the page), the #cd9 period description is picked up in the Page Setup.

- For notes: The page header is picked up for all notes from the Page Setup in the first note, ie normally the accounting policies note.

Nominal ledger

The nominal ledger for FRS 102 companies is a 4 digit chart of accounts. The coding structure adopted in these formats has been designed to cater for the requirements of FRS 102 and IFRS. The nominal chart has the following key identifiers:

- Code ranges that group similar items together

- Descriptions that enable the user to understand the posting

- Category information which identifies where a posting will end up in the financial statements

The nominal chart is searchable both by browsing through codes and by entering text, and displays the 3 identifiers above, in data entry and information screens. Therefore, the entry of information is normally straightforward.

Note: although sub codes have not been used within the master chart of accounts, users can always create them if further analysis is required.

The overall structure of the nominal ledger can be summarised as:

Income statement

| Turnover Cost of sales Distribution costs Administrative expenses Exceptional items Other operating income Investment revenues |

0001 - 049Z 0500 - 199Z 2000 - 299Z 3000 - 398Z 3990 - 399Z 4000 - 419Z 4200 - 439Z |

Other gains and losses Finance costs Taxation Discontinued activities Extraordinary items Dividends and reserve movements Income statement suspense |

4400 - 449Z 4500 - 459Z 4600 - 479Z 4800 - 489Z 4900 - 499Z 5000 - 589Z 5900 - 599Z |

Balance sheet

| Intangible assets Tangible assets Investment properties Non-current financial assets Non-current derivatives Finance lease receivables Investment in group companies Inventories Trade and other receivables Current asset investments Short term investment in groups Short term investments Current derivatives Cash and cash equivalents Assets held for sale Current trade and other payables Current tax liabilities Current borrowings Non-current borrowings Non-current trade and other payables Non-current tax liabilities |

6000 - 619Z 6200 - 669Z 6700 - 674Z 6750 - 679Z 6800 - 684Z 6850 - 689Z 6900 - 699Z 7000 - 709Z 7100 - 749Z 7500 - 751Z 7520 - 759Z 7600 - 769Z 7700 - 779Z 7800 - 789Z 7900 - 799Z 8000 - 814Z 8150 - 819Z 8200 - 889Z 9000 - 906Z 9070 - 912Z 9130 - 915Z |

Non-current convertible loans Non-current borrowings Retirement benefits Deferred tax Provisions Liabilities associated with held for sale assets Share based payment liability Ordinary shares Preference shares Equity reserve Share premium Revaluation reserve Capital redemption reserve Own shares reserve Other reserves Hedging reserve Non-controlling interests Spare reserves (future development) Retained earnings Spare reserves (future development) Balance sheet suspense |

9160 - 916Z 9170 - 929Z 9300 - 939Z 9400 - 944Z 9450 - 948Z 9490 - 9498 9499 - 949Z 9500 - 959Z 9600 - 969Z 9700 - 970Z 9710 - 971Z 9720 - 9734 9735 - 973Z 9740 - 9744 9745 - 975Z 9760 - 976Z 9770 - 979Z 9780 - 989Z 9900 - 990Z 9910 - 989Z 9990 |

IFRS-only codes

Some of the nominal codes that exist in the FRS 102 chart of accounts are present only to align the chart with the IFRS chart of accounts. These codes are clearly marked 'IFRS only' in the Nominal Description and/or the Chart Category, such as :

9325 IFRS ONLY Exchange differences on pension scheme obligation

You should not post any transactions within FRS 102 accounting periods to such nominal codes. If you do, the formats will usually print a warning message to alert you. For example:

Nominal codings to be aware of

Exceptional items

There are codes in each area of the income statement:

0499 Exceptional item - Sales

1999 Exceptional item - Cost of sales

2999 Exceptional item - Selling and distribution

3989 Exceptional item - Admin costs (incl in Admin range)

3990 Exceptional 1 - Above operating profit

3991 Exceptional 2 - Above operating profit

3992 Exceptional 3 - Above operating profit

3993 Exceptional 4 - Above operating profit

4199 Exceptional item - Other operating income

4800 Exceptional - fair value gains and losses on investment properties

4801 Exceptional - fair value gains and losses on foreign exchange contracts

4802 Exceptional - profit or loss on sale of discontinued activity 1

4804 Exceptional - profit or loss on sale of discontinued activity 2

4806 Exceptional - profit or loss on sale of discontinued activity 3

4808 Exceptional - profit or loss on sale of part interest group undertaking

The codes permit the user to either:

- include these items within the broad category (eg posting to 0499 includes it as part of sales); or

- show them separately on the face of the income statement (eg posting to 3990)

If any postings are made to an exceptional item code, the Exceptional Items note is triggered. However, the user may wish to exclude this note from printing in the situation where they have used an 'exceptional' posting simply to show the figure on the face of the income statement and decide that no further information is required.

Exchange differences and hedging gains

There are codes in each area of the income statement for exchange differences and hedging gains, eg:

4180 Exchange differences arising on operating activities

4182 Fair value gains or losses on hedged item (other operating income)

4184 Fair value gains or losses on hedging instrument (other operating income)

4186 Reclassification of gains or losses on cash flow hedge re trading to profit or loss

Where there is a gain on a class of investment, loan or other financial instrument, it is important to post the double entry to the relevant code that captures the movement for cash flow purposes, eg:

7431 Exchange differences in the year on loans and receivables

Within the cash flow grids in the statutory database, there are override adjustments available to capture further instances of non-cash movements such as these.

Note: hedging gains are not treated as exchange gains but as fair value gains. (See also note below relating to the foreign currency reserve).

Fair value gains for investment properties

The rules for investment properties are different from those for fixed asset investments. All gains - including gains upon disposal - are treated as fair value gains on investment properties. (FRS 102 Section 16). Therefore, you would normally post such gains to either:

- 4170 (which will include them in the line 'Other gains and losses' ** see note below) or

- 4800 (which will show them as a separate line after other gains and losses) or

- 4165 (which includes it in other operating income)

If you wish to show it as a separate line in the Income statement, there are various 'exceptional' income/ cost codes you can post to, including sales, other operating income, other income/costs above operating profit. Posting to an 'exceptional' code such as 4800 does not mean it has to be called exceptional, and you can suppress the Exceptional items note that pops up as a result. It is entirely acceptable to show additional lines compared with the Companies Act formats where the additional information is relevant.

** As for the description on the Income statement if you post to 4170: 'Amounts written off investments' is the Companies Act description. Most practices would change this to 'Other gains and losses', which is permitted since the date FRS 102 came in force. This is either done by changing Term29 in Compliance terminology in the practice pack or by changing the description on the format.

