CCH Corporation Tax 2022.1: Release Notes

Release Highlights

This release of CCH Corporation Tax continues the work introduced in the last release for the budget changes. The work includes but is not restricted to:

- New form CT600

- New boxes for Enhanced Capital Allowances

- Changes in AIA rate

- New form CT600L for reporting Research & Development claims

In addition to the above items, we have also included several ITS fixes, details of these and other changes are included in these release notes.

Note: It has not been possible to include changes to the rate of S455 charge due to issues with the RIM artefacts – this is currently with HMRC for review. Please see HMRC Service Issues.

Prerequisites

Installing CCH Corporation Tax 2022.1

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licenced are installed in the correct sequence. Click here to learn about the Central Suite Installer.

Legislative and Compliance Update

New form CT600

The new form CT600 and Supplementary Form CT600L is included in this release. The new form CT600 is generated for all Accounting Periods ending on or after 1 April 2015 although certain entries on the form CT600 are only available based on the company’s Accounting Period.

Note: The entries on the new form CT600 for the Northern Ireland Pages are not available for data entry as the Northern Ireland tax changes have not been implemented.

Enhanced Capital Allowances

HMRC has now included new fields on the form CT600 to report details of Enhanced Capital Allowances attracting FYA at 50/130%, balancing charges and cost of all qualifying expenditure on Pages 8 and 9 of the form CT600. These entries are to be disclosed for all Accounting Periods ended after 31 March 2022.

Change in AIA rate

We have implemented the AIA rate change announced in the last budget. The AIA rate remains at £1million until 31 March 2023 when it then reduces to £200,000.

Research and Development

HMRC has updated the Form CT600L for reporting claims for Research and development for Accounting Periods ended after 31 March 2022. We have implemented the updated form and updated the RDEC calculations.

We have added new data entry fields in the tax credits screen. These new fields cover the entries required for the pre-step 1 calculations, and other new manual entry fields for the form CT600L.

CT600L - PAYE References

We have added new data entry fields on the form CT600L for the disclosure of the company’s PAYE references, and for associated companies up to a maximum of 15 entries.

Software Enhancements

Exporter Information

For Accounting Periods ended after 31 March 2022, disclosure must be made if the company made exports of Goods and Services outside the United Kingdom. We have included a new data entry area in the Tax return information screen for this. The default entry will be No exports of Goods and Services have been made.

Quality Improvements

The following quality improvements are addressed in this release.

ITS 57055 - Form CT600A and Participator's name

Where the Participators name was not displayed in the CT600A screen, this caused an online filing validation. We now display “Missing name” in the Loans to Participators data entry screen and show an error and exceptions message. You need to overwrite the Missing Name entry with the correct name.

ITS 57629 - Trade Loss Summary Report

In the trade loss report the values displayed of losses utilised were displayed only for the Primary trade.

ITS 64005 - Tax District Reference

Tax District Reference has been removed from the Main return data screen for Accounting Periods ended after 31 March 2022. The Tax District Reference is no longer shown on the form CT600 for Accounting Periods commencing after 1 April 2015.

ITS 65029 - Enhanced Capital Allowances Report

In the special rate Capital allowances Pool report the capital allowances claim was erroneously shown in brackets.

ITS 65032 - Large Companies RDEC report

When formatting the Large Companies RDEC claim report all values were being displayed in Bold.

Items to be Included in the 2022.2 release

Form CT600B and CT600M

It is planned to implement the updated supplementary Forms CT600B (reporting Hybrid and other mismatches) and CT600M (reporting Freeport SBA (Structures and Buildings Allowance) and Capital Allowances claims) in the next (2022.2) release.

Car leasing restriction

The restriction for Leased cars registered after 31 March 2021 is to be included in the next release.

Residential Property Developer Tax

HMRC has advised they have no plans to include the new tax on the form CT600 until April 2023; if a company is liable to the charge for an Accounting Period ended after 31 March 2022, this should be discussed with their HMRC Customer Compliance Manager.

New Taxonomies

Although the taxonomies have been coded, we are unable to implement the these in this release. HMRC had not opened the update portal to test the Taxonomies at the end of March 2022; as you will appreciate it was not possible to test the Taxonomies in time for the release date.

HMRC Service Issues

HMRC has recently advised of several issues have been identified with V1.97 RIM artefacts. HMRC has advised that a new release of the RIM artefacts is to be made available to software developers but a date has yet to be made available. We will update CCH Corporation Tax as soon as we possibly can.

