Non Client Group Companies

Add profit / loss for a non client

To correctly represent the entire group profit and loss position, add details of the profits and losses for any companies which are created as contact records.

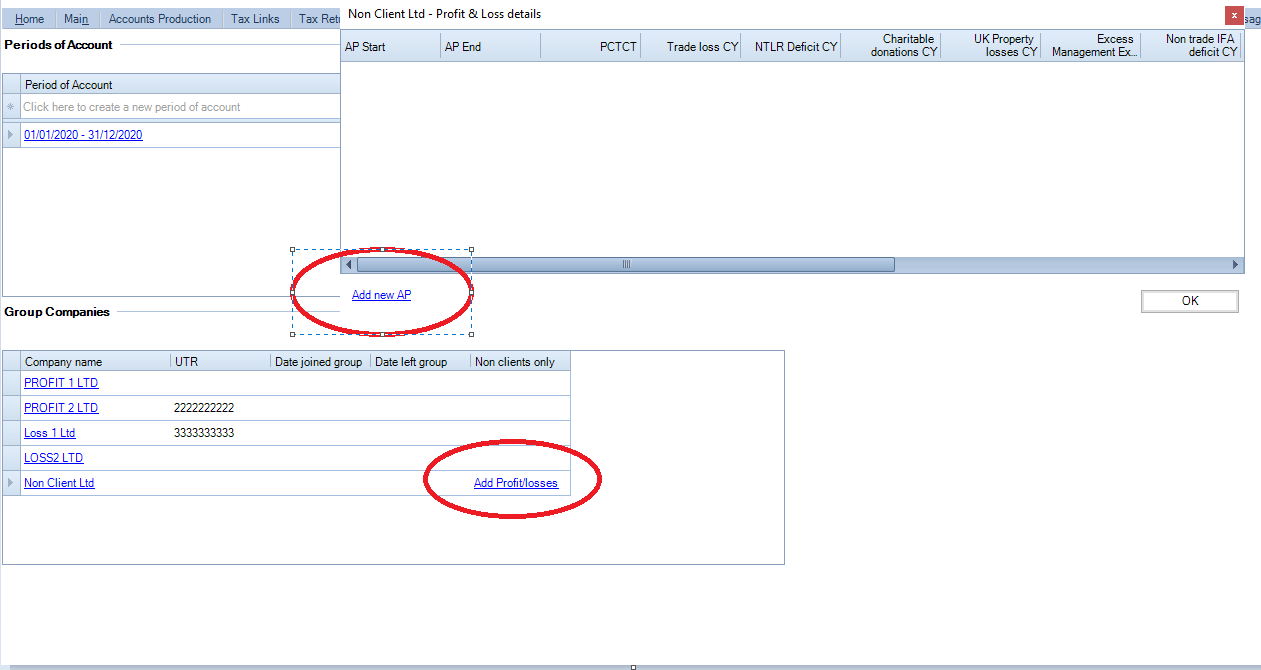

The information can be added using the Add Profit/losses hyperlink from either the Tax Group tab or from the Companies in group data node within a group period of account.

Click on the Add Profit/losses hyperlink.

A new window Profit & Loss details for the contact company opens.

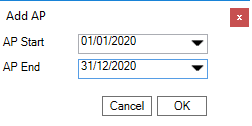

Click Add new AP.

Add the accounting period start and end dates for the company and select OK.

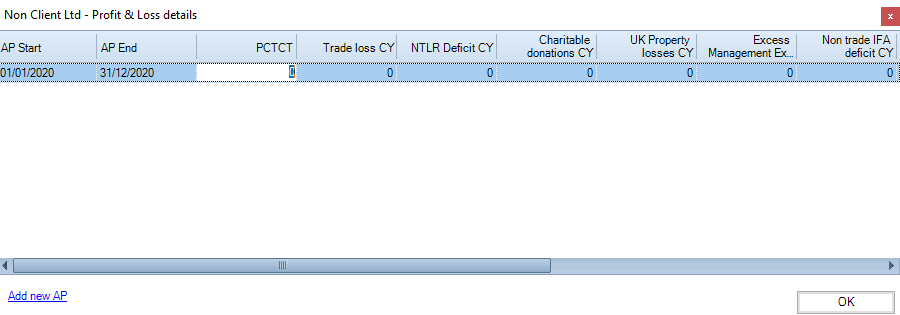

Enter details of the profit or loss for each category.

The information for multiple accounting periods for the company can be added by clicking Add new AP and repeating the steps above each time.

Select OK once details are complete.

You can amend the profit and loss figures by clicking on Add Profit/losses and editing the information in the Profit & Loss details window.