Codes that are allocated to assets or liabilities dependent upon their value

The following will be shown under assets or liabilities according to their value:

Derivatives 6800 - 6820 and 7700 - 7720

Bank accounts 7800 -7888Z

VAT control account 8160 (but users can also specifically post to the VAT recoverable code 7305 if they wish to show both an asset and a liability)

Note that corporation tax balances (8150) and PAYE balances (8170) are not automatically shown as assets if they are debit balances and users need to specifically post to the following codes when recording assets:

7280 Corporation tax repayable

7290 Corporation tax recovered in year

7330 Income tax recoverable

Codes for amounts passing through other comprehensive income

The following will go through OCI rather than the income statement and will directly affect reserves:

5120 Currency translation differences (OCI)

5210 Actuarial differences on defined benefit pension schemes recognised in OCI

5230 Share of OCI - associates

5231 Share of OCI - joint ventures

9721 Revaluation reserve - PPE or intangibles revaluation

9724 Revaluation reserve - share of associate revaluation

9726 Adjustments to fair value of financial asset

9727 Fair value adjustments reclassified to profit and loss

9756 CTR Translation differences in current year (OCI)

9759 CTR Amounts reclassified to profit and loss (IFRS only) -

9761 Gain or loss recognised on cash flow hedges

9763 Reclassification of OCI to income re cash flow hedges

Plus tax on the amounts noted above (5220,5350,9723,9728-31,9734,9758)

Deferred income, accruals and government grants

Current accruals 8085..808Z

8085 Accruals

8086 Accrued defined contribution payments

8087 Accrued defined benefit payments

808Z Last account in accruals range

Current deferred income 8091..8092

8091 Deferred income - government grant - current

8092 Deferred income - spare account - current

Non-current accruals 9111..9113

9111 Accruals

9112 Accrued defined contribution payments

9113 Accrued defined benefit payments

Non-current deferred income 9115..9116

9115 Deferred income - government grant

9116 Deferred income - spare account

Deferred income - separate line 9497..9498

9497 Deferred income - government grant - on balance sheet

9498 Deferred income and accruals - on balance sheet

UK small companies can show accruals and deferred income as a separate line in the balance sheet. If the amounts are treated as creditors instead, the accruals and deferred income are not shown separately in creditors; it is part of Other creditors. The regulations state 'In Format 1, accruals and deferred income may be shown under item J [Accruals and deferred income as separate line in the balance sheet] or included under item E.4 [Other creditors , 1 year] or H.4 [Other creditors > 1 yr], or both (as the case may require).' The important word here is 'included', ie it's part of E4 'Other creditors' and not a separate item to list after E4.

UK non-small companies have 'Accruals and deferred income' as a Companies Act format line in 3 places:

- as a separate line in Creditors < 1 yr (8085-808Z),

- as a separate line in Creditors >1 yr (9111-9113), and

- as a separate line on the balance sheet (9497-9498).

It is up to users to decide where they want to show it.

In these formats, the separate line in the balance sheet is described as follows:

- 'Government grants' If 9498 is zero

- 'Deferred income' if 9498 is not zero (excludes a reference to accruals on the basis that users would not normally show accruals there. This is a pragmatic departure from the Companies Act description)

- Both of those titles can be overridden by statutory database entry #bn9991673, if the user wishes to show a different description

ROI companies do not have a heading 'Accruals and deferred income' but instead have 'Accruals'. Users would normally post deferred income to 9497 or 9498 (which shows 'Deferred income' as a separate line on the balance sheet) unless they decide that the deferred income properly falls into the ROI heading of 'Accruals'.

Deferred income headings within the note

Heading - whole note #bn9991673 (with defaults to 'Government grants' If 9498 is zero or 'Deferred income' if 9498 is not zero)

Description of grants #bn9991674 (defaults to 'Arising from government grants')

Description of other deferred income 'Arising from #bn999520' (defaults to 'Other deferred income')

Statutory database

Guidance notes

There are 'Guidance Notes' within certain nodes of the Statutory Database, which help the user understand the information that needs to be disclosed within the particular node:

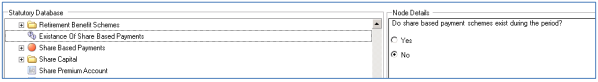

Trigger questions

There are 'Trigger Questions' within certain nodes of the Statutory Database, enabling the user to mould the database and formats depending on how the questions are answered:

Check facilities

Built within the following nodes of the Statutory Database is a check facility, which ensures that the information disclosed in the database agrees to the trial balance:

- Profit and Loss Account / SOCI Notes - Turnover - Analysis of Turnover (by class and market)

- Profit and Loss Account / SOCI Notes - Turnover - Audit fees

- Profit and Loss Account / SOCI Notes - Taxation - Reconciliation of Tax Charge

- Profit and Loss Account / SOCI Notes - Dividends - Ordinary Shares - Final and Interim Dividends

- Profit and Loss Account / SOCI Notes - Dividends - Preference Shares - Final and Interim Dividends

- Profit and Loss Account / SOCI Notes - Impairments - Analysis of Impairments

- Profit and Loss Account / SOCI Notes - Impairments - Analysis of Reversal of Previous Impairments

- Balance Sheet / SOFP Notes – Tangible Fixed Assets - Land and buildings

- Balance Sheet / SOFP Notes – Fixed Asset Investments - Movements

- Balance Sheet / SOFP Notes - Finance Lease Receivables - Minimum Lease Payments and Present Value

- Balance Sheet / SOFP Notes - Financial Instruments - Analysis

- Balance Sheet / SOFP Notes - Finance Lease Obligations - Future Lease Payments

- Balance Sheet / SOFP Notes - Deferred Tax - Deferred Tax Balances and Movements

- Balance Sheet / SOFP Notes - Retirement Benefit Schemes - Defined Benefit Schemes - Obligation Split (see example at end of list)

- Balance Sheet / SOFP Notes - Retirement Benefit Schemes - Defined Benefit Schemes – Fair Value of Scheme Assets

- Balance Sheet / SOFP Notes - Share Capital - Ordinary and Preference

Spare notes

Within the FRS 102 Master Pack, it is possible in CCH Accounts Production to trigger a spare note to print by populating the Header and Text within the Statutory Database. This approach has been implemented on the following areas within the Statutory Database:

- Critical Accounting Estimates

- Profit and Loss Account / SOCI Notes

- Balance Sheet / SOFP Notes

- Other Notes

In total there are 26 Spare Notes across the database.

Specific areas of the statutory database

Client preferences

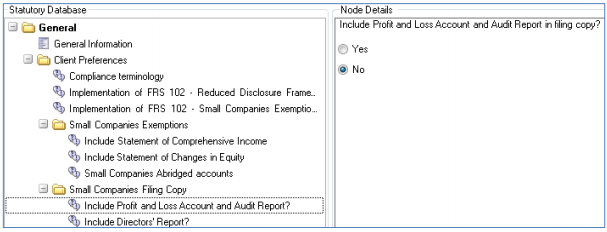

The Client preferences node offers a series of questions to help you tailor the financial statements (partial example shown):

Defective financial statements

An option under Client preferences permits the user to identify the current financial statements as a revised version of a previously published set of financial statements.

Voluntary revision of financial statements and reports by the directors under s454 of the Companies Act 2006 is only permissible if the financial statements previously approved are defective – ie, where they failed to comply with the requirements of the Companies Act 2006 (including relevant accounting standards), or, where applicable, Article 4 of the IAS Regulation (for periods commencing before 1 January 2021).

Where the original financial statements or report(s) are defective, and the directors elect to revise them under s454 of the Companies Act 2006, they may do so by:

- Supplementary note (ie a note explaining the corrections required); or

- Replacement (ie a corrected set of financial statements or reports).

The formats support revision by supplementary note and where the user chooses to identify the current financial statements as revised:

- Note 118 provides the declarations and information required; and

- The audit report is amended to refer to the revised financial statements.

Note that a company revising its financial statements by replacement must file the full revised financial statements and auditor’s report thereon (if applicable). No "filleting" of small company financial statements is permitted.

Compliance terminology

Within the FRS 102 Master Pack, it is possible to specify the terminology you wish to use at client level.

- Use IFRS terminology within the notes - This option will use IFRS terminology throughout the financial statements, both in the primary statements and notes, eg instead of seeing Stocks you will see Inventories

- Use Companies Act terminology - This option will use Companies Act terminology throughout the financial statements, both in the primary statements and notes, eg instead of seeing Inventories you will see Stocks

- Use Companies Act terminology except for Primary Headers - This option will use Companies Act terminology throughout the financial statements, both in the primary statements and notes, eg instead of seeing Inventories you will see Stocks. The only change is that the header for Profit and Loss Account and Balance Sheet will change to Income Statement and Statement of Financial Position.

