CCH Corporation Tax 2023.1: Release Notes

Release Highlights

This release of Corporation Tax forms part of our annual compliance release. The work includes but is not restricted to:

-

New form CT600 and supplementary Form CT600F

-

Changes in AIA rate on 31 March 2023

-

Changes in R and D rates after 31 March 2023

-

Updated RIM artefacts

In addition to the above items, we have also included several ITS fixes, details of these and other changes are included in these release notes.

Prerequisites

Installing CCH Corporation Tax 2023.1

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licenced are installed in the correct sequence. Click here to learn about the Central Suite Installer.

Legislative & Compliance Updates

New Form CT600

The new form CT600 and Supplementary Form CT600L is included in this release. The new form CT600 is generated for all Accounting Periods ending on or after 1 April 2015 although certain entries on the form CT600 are only available based on the company’s Accounting Period.

The new form includes new entries for the Energy Oil and Gas Profit Levy, that are reported in Boxes 986 and 501. The data entries are made in the Tax Payments screen as follows:

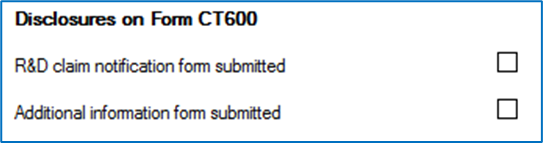

The new form includes new fields for claims made by the company for Research and Development where the company has already disclosed, in advance, to HMRC details of the claims it would make for Research and Development during the Accounting Period.

Note: The entries on the new form CT600 for the Northern Ireland Pages are not available for data entry as the Northern Ireland tax changes have not been implemented.

Freeport Plant and Machinery

We have implemented the link from the Tangible Fixed assets area to the Plant and Machinery in Freeports for all additions and disposals.

Change in AIA rate

We have implemented the AIA rate change announced in the last budget and the AIA rate remains at £1million after 31 March 2023.

Change in R&D rate after 31 March 2023

We have implemented the R & D tax credit rates announced in the last budget. The rate for SME Basic relief is an enhanced rate of 86% for expenditure after 31 March 2023 and the rate of tax credit is 10%. We have updated the logic where a claim for R & D SME is made so that it calculates the maximum Tax credit claim.

For claims made under the RDEC scheme the tax credit is calculated at 20% for expenditure after 31 March 2023.

Form CT600F

We have implemented the changes to the Form CT600F – the changes are narrative only on the form and remove reference to the EU and replace it with the UK.

Quality Improvements

Patent Box Deduction

We have removed the change that was made to the calculation in the 22.3 release. Under certain circumstances it was updating calculations with the wrong value. There is still an issue with the calculation when there are multiple Accounting Periods in the Period of Account.

Associated Companies

For Accounting Periods ended after 31 March 2023, the number of associated companies are now disclosed in Box 326, they are no longer reported ion Box 625. The number of associated companies has also changed to just show the associated companies. Previously, in Box 625 it was

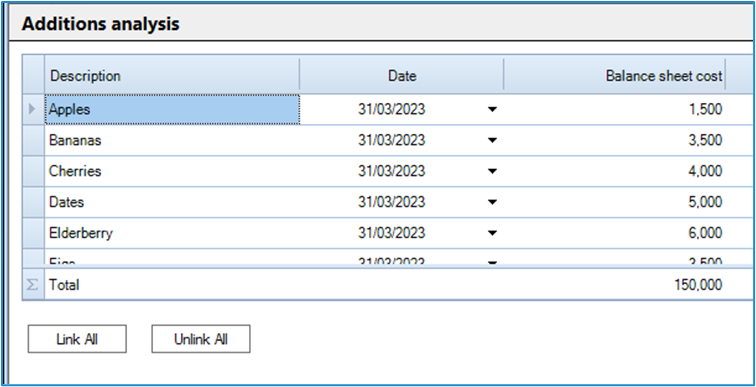

Unlink All in TFA Additions

We have implemented an Unlink All function within the Tangible Fixed Asset Additions screen. When this is selected it removes all associated capital allowance data from the detailed capital allowance screens and the additions can then be relinked at a later time.

R & D tax credits not appearing in reports for AP’s ended after 31 March 2022

For Accounting Periods ended after 31 March 2022 any claim for tax credits for Research and Development under either RDEC or SME:Basic relief now appears in the corporation tax computation.

Box L166 on Form CT600L

The entry in Box L166 now appears for all Accounting Periods following a change in the RIM artefacts.

Items to be included in a future release

Residential Property Developer Tax

HMRC have included the new Form CT600N which reports details of the Residential Property Developer tax applicable for Accounting Periods commencing after 31 March 2022. The charge is only applicable under specified circumstance, put simply when the company’s profits chargeable to corporation tax from Residential Property Development exceed £25 million per annum on a pro-rata basis. We will await feedback from you our customers before deciding whether or not to include this form in a future release.

Taxonomies

HMRC have just released a new corporation tax computation taxonomy. It was received by us too late to be included in this release. We will include this in a future release in time for when this becomes live on 16th June 2023.

Notable Issues

ITS 66561 - Link from Tangible Fixed Asset area to Plant & Machinery in Freeport screen

When making changes to the disposal proceeds in the Tangible Fixed Asset area to an asset linked in the Plant and Machinery in Freeports screen, on some occasions the data is not updated. This was identified too late for a resolution to be included in the release.