Asset Movement

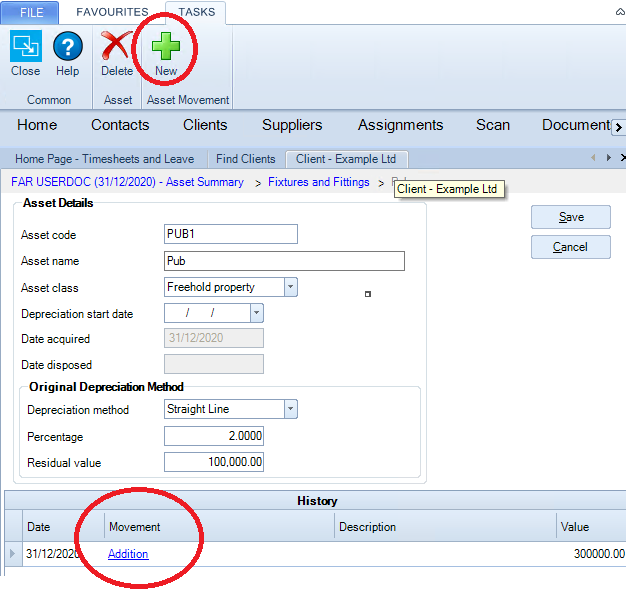

To access the he Asset Movement screen either select New from the Asset Movement area of the top Ribbon within an Asset, or select the hyperlink to an existing Movement.

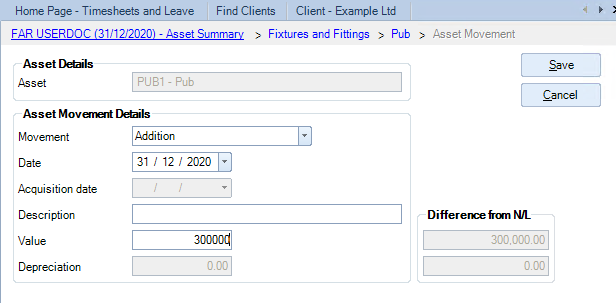

The Asset Movement screen shows a single asset transaction.

Asset Movements are stored in the Fixed Asset Register and are not linked to transactions in CCH Accounts Production. For instance, you might take on a client's trial balance with all entries dated at the year end, but there could be several Asset Movements in the Fixed Asset Register that represent the Motor Vehicles Additions account and they could be dated on the actual Addition date rather than the year end date.

There are five Movement types

- Cost B/Fwd Used when the cost and accumulated depreciation are being taken on for an asset at the year start date. A Cost B/Fwd should not be dated after the year start date. Otherwise, the Cost B/Fwd nominal account is unlikely to reconcile with the Fixed Asset Register balance for the Cost B/Fwd.

- Addition Used for posting Additions to an asset, either an original purchase or an addition to the original cost.

- Adjustment Used when the accumulated cost or depreciation needs to be adjusted, e.g. for an Impairment posting or for transferring part of the cost and depreciation to another asset. On the Asset Summary and Asset Class screens, the cost of Adjustments is included in the figure for Additions and the depreciation on Adjustments is included in the figure for the Depreciation Charge for the year.

- Revaluation Used to revalue an asset. The Value is the difference between the new valuation and the original cost.

- Disposal Used for selling an asset. There can only be a single Disposal movement for an asset and it must be the last entry on the asset's history.

- Change of Method A Change of Method movement is used to change the depreciation method or rate from a particular date. It has no Acquisition Date, Value or Depreciation fields and is described in a separate section below.

Date shows The date of the movement. Movements cannot be posted to a finalised period and a warning is given if a posting is made to a prior period that is not finalised. Movements dated after the year end are allowed, but ignored until you roll forward into the later year.

Acquisition date - This date is only enabled for Cost B/Fwd movements. It allows you to record the original acquisition date of an asset even if it is being taken on using a Cost B/Fwd.

Description - A description for the movement.

Value - For Disposals this is the disposal proceeds; for other movements it is the cost amount.

Depreciation - Only enabled for Cost B/Fwd and Adjustment entries. The amount of the depreciation b/fwd or depreciation adjustment.

Difference from N/L shows amounts un-Reconciled. It shows the amount that should be posted to remove the difference with the nominal ledger dependent on the Movement Type:

- Cost B/Fwd shows the Cost B/Fwd and Depreciation B/Fwd on the nominal accounts for this Asset Class less the Cost B/Fwd and Depreciation B/Fwd calculated in the FAR.

- Addition shows the Additions on the nominal account less the Additions on the FAR.

- Adjustment The box does not appear.

- Revaluation shows the Cost Revaluation on the nominal account less the Cost Revaluation on the FAR.

- Disposal shows the disposal proceeds on the nominal ledger less the disposal proceeds on the FAR. The disposal proceeds on the nominal ledger are calculated as the sum of the manual entries on the P/L on Disposal account, i.e. excluding any cost and depreciation eliminated on disposal that was automatically posted there by the FAR.

Delete Asset Movement

An asset movement cannot be deleted if it affects a finalised period.

Change of Method Movement

A Change of Method movement is used when the depreciation method or rate needs to be changed from a particular date. This happens in the following circumstances:

- When a review of the remaining life of assets suggests that a change in the depreciation rate is required. This often happens in conjunction with a revaluation.

- When a change of accounting policy requires a change in how depreciation is calculated.

Depreciation is calculated using the asset’s Original Depreciation Method up until the Change of Method and then using the new method from that date onwards.

The fields on a Change of Method movement are:

- Date The date from which the new depreciation method or rate will take effect. This is usually the first or last day of the accounting period.

- Depreciation Method (None/Straight Line/Reducing Balance). The new depreciation method.

- Percentage The new depreciation percentage.

- Residual value The new residual value