More detail on how to use, edit and control the Compliance Terminology function is contained in Appendix 5.

Compliance terms lookup

A user who does not have the Task Permission to access the Compliance Terminology maintenance screen may easily check the list of available terms while editing a format by selecting the 'Compliance Terms' action on the task bar:

Classic mode: |

Ribbon mode: |

Commands

There are commands within the formats that allow users to reference the Compliance Terminology:

- =AP("#Term1") - This is used within the body of a format or within a paragraph.

- =AP("#TermH1") - This is used within the header of a format. (It is the same value as #Term1, the "H" informs the application that the command has been used in the Header of the format)

- =AP("#CustomTerm") - May be added by users if required.

Note the capitalisation rules:

=AP("#term31") = Tangible assets (first letter is capitalised)

=AP("#Term31") = Tangible Assets (capitalises first letter of each word)

=AP("#tERM31")= tangible assets (lower case)

=AP("#TERM31")= TANGIBLE ASSETS (upper case)

Standard text

There is a table of standard text used throughout the financial statements, and these can be amended at practice level by accessing the Maintenance > Word items menu. Some of these "alternative words" are set out within the auditor/accountant section below, and a further key term is:

#aw3: 'Accounts' vs 'Financial statements' The default description used in this pack is "financial statements" and this has been used in the formats. However, the wording can be changed within Word items.

Companies limited by guarantee

The master pack supports the generation of financial statements for Companies Limited by Guarantee (CLG), incorporated in either the United Kingdom or the Republic of Ireland. Please see Appendix 3 for more detailed guidance.

Note that where the user has chosen the CLG option, a further question will appear, asking whether the company is non-profit (the default) or is run for profit. A CLG run for profit will have very few accounting differences compared with a company that has share capital.

Implementation of Reduced Disclosure Framework

If the company for which you are preparing FRS 102 financial statements is a qualifying entity (broadly speaking, a subsidiary of a parent company that reports under FRS 102), it is possible to take some exemptions from certain disclosures (for example exemption from cash flow). Simply select the Yes option:

Once 'Yes' has been selected, further questions will appear, eg 'Include Cash Flow' (not required under the Reduced Disclosure Framework, but it can be optionally disclosed). Additionally, areas that are optional fields to be disclosed are now identified with a blue 'optional' symbol throughout the Statutory Database.

Audit exemption

It is possible to specify whether the client is exempt from audit.

Note: if an audit report is not required, the user can choose between including an accountants’ report within the financial statements or having no report at all.

Type of accountants’ report

The user can choose either a standard accountants’ compilation report or an assurance review report:

Users have a choice between generic assurance review report text in accordance with the ISRE 2400 (Revised) and extended text provided by the ICAEW.

Size of entity

A statutory database grid gives an indication of the size of the data (based on the Companies Act thresholds) and whether the job qualifies for an audit. This node is for information purposes only and will not directly affect any of the data settings or selections.

The node will display the relevant company size thresholds for either UK or Ireland country of incorporation. Turnover will be apportioned if the accounting period is either short or long.

The calculated result is for advisory purposes only and the user should always perform an independent calculation. Once the user has decided whether the company qualifies as Small, Medium or Large, this decision is recorded in the Size of Entity node (#size1):

Newly created FRS 102 clients are assumed to be large by default, to avoid any risk of under-disclosure.

FRS 102 Section 1A - Small companies exemptions

The small entities regime (Section 1A of the FRS102 legislation) is available to companies which qualify as a small entity. This permits a range of reporting exemptions. By default, these exemptions are applied but in some cases the user can override specific exemptions and over-disclose.

Where these exemptions are applied, many notes will be excluded from printing and others will become less detailed. Further details are included in Appendix 2 and Appendix 8.

Small companies not applying Section 1A

If a small company chooses not to apply Section 1A, or cannot do so if it is a subsidiary of an ineligible group (eg where one of the members of the group is a plc), it is still exempt from the requirement to include a strategic report and cash flow within its own financial statements. The system will assume that the user wishes to apply these exemptions, and those formats will be suppressed. It will also trigger an extra bullet point in the Audit Report Matters section and suppress other references to the strategic report. However, if the user wishes not to take this exemption, overrides are available, eg to include the cash flow or strategic report:

Note: small companies that do not apply Section 1A are still able to file 'filleted' financial statements with Companies House.

Dormant companies

To indicate that the company qualifies as dormant for the current accounting period, open the General screen within the statutory database. Select the Dormant drop down and change the default value from 'Trading' to either 'Dormant – Never Traded' or 'Dormant – Ceased Trading' as required. Click the Apply button, and the rest of the statutory database will be refreshed to trigger the correct disclosures for dormant companies. Please see Appendix 4 for more information.

Auditors' or accountants' reports

Identifying the auditor or accountant

The auditor or accountant is identified by linking to the firm involved, within the client associations for "has auditor of". This will provide the name of the firm and the firm's address, but not the individual named statutory auditor (see later):

Note that the first "auditor" in this relationship type is applied to:

- the auditor where an audit is carried out; or

- the reporting accountant where an audit is not carried out.

This "auditor" (Auditor Example in the screenshot above) is therefore shown as the auditor or accountant on the information page, and also in the sign-off section of the appropriate auditors' or accountants' report.

Where the user also identifies a second "auditor" (Example Accountants in the screenshot above), that firm is treated as an additional firm of accountants and disclosed as such on the information page, though the firm is not referred to elsewhere. The user has an option to override the information page description in the statutory database:

Identifying the named statutory auditor

Where an audit is carried out, the audit firm is identified from the association set up above. In addition, the audit partner signing the report needs to be named. The named individual is chosen from the list of employees already set up (including a name override where relevant).

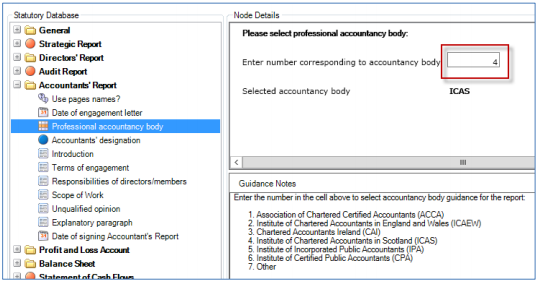

Professional body

The FRS 102 master packs include Auditors' or Accountants' Report paragraphs with the correct wording required for different professional accountancy bodies:

- Association of Chartered Certified Accountants (ACCA)

- Institute of Chartered Accountants in England and Wales (ICAEW)

- Chartered Accountants Ireland (CAI)

- Institute of Chartered Accountants in Scotland (ICAS)

- Institute of Incorporated Public Accountants (IPA)

- Institute of Certified Public Accountants (CPA)

- Association of Chartered Certified Accountants (ACCA) - ROI

- Association of Accounting Technicians (AAT)

99. Other

Within the Statutory Database, you may select the correct body by entering the corresponding number into the grid as shown below. This will refresh the Statutory Database and trigger the correct paragraphs to be automatically selected in the Accountants Report section.

There is a task permission applied to this node: #Client #Can Edit Accountancy Body. Only users who have this permission may amend the value. Additionally, you can specify a default value for your firm which will be applied to any new clients that you create in CCH Accounts Production.

Open Maintenance > Accounts > Statutory Database Defaults and use the drop down list to select the correct default for your firm.

