Getting Started with CCH iFirm MTD for Income Tax

Overview

Making Tax Digital for Income Tax introduces the requirement for sole traders and landlords from April 2026 with a turnover over £50,000, expanding to those earning over £30,000 from April 2027 and over £20,000 from April 2028 to keep records in digital form and file their quarterly submission, perform their end of year adjustments and final declaration via compatible software.

Our priority is to support Advisors, and their Clients, by delivering an MTD for Income Tax solution that supports the full MTD requirement. This Get Started guide documents how to work with Making Tax Digital for Income Tax within CCH iFirm ( via CCH Central).

Checklist: How to Sign Up

Accountant Sign up

You will need an agent services account to use Making Tax Digital for Income Tax. Find out how to create an agent services account with HMRC if you do not have one. Create an agent services account (ASA) for your tax agent firm to use certain HMRC services.

Single ASA per practice

- HMRC requires only one ASA per practice.

- This ASA is used for all MTD services, including:

- MTD for VAT

- MTD for Income Tax Self Assessment (ITSA)

- Trust Registration Service (TRS)

You’ll need:

- Your Government Gateway user ID and password. If you do not already have them, you can create the sign in details from the sign in page

- the Unique Taxpayer Reference (UTR) for your tax agent firm

- the postcode associated with yourUTR

- your company registration number, if you have one

- your VAT registration number, if you have one

- your National Insurance number and date of birth to confirm your identity if you’re a sole trader or business partnership

- your National Insurance number and date of birth to confirm your identity if you’re a Limited Liability Partnership (in some cases)

- the name of youranti-money laundering supervisory body, membership number and renewal date

Client Sign up

Your client needs the user ID and password they got when they signed up for Self Assessment.

They may be asked to provide further proof of their identity to use this service. They can do this by:

- using an app on their mobile phone to match a photo of their face to their passport or driving licence

- answering questions about information HMRC already hold about their identity — for example, passport, credit reference, driving licence, Self Assessment, latest P60, or a recent payslip

Sign Up Now>

Please note: You need to have signed up your client and be authorised to act on their behalf for MTD for Income Tax, otherwise you will not be able to view their quarterly submission obligation in CCH iFirm.

Client Authorisations for MTD for Income Tax

Add your client authorisations for Making Tax Digital for Income Tax - GOV.UK

Important note

- You’ll still retain access to your HMRC Online Services account for clients not using MTD.

- If you stop working with a client, you must remove their authorisation in both your ASA and HMRC Online Services account

How to Authorise CCH iFirm MTD for Income Tax with HMRC

Ensure that your practice has obtained the authorisation token before proceeding to the next step.

This is a one-time authorisation with HMRC and is valid for an 18-month period.

See the steps above under " How to Authorise CCH iFirm MTD for Income Tax with HMRC"

Note: You need to have signed up/subscribed to MTD for Income Tax on HMRC’s website, otherwise you will not be able to authorise CCH iFirm with HMRC. The revenue have produced a short video to guide you through the process (see below).

|

Video: Watch this video to find out how to sign up your client for Making Tax Digital for Income Tax |

How to create CCH iFirm MTD for Income Tax client in Central

Prerequisites

- Must have the Latest version of CCH Central installed

- Your practice has subscribed to CCH iFirm MTD for Income Tax

- In CCH Central, a new task permission #Client#LaunchiFirmMTDfIT has been created to allow firms to select which employees can access MTDfIT.

Note: Without this permission you won't be able to launch MTDfIT. - .Net 8.0 runtime installed ( This is available via our CSI installer > Tools Install) These applications are essential for CCH iFirm and must be installed on the SQL Server and all Workstations wherever CCH Central is run from. The CCH iFirm console allows firms to authenticate and monitor the syncing of edited Contact and Client records from CCH Central CCH iFirm.