Note: We have already coded a few of the changes but encountered issues when submitting test cases to HMRC, these have been raised with HMRC. We have chosen to remove the s455 tax rate change to enable you to generate an IRMark and submit relevant returns. We plan to reintroduce this when HMRC has issued updated RIM artefacts.

The following is a list of issues extracted from the document provided to us by HMRC

Annual Investment Allowance (AIA)

The Autumn Budget 2021 extended the Annual Investment Allowance (AIA) provisional £1 million cap until April 2023. The extension of the temporary £1 million cap was originally due to revert to £200,000 on 1 January 2022 but this will now happen on 1 April 2023.

The Corporation Tax online service will be updated to reflect this change. You can file online before the service is updated if you are filing a return you do not need to claim this additional AIA.

For now, when validating a corporation tax return, and a claim for AIA is in excess of the previously released AIA rates, then a validation message appears:

Loans to Participators

The Autumn Budget 2021 raised the rate of tax charged under section 455 on loans to participators from 32.5% to 33.75% from 1 April 2022.

The Corporation Tax online service will be updated to reflect this change. You can file online before the service is updated if you’re filing a return and you do not need to report this increase.

Research and Development Claims

In 2021, HMRC introduced supplementary form CT600L for companies claiming either of the following credits:

- Small and Medium Enterprise Research and Development Payable Tax Credit

- Research and Development Expenditure Credit

Companies only claiming Research and Development enhanced expenditure are not required to complete this supplementary form and just use Box 660 on the CT600 to report their claim.

Enhanced expenditure but not SME Payable Tax Credit or Research and Development Expenditure Credit

Customers will only be affected if:

- your accounting period starts on or after 1st April 2022, and

- you are only claiming Research and Development enhanced expenditure (included in box 660) but no other Research and Development credits so would not be completing a CT600L.

The service will be updated to fix the issue and affected customers should wait until then to file your return.

Due to a recent update to the CT600 and CT600L forms, HMRC are aware that a small number of customers may have online filing issues due to some restrictions within the revised HMRC Corporation Tax online service.

RDEC and reporting Income Tax deducted from profits

Customers will only be affected if you are reporting:

- an amount carried forward under section 104N(2), step 2 of the Corporation Tax Act 2009, from a previous accounting period (included in box L5), and

- Income Tax deducted from profits (included in box L35)

The service will be updated to fix the issue and affected customers should wait until then to file your return.

Reporting an amount of brought forward Step 2 restriction to be carried forward to the next Accounting Period

This is for information only as it will not affect your ability to submit a CT600L to the HMRC Corporation Tax online service.

A new Pre-step 1 section has been added to the CT600L for customers to report the amount of Step 2 restriction brought forward from previous accounting periods. Any balance not used and carried forward to the next accounting period is captured in new Boxes L8 and L129.

The figure in Box L129 is correctly included in Box L140 – Balance carried forward to next accounting period, but has been captured twice in Box L150 – Total carried forward to next AP. This means that your software will be reporting an incorrect figure in Box L150 but this is used by HMRC for statistical purposes only.

The figure in Box L129 is the one included in Box L5 in your next CT Self-Assessment

Notable Issues

Research and Development RDEC Subcontracted and RDEC Subsiudised and capped

If you make an entry in the “Total expenditure only” area for SME:RDEC subcontracted and SME:RDEC Subsidised and capped then the entries are not flowing through to the Form CT600L. In these circumstances we recommend making a claim via the “Detailed” section.

Paper Returns

If you have a deadline or an urgent requirement to file your return before the update, HMRC will accept a paper return for these exceptional cases. In this instance, a paper return should include:

- Form WT1, explaining (in box 6) that your Research and Development claim includes Income Tax deducted from profits – place this form under your return

- Form CT600

- Form CT600L

- your accounts and computations

Send your paper return to:

Corporation Tax Services

HM Revenue and Customs

BX9 1AX

United Kingdom

Validation form CT600L and Box L150

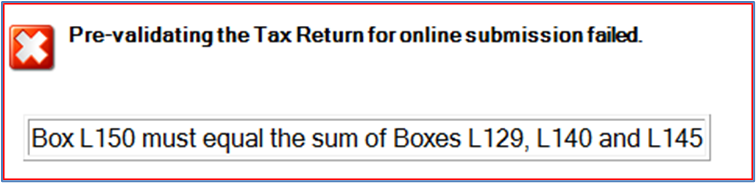

When attempting to pre-validate a form CT600L for the completion of Box L150, the following error message is received:

The value in Box L129 is included in Box L140 and where Box L129 is populated it is not possible to validate the corporation tax return.