Designation

The 'designation' is the description below the firm's name on the format (eg 'Chartered Accountants'). The default designation is set in Word Items (#aw7), which can be amended for the practice. The designation can also be overridden for individual clients (eg where preparing financial statements for someone else to sign). Where no text is entered in the designation grid, the default text will be used instead.

Similar defaults exist for the common designations required where someone signs as the 'Statutory Auditor' (#aw9) or 'Registered Auditor' (#aw8).

Reference to auditor or auditors

Word Items are used to set the firm's preferences:

- #aw11 is set by default to auditor but may be changed to auditors

- #aw10 is set by default to auditor's but may be changed to auditors'

Fraud/irregularities section of the audit report

ISA 700 requires the inclusion of a section that deals with the risks due to irregularities including fraud. There is guidance in the ISA about what is required, but no particular structure is specified, and firms are dissuaded from general statements:

A39-2. The matters required to be set out in the auditor’s report in accordance with paragraph 29-1 may be useful to users of the financial statements if they are explained in a manner that, for example:

- Enables a user to understand their significance in the context of the audit of financial statements as a whole. In determining those matters that are of significance, both quantitative and qualitative factors are relevant to such consideration.

- Relates the matters directly to the specific circumstances of the entity and are not therefore, generic or abstract matters expressed in standardized or boilerplate language.

Since each firm will have its own approach, we have set up the fraud/irregularities section to be prepared in a variety of ways, so that users can adopt the approach that best suits their practice and the individual audits:

- As text paragraphs with no headings.

- As text paragraphs with amendable headings.

- As an introduction followed by a table, again with amendable headings.

Separate dummy paragraphs have been set up for each potential item within the section, enabling practices to take these paragraphs and create their own versions for introductory explanations, general approach and so on.

Turnover/Revenue

For a small company applying small company exemptions, the entire turnover note is suppressed in the financial statements screen but it can be forced to print (through that screen) in the usual way. The statutory database node will be marked with a blue 'optional' button but will show the full options under that node.

For all companies, the user can choose whether to analyse turnover by class in a table:

Where the table is used, the user populates the grid with the categories of turnover, even if there is only 1 category of turnover. This information is then used within the Turnover note. The information is not taken from the nominal ledger (nominal codes 0001 - 049Z) but the table will show whether the totals agree to the nominal ledger:

For the geographical analysis, it is not necessary to state the market if there is only one material market. Therefore within the statutory database, the user can choose to suppress the geographical analysis entirely. If this is not suppressed, a grid for entry of the market analysis will be shown:

Dividends

There are only 4 nominal codes to post to:

- 5001 - Ordinary dividends final paid

- 5002 - Ordinary dividends interim paid

- 5003 - Preference dividends final due or paid

- 5004 - Preference dividends interim paid

All analysis work (not required for small companies) is done within the statutory database in Profit and Loss Account Notes > Dividends, eg:

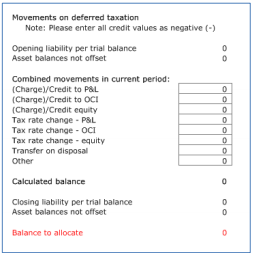

Deferred tax

There are only 3 areas to post to:

- 9400-940Z Deferred tax liability balances not offset (one code for each jurisdiction)

- 9410-941Z Deferred tax asset balances not offset (one code for each jurisdiction)

- 9420-944Z Spare codes (currently treated as asset balances)

If balances can be offset, then they should be entered in the same range. For instance, if there is a liability for £300,000 and a separate asset of £100,000 which can be offset, they should be entered (say) as 9400 £300,000 Cr and 9401 £100,000 Dr. If asset and liability balances cannot be offset and must therefore be disclosed separately, they are entered in the separate asset and liability ranges.

All analysis work (not required for small companies) is done within the statutory database in Balance Sheet Notes > Deferred Tax:

There is one grid that permits the amendment of the standard category descriptions for the breakdown of the balances, and the analysis of the closing balances (assets and liabilities):

A second grid permits entry of total movements during the year. Both grids have checks built in to show differences from the nominal balances.

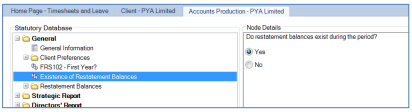

Presentation of restatements

Any restatements that are disclosed upon the correction of prior period errors or adoption of the FRS 102 standards may be presented in the financial statements in three possible ways:

- A summarised 'list' of the restatements

- A detailed breakdown of the movements resulting from the restatements

- Both of the above

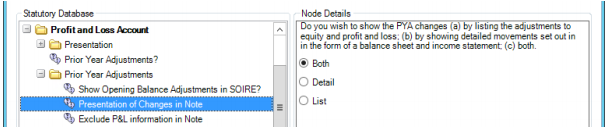

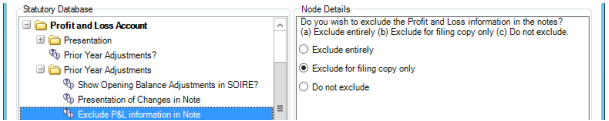

The default presentation used is the 'list' option, but this may be altered in the Statutory Database screen, eg:

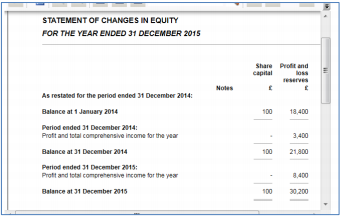

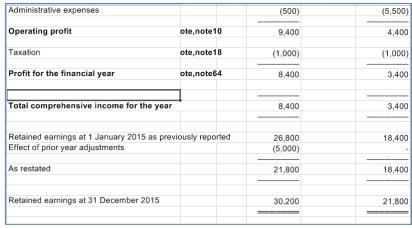

An example of the reconciliation of equity note when using 'list mode' is shown below:

An example of the same note when using 'movements mode' is shown below:

An explanation of the transition entries to be made is set out in the Transition to FRS 102 section. An explanation of the entries to be made for prior period error adjustments and their interaction with transition adjustments is set out in the Prior Period Errors section.

Income statement and statement of comprehensive income

Options

FRS 102 permits three options:

- Three separate statements: income statement; statement of comprehensive income; statement of changes in equity.

- The first two can be combined into a single statement of comprehensive income, with a separate statement for changes in equity.

- The three can also be combined into a statement of income and retained earnings.

In the Master Pack, the default is the first option (show all three statements). The second and third options can be chosen in the statutory database under the 'Profit and Loss Account' heading. For each option, the statutory database displays guidance taken from FRS 102.

The third option is permitted only where:

- There are no movements on other comprehensive income; and

- The only changes to equity for all periods presented arise from profit or loss, payment of dividends, corrections of prior period material errors, and changes in accounting policy.

Note: that if the third option is wrongly chosen (eg, where there exists other comprehensive income) a warning message is triggered on the income statement format.

Titles applied

Compliance terminology options are available for the 'Income statement'. However, where a combined statement has been chosen (options 2 & 3 above), the titles used for the formats default to the specific FRS 102 names 'Statement of comprehensive income' and 'Statement of income and retained earnings'.

Within the analysis in the statement of comprehensive income, users can choose to refer to comprehensive "expense" or "loss" where relevant (note however that this is optional and most businesses will not apply this wording). The wording for this is amendable and is included as an option in the income statement section.

Format II Profit & Loss

If you wish to present the Income Statement using the Format II layout, this can be done by setting the option in the statutory database as shown below:

Other options

- The Income Statement can show the full detail required in Format I for Investment Income and Interest Payable, or alternatively it can show the total, with the breakdown shown in the note.

- Other Comprehensive Income items can either be shown net of tax, or else gross with a separate tax line. The statutory database option chosen discloses on the face of the statement the approach taken.