- Ensure that the 'CCH iFirm Console' Central service is running and signed in

- Ensure the user can access CCH iFirm - MTDfIT

- The NINO and post code are mandatory fields for MTD for Income Tax, they must be present in the client record. Otherwise, an error will be shown and you won't be able to create that client in MTD for Income Tax, as these fields are used get the quarterly submission obligation from HMRC into CCH iFirm

Note: The starting tax year that CCH iFirm supports for MTD for Income will be 2025/26. You will not be able to create an MTD client for any previous years.

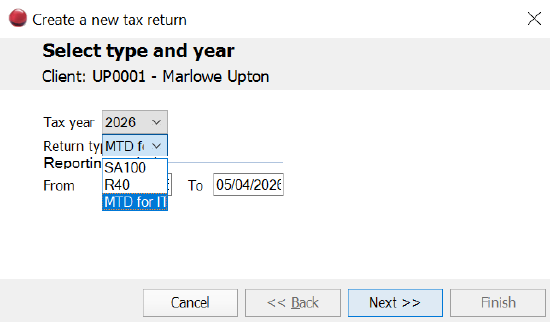

- In CCH Central, click on Create a new tax year within Tax Return

- In the 'Create a new tax return' panel, select a tax year e.g 2026

- Select the return type of MTD for IT in the Tax Year drop-down list.

- Click Next >>

- Link to the appropriate CCH Central Workflow or Tax flow (or click next if you don't use CCH Central Workflow)

- Click Finish

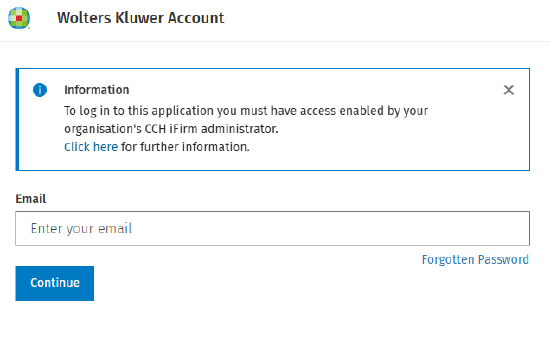

- You will be redirected to the CCH iFirm webpage. Log-in using your email address that is registered in CCH iFirm.

(Note: this email address here should match your employee email address in CCH Central)

- Once logged in, you will see the MTD for Income Tax quarterly submissions screen for your client.

9. If your Practice doesn't have authorisation to act on the clients behalf for MTD for Income Tax, then you can click 'Request Authorisation'

- Click on

- Now, share that link with the Client

Note: The Client will need to grant you authorisation by logging into their online service account.

- Once authorisation has been granted by the client, CCH iFirm MTDfIT will retrieve the quarterly submission obligations for the client, this is based on the previous years tax submission.

Adding income and expenses data

- Click 'Add'

- Click Add income and expenses

- Click Upload Excel File

4. Click Choose a template

5. Select to download either 'Separated quarters' or 'Combined quarters'

6. Open the spreadsheet for each of your obligations

Note: If you have existing workbooks that you use to capture your clients income and expenses for example, you can include the MTD for Income Tax spreadsheet into your existing workbook and link the figures using macros or formulas so that it populates the tagged fields.

As long as the CCH iFirm spreadsheet is the first tab in the workbook, the data will be injected into CCH iFirm MTD for Income Tax. This is still a valid digital link from a MTD requirement point of view.

Please note: The client name, NINO, tax year and property/self employed details in the spreadsheet need to match what is in CCH iFirm for the client and obligation that you are uploading.

7. When you are ready to upload the file, select Add income and expenses and click upload from MS Excel

8. Click Upload File

- If the client name, National Insurance Number (NINO), tax year and property/self employed details in the spreadsheet do not match what is CCH iFirm for the client and obligation you are uploading, then the error below is shown .

- If the information matches, you will see a 'Success - File uploaded successfully' message

Filing the quarterly submission

- Click on the Finalised toggle

2. Click on the Submit to HMRC button

3. Confirm submission