Tax Return Status

Updating the Status

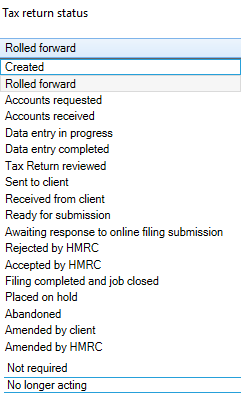

There are a number of different statuses that could be applied throughout the compliance process.

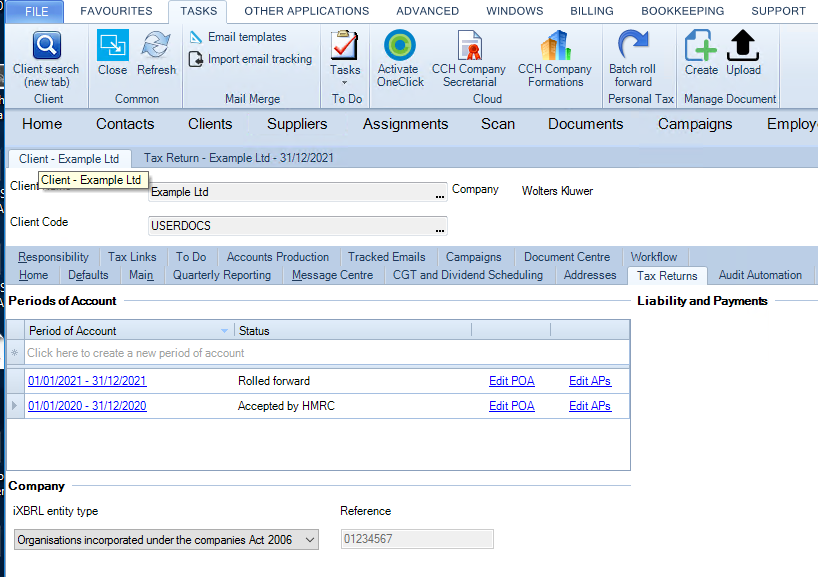

Select the Tax Return tab within the client in CCH Central.

The current status of the Return is displayed alongside each period of account.

Created is automatically set when the period is created.

Rolled forward status is set automatically when he period is rolled forward from a previous period.

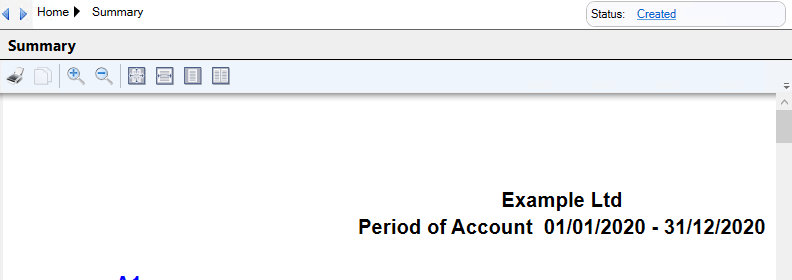

Select the period of account.

Select the hyperlinked Status located at the top right hand side of the data entry area.

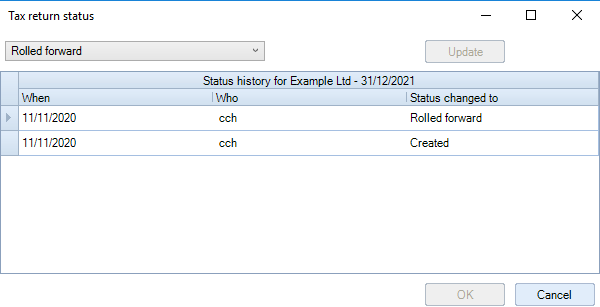

The Tax return status window allows the status to be updated and shows a history of status changes.

Status can be selected from the drop down menu.

Selecting Update will change the status and display a record of what the Status changed to, Who changed it and When.

Status updated for HMRC Submissions

The following statuses will be updated automatically when a response is received from filing the Return to HMRC:

- Accepted by HMRC - a success response is received

- Rejected by HMRC - a failure response is received