- The existence of prior period adjustments can be flagged. An explanation of the entries to be made for prior period error adjustments and their interaction with transition adjustments is set out in the section on prior period adjustments below.

- The existence of discontinued operations can be flagged, triggering grids to show the headings and adjustments required. The income statement that results is displayed in a landscape format, showing separate columns for continuing and discontinued activities.

- For dormant companies with no income or expenditure, there is an option to either have no Income Statement or else include a statement that there was no income or expenditure.

- The user can choose to include a statement that all operations are continuing.

- Together with the other primary statements, there is an option to include the message 'The notes on pages X to Y form part of these financial statements.'

Statement of changes in equity

The master pack includes two useful options.

Using 8 point font

A flag in the statutory database enables the user to choose to show the SOCIE table in the smaller 8 point font (vs the normal 9.5 point). This is particularly useful where:

- The number of reserve types is causing the page to be shown as landscape when with a smaller font it could be shown in portrait mode; or

- The number of reserves are so great that the columns cannot even fit onto a landscape page; or

- The number of rows is causing the SOCIE to break over multiple pages.

Splitting other movements

Most reserves (plus share capital) have codes for 'other movements' on the reserve. Where there is only one cause for such movements, this can be shown and described easily on the SOCIE by using the amendable line description #soc1 (which defaults to 'Other movements').

Where there are multiple causes for movements, they can be split out using a table in the statutory database 'Analysis of other movements'. This enables the user to analyse a maximum of 6 specified movements across all 11 reserves.

Reserves presentation

The Master Pack has various reserves already set up:

| Ordinary shares Equity reserve Revaluation reserve Own shares Hedging reserve Retained earnings (Movements: 5001-5890) |

9500 - 959Z 9700 - 970Z 9720 – 9734 9740 – 9744 9760 - 976Z 9900 - 990Z |

Preference shares Share premium Capital redemption Other reserves (1-2) Currency translation reserve Non-controlling interests |

9600 - 969Z 9710 - 971Z 9735 - 973Z 9745 - 9754 9755 - 975Z 9770 - 979Z |

The revaluation reserve, currency translation reserve and hedging reserves have specific codes set up which will show as movements in Other Comprehensive Income. Own shares and other reserves have amendable headings.

Retained earnings can be further subdivided between distributable and non-distributable reserves (see below).

Presentation options

There are three options offered in flag #bn9991396:

Do you wish to disclose separate notes for all active reserves in addition to disclosure in the Statement of Changes in Equity / Statement of Income and Retained Earnings? If so, choose between:

- showing the complete notes including the movements

- showing text only, within individual notes [the note will display only if text has been entered]

- showing text only, in one combined 'Reserves' note

The software will default to showing text only, and therefore the individual notes will not be triggered unless the user enters text in the free format paragraphs provided. Where 'complete notes' is chosen, the note will be triggered if either there are current or comparative nominal balances, or if text is entered.

Non-distributable retained profits

There is no requirement in FRS 102 or the Companies Act to split the retained profits between distributable and non-distributable elements. However, clients may wish to show this. The Master Pack permits this.

Nominal chart entries

The user makes contra adjustments between the following nominal codes:

| 9901 9902 9907 9908 |

CY Profit transferred to 9907 non distributable PY Profit transferred to 9908 non distributable Non distributable CY profit from 9901 Non distributable PY profit from 9902 |

The range 9900..9909 remains the full retained profits range, with 9906..9908 set up as a range for recording the non-distributable element. 9907 and 9908 close off to 9906 Non distributable retained earnings b/fwd.

9902 / 9908 would normally be used once, to transfer the non-distributable profits to date. From that point onwards, only the current year profits or losses would be transferred.

As an example, the current year might commence with the balances:

| 9900 | Retained earnings brought forward | £(100,000) credit |

This might include £20,000 non-distributable profits. The journal needed to separate this out is:

| 9902 9908 |

PY Profit transferred to 9908 non distributable Non distributable PY profit from 9902 |

£ 20,000 debit £(20,000) credit |

If the profits during the year included a further £3,000 non-distributable, then:

| 9901 9907 |

CY Profit transferred to 9907 non distributable Non distributable CY profit from 9901 |

£ 3,000 debit £(3,000) credit |

At the end of the year, non-distributable profits of £23,000 are shown, and these roll forward into 9906.

Statutory database options

There is an option within the balance sheet presentation area which allows the user to choose between:

- a simple analysis within the main retained profits note (this is the default)

- a split throughout the formats, affecting balance sheet, statement of changes in equity, retained profits and a separate non-distributable reserve note. This effectively treats the balance as a separate reserve rather than an sub-analysis of the retained profits.

There are further options enabling users to apply their own wordings for the headings and descriptions, including on the balance sheet and statement of changes in equity. Some of these options are shown below:

… and also in the notes:

Statement of cash flows

Formats

The statement of cash flows has the following characteristics:

- The statement uses the indirect method.

- The starting point of the main cash flow statement is a line for cash generated from/absorbed by operations, referenced to a separate note that shows the adjustments made to profit to arrive at this figure.

- The analysis of cash and cash equivalents is shown at the end of the cash statement.

- A separate note shows the analysis of movements on net debt.

Statutory database

The following adjustments are available within the statutory database:

- to permit the option within FRS 102 to show certain movements either within operating activities, financing activities or investing activities;

- to gross up any net movements on financing activities and investing activities;

- to identify non-cash movements;

- to allocate interest received and other gains between loans and other financial assets;

- to reallocate interest paid that has been rolled up into borrowings;

- to allocate dividends paid that have been credited to directors' loan accounts;

- to reflect finance lease additions;

- to identify the amounts included within current asset investments that should be treated as cash equivalents;

- to enter roundings adjustments, as follows:

Management accounts collection

The Management collection provides the following formats:

Note: there is also an Exception Report

included at the start of the Full Collection, which highlights potential problems within the formats.

The printing or suppression of most of the above formats can be set within the statutory database, as below:

Lead schedule collection

This collection includes a comprehensive set of Lead Schedule formats. The collection consists of 'main' schedules (in upper case), and backing schedules. The statutory database contains new nodes to facilitate entering information which is then displayed on the lead schedules, eg:

The ‘Display Draft/Adjusted Mode’ allows users to determine the presentation of the lead schedules. If ‘Yes’ is selected then the lead schedules will have 4 columns showing (as shown below for backup lead schedule):

- Draft

- Adjusted

- Final

- Prior year

These lead schedules will track from a client TB through to Final Accounts. If ‘No’ is selected then the lead schedules will only have 2 columns (as shown below for main lead schedule):

- Current

- Comparative

An example of a Main Lead Schedule is shown below:

Note: only the main schedules include prepared by/reviewed by / partner review details.

The numerical content displayed on the lead schedule comes from the Trial Balance. The 'Adjusted' balance displayed is based on the total of the Audit Journals input as either 'Adjusting' or 'Reclassification':

Specific functionality within the financial statements

Multiple worksheets in a format

It is possible in CCH Accounts Production to add multiple worksheets to a format, and to trigger the printing of each worksheet based on a test condition. There is a group of actions displayed on the task bar when editing a format:

The use of multiple worksheets is particularly relevant where the number of columns varies within the format.

There are variations of the Attach command available to control the printing of multiple worksheets within a Format:

1) relative worksheet reference: =AP("*Attach*,@Sheet3,(f1=f1)") - Attaches from current format the worksheet named 'Sheet3'.

2) indirect format reference: =AP("*Attach*,page4dir,(f1=f1)") - Attaches all worksheets within the attached format.

3) indirect worksheet reference: =AP("*Attach*,page4dir@Sheet3,(f1=f1)") - Attaches from format 'page4dir' the worksheet named 'Sheet3'.

Page orientation

When editing a format, in the Page Setup screen there is an option for orientation called 'Autodetect'.

If Autodetect is selected, when the format is previewed, CCH Accounts Production will calculate the required width of the content to be printed. If it can fit onto a portrait A4 page, the preview will automatically show as portrait. If the content is too wide, the orientation will be automatically switched to landscape.

Set rows to repeat at the top of subsequent pages

If a page or note spans more than one page, it is possible to designate rows to repeat at the top of the new page. For example, you may have a management page or a tangible fixed asset note that goes on to two pages and you wish to repeat the same 'heading' rows on the second page.

There are two options:

- Title rows are applicable when you want certain rows to repeat for the whole of the note or page. This is less common.

- Subtitle rows allow you to also designate where you want them to stop being applied. This is relevant to formats using multiple tabs and to formats where you want a long numerical section to repeat the headings but do not want headings repeated for the text below that, if it spills over the page.

The approach for both is the same as follows, except that for subtitles is it possible to mark the end row where you want the subtitles to stop repeating. To use this function, open the page or note and select Draft Mode. Highlight the rows you wish to repeat, right click and select 'Set title rows…'. [Or 'Set subtitle rows']

This will display a small pop up window, showing the rows you have selected. To accept this, press 'Enter' to set the title rows.

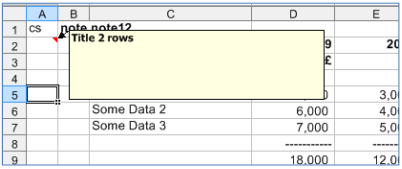

Note: The image below shows the rows chosen in the example. However, you would normally want to also include a blank row below the headings (to row 4 instead of 3).

A tooltip will be added to the cell to indicate the title/subtitle rows:

To remove title/subtitle rows once set, right click and select 'Set title rows…' again, and this time click the 'Clear' button in the pop up window:

For subtitle rows, highlight the final row you want titles to repeat on and choose 'Stop repeating subtitle rows'. This final row should be one that is active, since if it is suppressed, the 'Stop' command might not be effective.

Statutory ranges

It is possible in CCH Accounts Production to add/subtract statutory database fields and cross reference them in a format. Within Maintenance > Accounts > Statutory Ranges:

There is a new command within the formats that allows users to reference to a Statutory Range:

=APSTATRANGE("a","CAFL")

This command can be used on its own or within a print condition or with name ranges eg

=AP("[a,*TOTREV]")-APSTATRANGE("a","DISOPREV")

Comparative statutory values

For example, the number of employees is contained in statutory item #on57. The following command would be used to pick up the prior year's figure:

=AP("b,#on57")

Within such commands you can reference to:

- a = Current accounting period.

Please note =AP("#on57"), will also return the number of employees for the current accounting period and this is the default entry used in the CCH FRS 102 Master Pack.

- b = Comparative accounting period

- c = Pre-comparative accounting period (and so on)

This command can be used on its own or within a print condition or with name ranges.

Excel commands

Most standard Excel commands can be used, for instance =Sum, =Countif commands.

Column and row print conditions

For rows

All rows will print by default but can be suppressed either by:

- using the Data Regulation (DR) column to suppress non-zero lines; or

- the existence within column A of AP("RS"), either on its own or as part of a formula.

For columns

All columns will print by default but can be suppressed by the existence in a suppressed row above the non-suppressed active section of:

- the command AP("CS"), either on its own or as part of a formula; or

- the specific AP("WC .....") formula that sets the column width to zero.

Warning messages

Warning messages will print within many formats where an error has been detected, for example:

Statement of Changes in Equity (Page7soce) and various reserve notes - differences between b/wd and c/fwd values

The SOCIE page and the reserves notes include tests at the end of the formats for differences (a) between balances b/fwd for the prior year and the corresponding balance c/fwd in the pre-prior year and (b) between balances c/fwd at the end of each period and the calculated balances using the balances b/fwd adjusted for all movements shown on the format.

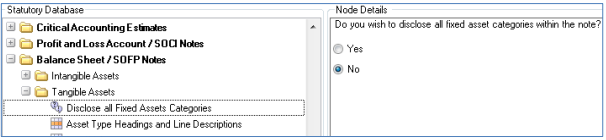

Tangible Assets (Note26) - Spare Nominal Codes and differences between b/wd and c/fwd values

Within the FRS 102 Master Pack there is space in the chart for tangible assets for codes 6530..669Z. These are earmarked for future development and should not be posted to within FRS 102. If these codes are posted to then they will appear within the total net book value column but not within the analysis. Therefore, if a user posts to these nominal codes a warning message will appear at the bottom of the Tangible Assets note advising the user to reconsider posting.

There is also a test which compares b/fwd values for cost and depreciation in the the current year against c/fwd values from the prior year.

Appendix 1 - FRS 102 Periodic Review 2024

Major changes to align FRS 102 more closely with IFRS:

- New accounting requirements for revenue, based on the five-step model for revenue recognition from IFRS 15 Revenue from Contracts with Customers, with appropriate simplifications. The extent to which this will change an entity’s revenue recognition in practice will depend on the nature of its contracts with customers.

- New lease accounting , based on the on-balance sheet model from IFRS 16 Leases, with appropriate simplifications. This is expected to result in an impact on the financial statements of most entities that are lessees under one or more operating leases

Other incremental improvements:

- Greater clarity for small entities in the UK applying Section 1A Small Entities regarding which disclosures need to be provided in order to give a true and fair view.

- A revised Section 2 Concepts and Pervasive Principles, updated to reflect the IASB’s Conceptual Framework for Financial Reporting, issued in 2018.

- A new Section 2A Fair Value Measurement, replacing the Appendix Fair Value Measurement to Section 2 and updated to reflect the principles of IFRS 13 Fair Value Measurement.

- Removal of the option to newly adopt the recognition and measurement requirements of IAS 39 Financial Instruments: Recognition and Measurement under paragraphs 11.2(b) and 12.2(b) (unless needed to achieve consistency with group accounting policies), in preparation for the eventual removal of this option. Entities already applying the IAS 39 option are permitted to continue to apply it.

Effective dates:

The principal effective date for these amendments is accounting periods beginning on or after 1 January 2026, with early application permitted provided all amendments are applied at the same time.

Earlier effective dates apply to new disclosures about supplier finance arrangements in Section 7 Statement of Cash Flows of FRS 102 (periods beginning on or after 1 January 2025, with early application permitted).

Comparative figures and information about the current year effect of changes made:

- Changes to leasing cannot be applied retrospectively, and the year prior to the effective date must not be restated. Changes to opening reserves must be shown as an adjustment as at the beginning of the period in which the 2024 Periodic Review is applied. For the current period, to the extent practicable, it must disclose the amount of the adjustment to profit or loss for the effect of applying the revised Section 20, or an explanation if it is impracticable to determine the amount to be disclosed.

- Changes to revenue can be applied retrospectively, with the prior year figures restated. Alternatively, the changes can be applied as for leasing, ie as from the beginning of the period in which the 2024 Periodic Review is applied. For the current period, to the extent practicable, it must disclose the amount of the adjustment to revenue and to profit or loss for the effect of applying the revised Section 23, or an explanation if it is impracticable to determine the amounts to be disclosed.

Accounting for revenue

Revised FRS 102 requirements (* = required also for small entities applying S1A exemptions):

Disaggregation

23.131 An entity shall disaggregate revenue recognised from contracts with customers into categories that depict how its revenue and cash flows are affected by economic factors. Categories that might be appropriate include:

(a) type of good or service (eg major product lines);

(b) geographical market (eg country or region);

(c) market or type of customer (eg government and non-government customers);

(d) timing of transfer of goods or services (eg revenue from goods or services transferred to customers at a point in time and revenue from goods or services transferred over time); and

(e) revenue earned as an agent or as a principal.

Effect: The Companies Acts (ROI and UK) already require analysis of revenue by class and geographical market. The effect of this revision is to require some entities to also analyse their revenue in new ways, where the existing analysis is inadequate.

Changes made to pack: (1) The accounting policies section for revenue has been extended to permit up to 5 revenue types in addition to the existing standard types - sales of goods, services and construction. The user can show these with or without headings, as below.

Changes made to pack: (2) The revenue note, which includes tables for analysing revenue by class and geographical market, has not been extended for master pack 53 but from pack 54 it will be possible for users to amend the headings of the analysis types and to provide further analysis in a separate table.

Performance obligations

23.135 An entity shall disclose information about its performance obligations in contracts with customers, including a description of:

* (a) when the entity typically satisfies its performance obligations (eg upon shipment, upon delivery, as services are rendered or upon completion of service);

* (b) the significant payment terms (eg when payment is typically due, whether the contract includes a financing transaction, and whether the consideration amount is variable);

* (c) the nature of the goods or services that the entity has promised to transfer, highlighting any promises to arrange for another party to transfer goods or services (ie if the entity is acting as an agent);

(d) obligations for returns, refunds and other similar obligations; and

(e) types of warranties and related obligations.

23.136 For performance obligations that an entity satisfies over time, the entity shall disclose the methods it used to recognise revenue – for example, a description of the output methods or input methods used and how those methods are applied.

Effect: The way in which revenue is recognised and described has changed. Entities will need to identify revenue streams more clearly and set out more detail about how each revenue type is measured.

Changes made to pack: The accounting policies section for revenue provides free format text paragraphs, together with guidance reminding users of the need to provide the information set out above.

Additional disclosures - revenue and impairment

23.133 An entity shall disclose the following amounts for the reporting period unless those amounts are presented separately in the statement of comprehensive income (or income statement, if presented) by applying other sections of this FRS:

(a) revenue recognised from contracts with customers, which the entity shall disclose separately from its other sources of revenue; and

(b) any impairment losses recognised (by applying Section 11) on any receivables or contract assets arising from an entity’s contracts with customers, which the entity shall disclose, in aggregate, separately from impairment losses from other contracts.

23.134 An entity shall disclose:

(a) [see assets/liabilities disclosures below]

(b) revenue recognised in the reporting period that was included in the contract liability balance at the beginning of the period; and

(c) revenue recognised in the reporting period from performance obligations satisfied or partially satisfied in previous periods (eg changes in estimates of variable consideration).

23.137 An entity shall provide a quantitative or qualitative explanation of the significance of unsatisfied performance obligations and when they are expected to be satisfied. However, an entity need not disclose such information for a performance obligation if either of the following conditions is met:

(a) the performance obligation is part of a contract that has an original expected duration of one year or less; or

(b) the entity recognises revenue from the satisfaction of the performance obligation in accordance with paragraph 23.103.

23.138 An entity shall disclose:

(a) [see assets/liabilities disclosures below]; and

(b) the amount of amortisation and any impairment losses recognised in the reporting period.

Effect: These disclosures are new requirements, but they may already be shown elsewhere.

Changes made to pack: The information will be disclosed in the contract balances note, provided by the quantitative grids and optional text paragraphs.

Additional disclosures - assets and liabilities

23.134 An entity shall disclose:

(a) the opening and closing balances of receivables, contract assets and contract liabilities from contracts with customers, if not otherwise separately presented or disclosed; [b,c - see revenue disclosures above]

23.138 An entity shall disclose:

(a) the closing balances of assets recognised from the costs incurred to obtain or fulfil a contract with a customer (in accordance with paragraph 23.113 or 23.117), by main category of asset (eg costs to obtain contracts with customers, pre-contract costs and set-up costs); and

(b) [see revenue disclosures above].

Effect: These disclosures are new requirements, but they may already be shown elsewhere. Note that "receivables ... from contracts with customers" is likely to be the same as trade receivables / trade debtors recognised before the 2024 Periodic Review, but the statutory database provides and option to override this.

Changes made to pack: The information will be disclosed in the contract balances note, provided by the quantitative grids and optional text paragraphs.

Accounting for leases - as lessee

Revised FRS 102 requirements (* = required also for small entities applying S1A exemptions):

* 20.45 At the commencement date, a lessee shall recognise a right-of-use asset and a lease liability.

* 20.5 A lessee may choose not to apply the requirements in paragraphs 20.45 to 20.73 to:

(a) short-term leases; and

(b) leases for which the underlying asset is of low value (as set out in paragraphs 20.9 to 20.12).

* 20.76 A lessee shall provide a general description of its significant leasing arrangements.

* 20.77 If necessary to enable users to understand its significant leasing arrangements, a lessee shall provide additional qualitative and quantitative information. As a minimum, when relevant, a lessee shall disclose:

(a) information about future cash outflows to which the lessee is potentially exposed that are not reflected in the measurement of lease liabilities, including variable lease payments, extension options and termination options, residual value guarantees and leases not yet commenced to which the lessee is committed;

(b) information about restrictions or covenants imposed by leases;

(c) the types of discount rate (interest rate implicit in the lease, lessee’s incremental borrowing rate or lessee’s obtainable borrowing rate) used in calculating lease liabilities and the proportion of the total lease liability calculated using each of those types of discount rate; and

(d) information about sale and leaseback transactions, including:

(i) the lessee’s reasons for sale and leaseback transactions and the prevalence of those transactions;

(ii) key terms and conditions of individual sale and leaseback transactions;

(iii) payments not included in the measurement of lease liabilities;

(iv) the cash flow effect of sale and leaseback transactions in the reporting period; and

(v) when relevant, the entity having made the accounting policy choice to apply paragraph 20.123(a)(ii) in respect of sale and leaseback transactions when the transfer of the asset is a sale.

20.80 A lessee shall disclose the following amounts for the reporting period:

(a) interest expense on lease liabilities; [already incl in Finance Costs]

* (b) the expense relating to short-term leases accounted for applying paragraph 20.6. This expense need not include the expense relating to leases with a lease term of one month or less;

* (c) the expense relating to leases of low-value assets accounted for applying paragraph 20.6. This expense shall not include the expense relating to short-term leases of low-value assets included in paragraph 20.80(b);

* (d) the expense relating to variable lease payments not included in the measurement of lease liabilities;

(e) income from subleasing right-of-use assets;

(f) total cash outflow for leases; and [already incl in Cash Flow]

(g) gains or losses arising from sale and leaseback transactions.

20.82 A lessee that accounts for short-term leases or leases of low-value assets applying paragraph 20.6 shall disclose that fact and shall disclose separately the amount of its lease commitments for short-term leases and for leases of low-value assets at the end of the reporting period, for each of the following periods:

(a) not later than one year;

(b) later than one year and not later than five years; and

(c) later than five years.

[Note - The corresponding requirement for S1A is for the totals only]

Effect: The way in which leases for lessees are recognised has changed. By default, all leases are to be treated in as assets funded by lease obligations, with exemptions only for leases that are short term or where the underlying asset is of low value. Entities will need to identify the various classes of lease and apply the various requirements to them. In most cases, there will be many more leases treated under the finance lease model.

Changes made to pack: (1) The accounting policies section for leases provides free format text paragraphs, together with guidance reminding users of the need to provide the information set out in the standard. (2) The lease liabilities note discloses the leasing liability balances and provides free format text paragraphs, together with guidance reminding users of the need to provide the information set out in the standard. (3) The fixed assets note shows information about right-of-use assets, with two levels of detail available, including a split on the balance sheet. (4) The leasing information note discloses information about leasing payments, including as set out below. (5) Since leasing commitments only need to be disclosed where the amounts are significant, from master pack 54 new user options have been included, whereby the user decides whether to include information about operating lease payables and receivables.

ROU assets option:

The simplest application of the new requirements for right-of-use assets is to treat the disclosure of their movements as an additional disclosure for ROU assets only, which can be shown in a table after the main schedule, ie similar to the previous disclosure for leased assets but with greater detail. Only the classes of assets containing ROU assets will be shown in the table. This is the default option.

However, some users will wish also to show a split of the carrying values between ROU and owned assets. This is not required but the current flag enables that presentation. All classes of assets will be shown in the table and there will be an additional split of carrying value by ROU and owned assets.

Where such a split has been chosen, the user may also wish to show this split on the balance sheet and that is the third option.

ROU breakdown:

The ROU assets are identified only using the statutory database. Note that the IFRS equivalent disclosure does not require the same level of breakdown as FRS 102, with no requirement there to show cost and accumulated depreciation.

Other leasing information:

Accounting for leases - as lessor

Revised FRS 102 requirements (* = required also for small entities applying S1A exemptions):

Note:

- Small companies are not required to make any disclosures.

- Companies applying the reduced disclosure framework are not required to make the disclosures set out in 20.116.

20.114 A lessor shall disclose a general description of its significant leasing arrangements, including, if necessary to enable users to understand those arrangements, information about variable lease payments, renewal or purchase options and escalation clauses, subleases, and restrictions imposed by lease arrangements.

20.115 If necessary to enable users to understand its significant leasing arrangements, a lessor shall disclose additional qualitative and quantitative information.

20.116 A lessor shall disclose the following amounts for the reporting period:

(a) for finance leases:

(i) selling profit or loss; [from stat db entry #bn9991805]

(ii) finance income on the net investment in the lease; and [from nominal 4358]

(iii) income relating to variable lease payments not included in the measurement of the net investment in the lease. [from nominal 4005]

(b) for operating leases, lease income, separately disclosing income relating to variable lease payments that do not depend on an index or a rate.

Finance leases:

20.117 A lessor shall provide a qualitative and quantitative explanation of the significant changes during the reporting period in the carrying amount of the net investment in finance leases.

20.118 A lessor shall disclose a maturity analysis of the lease payments receivable, showing the undiscounted lease payments to be received on an annual basis for a minimum of each of the first five years and a total of the amounts for the remaining years. [from stat db entries]

A lessor shall reconcile the undiscounted lease payments to the net investment in the lease. The reconciliation shall identify the unearned finance income relating to the lease payments receivable and any discounted unguaranteed residual value. [from stat db entries]

Operating leases:

20.121 A lessor shall disclose a maturity analysis of the lease payments receivable, showing the undiscounted lease payments to be received on an annual basis for a minimum of each of the first five years and a total of the amounts for the remaining years.

Effect: There is little change in the way in which leases for lessors are recognised and disclosed, except for analysis of future cash flows by year.

Changes made to pack: (1) The accounting policies section for leases provides free format text paragraphs, together with guidance reminding users of the need to provide the information set out in the standard. (2) The finance lease receivables note discloses the leasing balances and provides free format text paragraphs, together with guidance reminding users of the need to provide the information set out in the standard. (3) The leasing information note discloses information about operating lease receivables future payments. (4) Since leasing commitments only need to be disclosed where the amounts are significant, from master pack 54 new user options have been included, whereby the user decides whether to include information about operating lease payables and receivables.

In finance lease receivables:

In operating lease receivables:

Appendix 2 - Transition to FRS 102

The FRS 102 legislation states:

Section 35 Transition to this FRS of FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland applies to the first-time adoption of FRS 102 and sets out how an entity prepares its first financial statements that conform with that standard.

FRS 102 will be effective for accounting periods beginning on or after 1 January 2015, although early application is permitted. It requires the comparative and opening balance sheet at the date of transition to be restated in accordance with FRS 102: the date of transition being the beginning of the earliest period for which an entity presents full comparative information. However, the opening balance sheet itself does not need to be presented.

FRS 102 requires the presentation of reconciliations of equity determined in accordance with its previous financial reporting framework and its equity determined in accordance with FRS 102 at two dates:

(a) the date of transition to FRS 102: and

(b) the end of the latest period presented in the entity’s most recent annual financial statements determined in accordance with its previous financial reporting framework. FRS 102 requires the presentation of a reconciliation of profit or loss determined in accordance with its previous financial reporting framework for the latest period in the entity’s most recent annual financial statements to its profit or loss determined in accordance with FRS 102 for the same period.

For example, for an entity with a 31 December year end, the first year of mandatory application will be the year ending 31 December 2015. The entity will need to restate its opening balance sheet at the date of transition (eg at 1 January 2014) and comparative balance sheet (eg at 31 December 2014) in accordance with FRS 102, although the opening balance sheet need not be presented. The entity will need to prepare reconciliations of equity at 1 January 2014 and 31 December 2014 and of its profit or loss for the year ending 31 December 2014.

Required amendments – retrospective restatement

For an entity with a date of transition of 1 January 2014, it is required to restate its balance sheet at 31 December 2013 by making the adjustments that are necessary to recognise and measure all assets and liabilities in accordance with FRS 102.

Paragraph 35.7 of FRS 102 requires an entity to:

(a) recognise all assets and liabilities whose recognition is required by FRS 102 (eg forward exchange contracts):

(b) not recognise items as assets or liabilities if FRS 102 does not permit their recognition:

(c) reclassify items (eg into different groupings in the cash flow statement): and

(d) restate certain assets and liabilities at a different value (eg financial instruments measured at amortised cost using the effective interest rate, which in some cases may vary from a previously used historical cost).

Paragraph 35.8 states that adjustments on transition shall be recognised in retained earnings, or where appropriate, another category within equity.

How to disclose the restatements

There is a 5 step process to follow when disclosing the restatements involved during the conversion to FRS 102:

- Calculate the restatements required for prior year for the specific job.

- Post a Restatement journal within CCH Accounts Production in the current year.

- Analyse out the detail within the Statutory Database in the current year.

- Reconcile the Transition Reconciliation format.

- Make cash flow adjustments where required.

Calculate the restatements required

This step is done externally to CCH Accounts Production, and relies on your knowledge of the company and its financial affairs.

Posting restatement journals

Current Year -

Once you have identified the restatements that are relevant, you need to post a Restatement Journal into CCH Accounts Production within the current year.

Restatement journals are entered in the current year because they will affect the comparative year figures only when viewed in the current year financial statements: they will not be seen in the comparative year when that is opened directly.

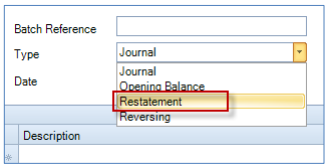

Note: you will separately be adjusting the current year opening balances using normal journals. Restatement journals are made via the usual Journal Entry screen, by first amending the Type from 'Journal' to 'Restatement':

Note: Restatement journals will only be available if a comparative accounting period is present.

The cumulative effect of changes to the opening and closing balances should be posted. For example, if the value of investments is increased by £3,000 at the start of the comparative period (ie uplifted from the original closing balance of the pre-comparative period) and is then increased by a further £2,000 at the end of the comparative period, then the restatement journal line that affects the investments code should be the total of £5,000 – ie, the effect on the closing balance.